Global| Apr 16 2007

Global| Apr 16 2007Senior Canadian Managers Positive on Outlook for Production and Inflation

Summary

The results of the Quarterly Survey undertaken by the Regional offices of the Bank of Canada were released today. The Survey is based on the opinions of senior management of 100 firms across Canada. The Bank cautions that while the [...]

The results of the Quarterly Survey undertaken by the Regional offices of the Bank of Canada were released today. The Survey is based on the opinions of senior management of 100 firms across Canada. The Bank cautions that while the method of selection ensures a good cross section of opinion, the statistical reliability of the survey is limited, given its small size. Given that caveat some of the results are listed below.

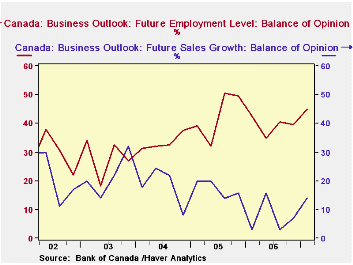

The difference between those senior managers who believe sales will improve and those who believe they will decline increased in the latest survey to 14.00% in the latest Survey, from 6.93% in the Winter Survey and 2.97% in the Spring Survey of 2006. Nevertheless, the conviction that sales will continue to improve appears to be lessening as trend in the balance of opinion on future sales has been down since the end of 2003. In spite of declining trend in the balance of opinion on the future of sales, there is a rising trend in balance of those managers expecting employment to increase and those expecting it to decline. In the latest Survey, there were 45% more managers who expected employment to increase than those who expected employment to decline. The contrast between the trends in Sales and Employment outlooks are shown in the first chart.

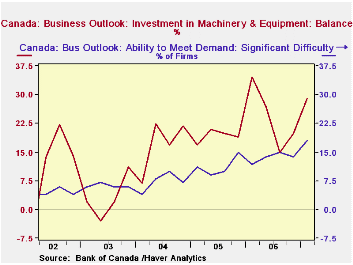

The increased balance of those managers experiencing significant difficulty in meeting demand is consistent with the rising trend in balance of those expecting to increase expenditures on plant and equipment, as shown in the second chart.

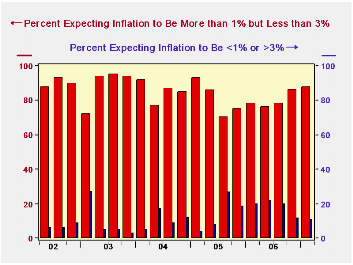

The percentage of the managers who expect inflation to be within the 1-3% range that the Bank of Canada considers its control range increased to 88% from 86.1% in the last survey and 78.2% in the Spring Survey of 2006. The third chart shows the percentage of respondents who expected inflation to be under 1% or above 3% and those who expected it to be between 1 and 3%.

| BUSINESS OUTLOOK SURVEY, BY THE REGIONAL OFFICES OF THE BANK OF CANADA (Percent Balances) | Mar 07 | Feb 07 | Mar 06 | M/M Dif | Y/Y Dif | 2006 | 2005 | 2004 |

|---|---|---|---|---|---|---|---|---|

| Future Sales Outlook | 14.00 | 6.93 | 2.97 | 7.07 | 11.03 | 7.18 | 17.43 | 17.91 |

| Future Employment Level | 45.00 | 39.60 | 42.57 | 5.40 | 2.73 | 39.35 | 42.75 | 33.42 |

| Investment in Plant and Equipment | 29.00 | 19.80 | 34.65 | 9.20 | -5.65 | 24.01 | 19.20 | 16.95 |

| Significant Difficulty in Meeting Demand (%) | 18.00 | 13.90 | 11.90 | 4.10 | 6.10 | 13.65 | 11.20 | 7.25 |

| Inflation Expectations (%)* | ||||||||

| Under 1% or Over 3% | 11.0 | 11.9 | 19.8 | -0.9 | -8.8 | 18.32 | 14.37 | 10.75 |

| Between 1% and 3%. | 88.0 | 86.1 | 78.2 | 1.1 | 9.8 | 79.72 | 81.15 | 85.25 |