Global| Oct 03 2007

Global| Oct 03 2007Service Sector Weakens in Europe

Summary

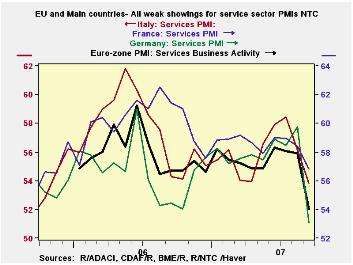

Service sector slows across EMU -- The Reuters/NTC EU indexes on the services sector show widespread weakness in September. For the Euro area 13, the index has dropped a sharp 3-plus points in September and the reading now resides [...]

Service sector slows across EMU -- The Reuters/NTC EU indexes on the services sector show widespread weakness in September. For the Euro area 13, the index has dropped a sharp 3-plus points in September and the reading now resides only just above the midpoint of its range since May of 2000. In Germany, the reading holds in the 55th percentile of its range. For the other featured EMU countries the reading has dropped below the range midpoint. All readings remain above 50 and thus show continuing expansion in the sector. The UK index is relatively strong by comparison.

| NTC Services Indexes | ||||||

|---|---|---|---|---|---|---|

| Sep-07 | Aug-07 | 3Mo | 6Mo | 12Mo | Percentile | |

| Euro area 13 | 54.22 | 58.04 | 56.87 | 57.20 | 57.26 | 54.0% |

| Germany | 53.09 | 59.76 | 57.11 | 57.58 | 57.25 | 55.4% |

| France | 56.79 | 58.40 | 58.04 | 58.28 | 58.67 | 48.0% |

| Italy | 53.86 | 56.18 | 56.17 | 56.15 | 55.66 | 45.3% |

| Spain | 52.37 | 53.51 | 54.07 | 54.65 | 56.38 | 42.1% |

| Ireland | 54.76 | 56.98 | 55.98 | 56.31 | 58.46 | 41.9% |

| EU only | ||||||

| UK | 56.69 | 57.55 | 57.09 | 57.24 | 58.10 | 72.9% |

| Percentile is over range since May 2000 | ||||||

Robert Brusca

AuthorMore in Author Profile »Robert A. Brusca is Chief Economist of Fact and Opinion Economics, a consulting firm he founded in Manhattan. He has been an economist on Wall Street for over 25 years. He has visited central banking and large institutional clients in over 30 countries in his career as an economist. Mr. Brusca was a Divisional Research Chief at the Federal Reserve Bank of NY (Chief of the International Financial markets Division), a Fed Watcher at Irving Trust and Chief Economist at Nikko Securities International. He is widely quoted and appears in various media. Mr. Brusca holds an MA and Ph.D. in economics from Michigan State University and a BA in Economics from the University of Michigan. His research pursues his strong interests in non aligned policy economics as well as international economics. FAO Economics’ research targets investors to assist them in making better investment decisions in stocks, bonds and in a variety of international assets. The company does not manage money and has no conflicts in giving economic advice.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates