Global| Dec 21 2007

Global| Dec 21 2007Service Sector Hits the Skids in France

Summary

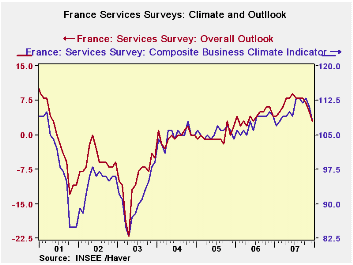

The service sector is beginning to ease in France. The index is down form its peak if 113 in October. As a percent of its range the December reading is still in the top 17% of its range. The outlook reading at +3 stands in the 80.6 [...]

The service sector is beginning to ease in France. The index

is down form its peak if 113 in October. As a percent of its range the

December reading is still in the top 17% of its range. The outlook

reading at +3 stands in the 80.6 percentile of its range and is still

in the top 20% of that range. Expected sales for the 3-months ahead are

in the 67th percentile of their range, the top third, roughly.

Employment expectations are still firm in their range. Over the past

three months observed employment is nearly in the top quarter of its

range whereas expected employment in the three months ahead slips to

the top third at a reading of 10 which is in the 68th percentile of its

range.

These readings generally show that the outlook is a bit weaker

than the current or recent past readings have been. And while the

slowdown and drop off is clear on the chart it is also true that the

survey levels are still firm; what we must wait and see is how far this

expected softening may go.

Insee released today a separate survey on industry in which

morale fared much better than for services. It is surprising with the

concerns over the strong euro that it is the service sector where

morale is fading faster. This could have something to do with the

financial turmoil that has been in train, of course. But industry is

holding up much better despite its competitiveness pressures. Even in

that survey, however, there are more concerns among executives about

the outlook for production in their own business sector. French

consumer spending on MFG goods in also November worked its way lower

showing an unexpected drop. This spending results may have been

affected by recent transits strikes.

There is evidence of strain in the French economy. All of

these reports will bear watching as we turn the calendar sheet to a new

month and new a new year. We will come upon this new year with the

economy a bit more challenged than usual in France, across the Euro

Area, in the US and elsewhere.

| France INSEE Services Survey Jan 2000-date | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Dec-07 | Nov-07 | Oct-07 | Sep-07 | %tile | Rank | Max | Min | Range | Mean | |

| Climate Indicator | 108 | 111 | 113 | 112 | 83.3 | 18 | 113 | 83 | 30 | 102 |

| Climate: 3-Mo Moving avg | 111 | 112 | 113 | 113 | 92.8 | 5 | 113 | 85 | 28 | 102 |

| Climate: 12-Mo Moving avg | 110 | 110 | 110 | 110 | 99.6 | 2 | 110 | 91 | 20 | 101 |

| Outlook | 3 | 5 | 7 | 8 | 80.6 | 23 | 9 | -22 | 31 | -1 |

| Sales | ||||||||||

| Observed 3-mos | 14 | 17 | 18 | 18 | 83.3 | 7 | 19 | -11 | 30 | 6 |

| Expected 3-mos | 9 | 13 | 14 | 14 | 67.9 | 38 | 18 | -10 | 28 | 7 |

| Sales Price | ||||||||||

| Observed over 3-Mos | 0 | -2 | 1 | 2 | 33.3 | 33 | 8 | -4 | 12 | 0 |

| Expected over 3-Mos | -2 | 2 | -1 | 1 | 30.0 | 69 | 5 | -5 | 10 | 1 |

| Employment | ||||||||||

| Observed over 3-Mos | 14 | 8 | 3 | 8 | 73.5 | 5 | 23 | -11 | 34 | 5 |

| Expected over 3-Mos | 10 | 11 | 17 | 9 | 68.2 | 13 | 17 | -5 | 22 | 5 |

Robert Brusca

AuthorMore in Author Profile »Robert A. Brusca is Chief Economist of Fact and Opinion Economics, a consulting firm he founded in Manhattan. He has been an economist on Wall Street for over 25 years. He has visited central banking and large institutional clients in over 30 countries in his career as an economist. Mr. Brusca was a Divisional Research Chief at the Federal Reserve Bank of NY (Chief of the International Financial markets Division), a Fed Watcher at Irving Trust and Chief Economist at Nikko Securities International. He is widely quoted and appears in various media. Mr. Brusca holds an MA and Ph.D. in economics from Michigan State University and a BA in Economics from the University of Michigan. His research pursues his strong interests in non aligned policy economics as well as international economics. FAO Economics’ research targets investors to assist them in making better investment decisions in stocks, bonds and in a variety of international assets. The company does not manage money and has no conflicts in giving economic advice.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates