Global| Jun 07 2007

Global| Jun 07 2007Slight Relief for Gasoline Prices as Inventories Loosen. But What Is Happening to West Texas Intermediate?

Summary

As prices are sustained at stratospheric levels, we're all learning the mechanics of gasoline production. Special conditions that matter little at $1.00/gallon become significantly more important at $3.00. It's also hard to know what [...]

As prices are sustained at stratospheric levels, we're all learning the mechanics of gasoline production. Special conditions that matter little at $1.00/gallon become significantly more important at $3.00. It's also hard to know what represents ordinary supply-demand movement and what is a "special condition".

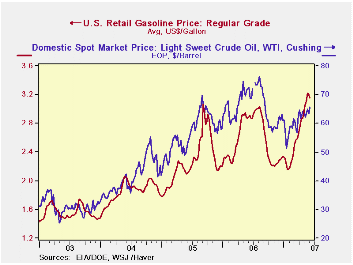

The Energy Information Administration of the Department of Energy (EIA) publishes its weekly petroleum situation every Wednesday, with gasoline prices measured through the Monday just before and other data taken as of the previous Friday. In this week's report, released yesterday morning, the national average retail price of "regular grade" gasoline fell -- that's "fell" -- in the week to June 4 by 5.2 cents to $3.157/gallon. The prior week, which included the Memorial Day weekend, saw a minuscule 0.9-cents decline. Small though this was, it is notable that the price did not rise further despite the holiday weekend driving.

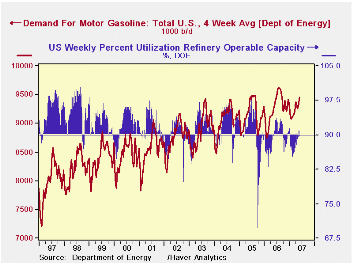

We last checked in with the energy markets three weeks ago, and we highlighted the light inventory situation for gasoline, unusual for the post-winter season, which has pushed gasoline prices to record highs. We attributed this to demand conditions that weren't nearly as weak this winter as has traditionally been the case. It's also evident from the second graph that even as demand for gasoline has grown, refiners have not been able to keep up. We show refining capacity utilization and we've drawn a line at 90%. Almost continuously since the middle of 1993, utilization has been well above this reference line. If we graph the variable with bars, they point up and down around the "horizontal reference". We see easily then that Hurricanes Katrina and Rita hurt refiners badly, and it's clear that refinery utilization rates have remained well below our reference point even as they have increased somewhat over the last few weeks. Thus, refining has not recovered from those big 2005 storms, leaving the industry -- and prices -- more vulnerable to ordinary operating outages.

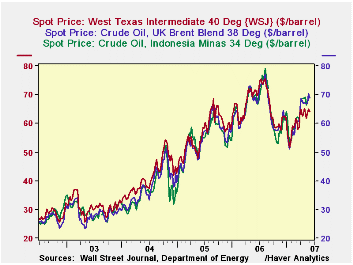

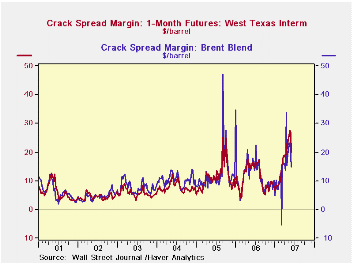

Another quirk in these data concerns the relationship between prices of various crudes, especially the US base, West Texas Intermediate (WTI) as delivered at Cushing, Oklahoma. As the EIA explain in This Week in Petroleum for May 2, conditions regarding the oil itself and also the operation of the Cushing Hub have depressed the price of WTI relative to other oils. In the third graph, WTI is seen to be lower over the last 3 months or so than Brent and Indonesian oil, which are both "heavier" and should have lower prices than WTI.  So when the price of gasoline has risen more than proportionately to the crude oil we're most familiar with, it may not be so much that refiners are trying to gouge their customers. In fact, the "crack spread" for Brent crude, while still high by past comparisons, has come down markedly from its recent levels. A similar measure for WTI fell last week, but it remains about $5 more per barrel than Brent, when the usual condition has been for the WTI crack spread to be marginally less than the Brent spread (since the crude is usually more expensive to begin with). As we noted at the beginning of this commentary, it makes one wonder if this mismatch of WTI and Brent (and other crude oils) is a "special condition" to be discounted as temporary, or is it a characteristic of the increasing supply/demand strains in the world energy market and in the US in particular? In that event, both energy suppliers and users would want factor the new relationships into their operating strategies.

So when the price of gasoline has risen more than proportionately to the crude oil we're most familiar with, it may not be so much that refiners are trying to gouge their customers. In fact, the "crack spread" for Brent crude, while still high by past comparisons, has come down markedly from its recent levels. A similar measure for WTI fell last week, but it remains about $5 more per barrel than Brent, when the usual condition has been for the WTI crack spread to be marginally less than the Brent spread (since the crude is usually more expensive to begin with). As we noted at the beginning of this commentary, it makes one wonder if this mismatch of WTI and Brent (and other crude oils) is a "special condition" to be discounted as temporary, or is it a characteristic of the increasing supply/demand strains in the world energy market and in the US in particular? In that event, both energy suppliers and users would want factor the new relationships into their operating strategies.

The data here on prices and US inventories are in the OILWKLY database. Haver Analytics analysts perform seasonal adjustment on some demand and supply series; these are maintained in our WEEKLY database.

| Select Oil Market Indicators | June 4 | May 28 | May 21 | Month- Ago Week | Year-Ago Week | 2006 | 2005 |

|---|---|---|---|---|---|---|---|

| Gasoline, US Regular Grade (cents/gal) | 315.7 | 320.9 | 321.8 | 305.4 | 289.2 | 257.2 | 227.0 |

| Crude Oil: West Texas Intermediate ($/barrel) | June 1 | May 25 | May 18 | 63.79 | 71.50 | 66.13 | 56.50 |

| 63.94 | 64.94 | 63.61 | |||||

| UK Brent | 68.91 | 70.32 | 66.92 | 66.92 | 69.43 | 65.19 | 54.58 |

| Refinery Utilization (%) | 89.63 | 91.08 | 91.10 | 89.03 | 90.97 | 89.36 | 90.35 |

| Gasoline Stock: Days' Supply | 21.3 | 21.0 | 21.0 | 20.9 | 22.5 | 22.7 | 22.8 |

Carol Stone, CBE

AuthorMore in Author Profile »Carol Stone, CBE came to Haver Analytics in 2003 following more than 35 years as a financial market economist at major Wall Street financial institutions, most especially Merrill Lynch and Nomura Securities. She had broad experience in analysis and forecasting of flow-of-funds accounts, the federal budget and Federal Reserve operations. At Nomura Securities, among other duties, she developed various indicator forecasting tools and edited a daily global publication produced in London and New York for readers in Tokyo. At Haver Analytics, Carol was a member of the Research Department, aiding database managers with research and documentation efforts, as well as posting commentary on select economic reports. In addition, she conducted Ways-of-the-World, a blog on economic issues for an Episcopal-Church-affiliated website, The Geranium Farm. During her career, Carol served as an officer of the Money Marketeers and the Downtown Economists Club. She had a PhD from NYU's Stern School of Business. She lived in Brooklyn, New York, and had a weekend home on Long Island.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates