Global| Sep 12 2011

Global| Sep 12 2011Safe Haven Currencies

Summary

In their attempts to find safe havens for their wealth in unsettled financial environments, investors have often looked to foreign currencies. Recently the Australian Dollar, the Norwegian Kroner, the Japanese Yen and the Swiss Franc [...]

In their attempts to find safe havens for their wealth in unsettled financial environments,

investors have often looked to foreign currencies. Recently the Australian Dollar,

the Norwegian Kroner, the Japanese Yen and the Swiss Franc have experienced substantial

inflows into their currency markets as investors viewed their currencies as a safe haven.

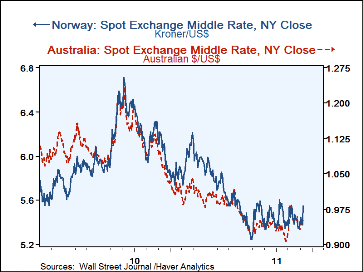

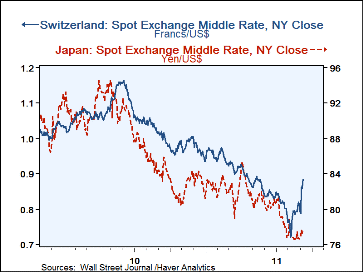

The flow of funds into these currencies has resulted in substantial appreciation of the

targeted currencies. Between October 22, 2008 and April 28 of this year the kroner appreciated 38.4%.

Between Oct 27, 2008 and July 27 of this year, the Australian dollar appreciated 82.5%, between

October 12, 2007 and July 27 of this year, yen appreciated 63.2% and between December 5, 2008

and August 9th of this year the Swiss franc appreciated 32.1%. These appreciations are all

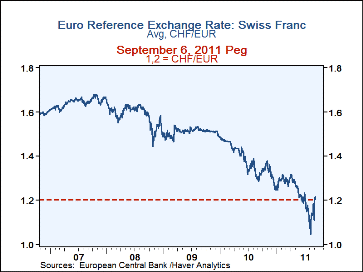

relative to the dollar. In the case of the Swiss franc, its appreciation relative to the

Euro is more important than its relation to the dollar. Over the period from

December 16, 2008 to August 16 of this year, the appreciation of the Swiss franc relative to

the euro was 51.3%, or almost 20 percentage points higher that the appreciation relative to the dollar.

In their attempts to find safe havens for their wealth in unsettled financial environments,

investors have often looked to foreign currencies. Recently the Australian Dollar,

the Norwegian Kroner, the Japanese Yen and the Swiss Franc have experienced substantial

inflows into their currency markets as investors viewed their currencies as a safe haven.

The flow of funds into these currencies has resulted in substantial appreciation of the

targeted currencies. Between October 22, 2008 and April 28 of this year the kroner appreciated 38.4%.

Between Oct 27, 2008 and July 27 of this year, the Australian dollar appreciated 82.5%, between

October 12, 2007 and July 27 of this year, yen appreciated 63.2% and between December 5, 2008

and August 9th of this year the Swiss franc appreciated 32.1%. These appreciations are all

relative to the dollar. In the case of the Swiss franc, its appreciation relative to the

Euro is more important than its relation to the dollar. Over the period from

December 16, 2008 to August 16 of this year, the appreciation of the Swiss franc relative to

the euro was 51.3%, or almost 20 percentage points higher that the appreciation relative to the dollar.

The appreciations have obviously disrupted domestic policies and some governments, notably Japan and Switzerland have intervened in the exchange market. Japan began to intervene on August 6, but has had little impact. Switzerland has been more forceful and announced on September 6 that it would defend a peg 1.2 Swiss francs to the Euro, which is 12.9% below, the high value of 1.0451. The September 9 value of the Swiss franc is slightly below the peg. Very recently, all four currencies have depreciated. The kroner has depreciated 5.5% from its high to September 9th, the Australian dollar, 5.0%, the Yen, 7.1% and the Swiss franc 13.4% relative to the dollar and 14.1% relative to the euro.

Three charts are attached. The first shows the appreciation and recent depreciation of the yen and the Swiss franc. The second shows the peg in relation to the recent history of the Swiss franc relative to the euro and the third, shows the appreciation and recent depreciation of the Australian dollar and the Norwegian kroner.

The Haver database INTDAILY is the source for the data.

| Sep 09, 11 | High Val | Date | Low Val | Date | Curr/High Pct Chg |

High/ Low |

|

|---|---|---|---|---|---|---|---|

| Norwegian Kroner/USD | 5.5467 | 5.2438 | Apr 28,11 | 7.2569 | Oct 22, 08 | -5.5 | 38.4 |

| Australian Dollar/USD | .95490 | .90730 | Jul 27,11 | 1.65540 | Oct 27, 08 | -5.0 | 82.5 |

| Japanese Yen/USD | 77.600 | 72.060 | Aug 19,11 | 117.620 | Oct 12. 07 | -7.1 | 63.2 |

| Swiss Franc/USD | .88350 | .72060 | Aug 9,11 | 1.22230 | Dec 5, 08 | -13.4 | 32.1 |

| Swiss France/EUR | 1.2165 | 1.0451 | Aug 16,11 | 1.5814 | Dec 16,08 | -14.1 | 51.3 |

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates