Global| Aug 20 2008

Global| Aug 20 2008Reduced Oil Demand Is Pushing Down on Prices

Summary

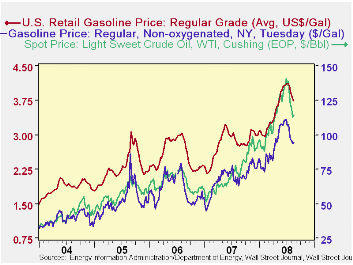

The recent price declines in oil and other energy products have been noticeable (see graph) and welcome, giving evident support to the stock market and consumer sentiment. In the U.S., the moving force in petroleum prices has been [...]

The recent price declines in oil and other energy products have been noticeable (see graph) and welcome, giving evident support to the stock market and consumer sentiment. In the U.S., the moving force in petroleum prices has been demand, highlighted in the table below. The Energy Department's "Weekly Petroleum Status Report", released around mid-day every Wednesday, began to draw attention with weaker usage figures in early- to mid-July, a period when gasoline consumption normally increases. The lower numbers for "product supplied" were mirrored in higher levels of gasoline and crude oil inventories, again, not a normal development for the height of the summer-vacation driving season.

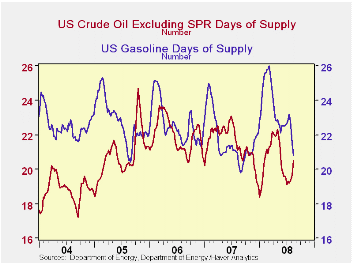

A summary of these demand and inventory developments can be seen in the second graph here, the "Days of Supply" data, an "inventory/sales" ratio for this industry. Inventories averaged over the last four weeks are divided by "product supplied" for gasoline or by crude oil input to refineries. The numbers out today for the period ended August 15 show gasoline inventories at 20.8 days of gasoline demand. This is down from 21.5 days last week, but still above 20.4 days a year ago. Crude oil supply stands at 20.5 days, up from 19.7 days last week. This supply figure is below the year-ago at 21.2, but compares favorably to 19.1 days at the beginning of July, about when demand weakness began to predominate.

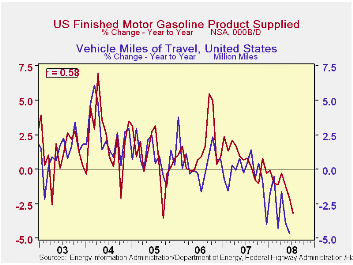

Lower demand, especially for gasoline, can come from more efficient vehicles, more of which are appearing on the roadways. But the most fundamental cause of less gasoline consumption is less driving. Miles driven began to sink below year-earlier levels late in 2007 and have had a negative comparison in nine of the last 10 months; the third graph here shows a 58% correlation between the year-to-year changes in vehicle miles of travel and gasoline product supplied since 2003. Other periods of such driving behavior occurred in 1973 and 1979, also times of energy crisis and surging prices. They were short-lived, however, and driving picked right up again when price and supply constraints eased. We have the impression that consumers realize more of the connection between their driving and the price of gasoline, so it will be interesting to see if they keep to their new behavior over a sustained period.

| U.S. Oil Demand (000 b/d) | 08/15/08 | 08/08/08 | July 2008 | June 2008 | 2007 | 2006 | 2005 |

|---|---|---|---|---|---|---|---|

| Total Product Supplied | 20,106 | 20,372 | 20,156 | 20,342 | 20,901 | 20,829 | 20,702 |

| Yr/yr % Chg | -5.6 | -3.6 | -3.2 | -2.1 | 0.5 | 0.6 | 1.7 |

| Finished Gasoline | 9,423 | 9,446 | 9,375 | 9,338 | 9,356 | 9,284 | 9,153 |

| Yr/yr % Chg | -3.5 | -1.3 | -4.0 | -2.4 | 0.8 | 1.4 | 0.9 |

Carol Stone, CBE

AuthorMore in Author Profile »Carol Stone, CBE came to Haver Analytics in 2003 following more than 35 years as a financial market economist at major Wall Street financial institutions, most especially Merrill Lynch and Nomura Securities. She has broad experience in analysis and forecasting of flow-of-funds accounts, the federal budget and Federal Reserve operations. At Nomura Securites, among other duties, she developed various indicator forecasting tools and edited a daily global publication produced in London and New York for readers in Tokyo. At Haver Analytics, Carol is a member of the Research Department, aiding database managers with research and documentation efforts, as well as posting commentary on select economic reports. In addition, she conducts Ways-of-the-World, a blog on economic issues for an Episcopal-Church-affiliated website, The Geranium Farm. During her career, Carol served as an officer of the Money Marketeers and the Downtown Economists Club. She has a PhD from NYU's Stern School of Business. She lives in Brooklyn, New York, and has a weekend home on Long Island.