Global| Sep 30 2020

Global| Sep 30 2020Small Upward Revision to GDP Still Leaves Q2 with Record Quarterly Decline

Summary

• Q2 GDP collapses at a 31.4% annual rate in third estimate versus -31.7% in previous take. • Consumption and housing revised up; capex, government and trade down. • This release now includes GDP by industry which will now be [...]

• Q2 GDP collapses at a 31.4% annual rate in third estimate versus -31.7% in previous take.

• Consumption and housing revised up; capex, government and trade down.

• This release now includes GDP by industry which will now be available concurrently with demand data.

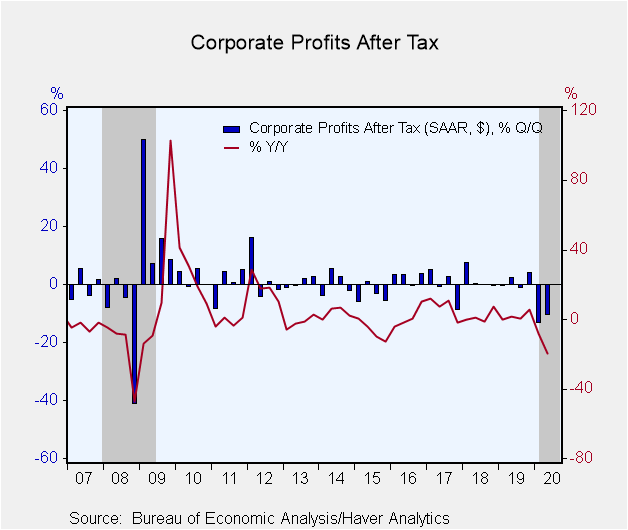

• Q2 after-tax corporate profits fall 10.5% versus -11.7% reported last month.

• A bit less deflation than the previous estimate.

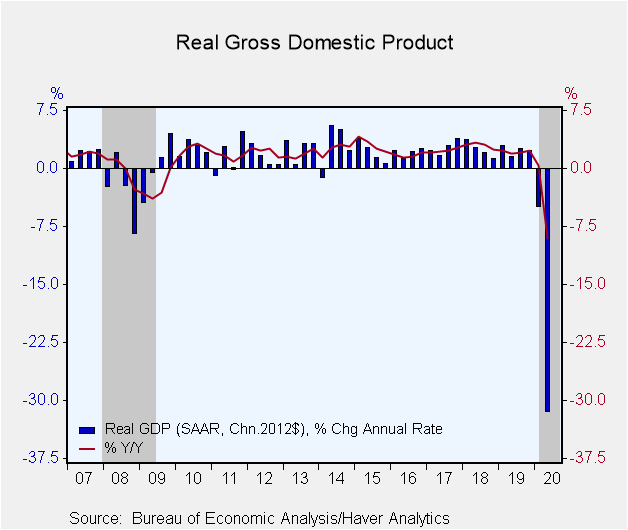

The third estimate of Q2 U.S. real GDP showed that economic activity plunged 31.4% quarter-on-quarter at a seasonally adjusted annual rate (saar), slightly less than the previously reported 31.7% decline. The revised figure was still the largest quarterly decline on record dating back to 1947. The Action Economics Forecast survey had looked for an unrevised -31.7%. In combination with the -5.0% saar decline in Q1, this leaves real GDP down 10.1% from its peak in 2019Q4. Monthly indicators are pointing to a rebound in economic activity in the third quarter, though GDP is still expected to end up well below its 2019Q4 peak.

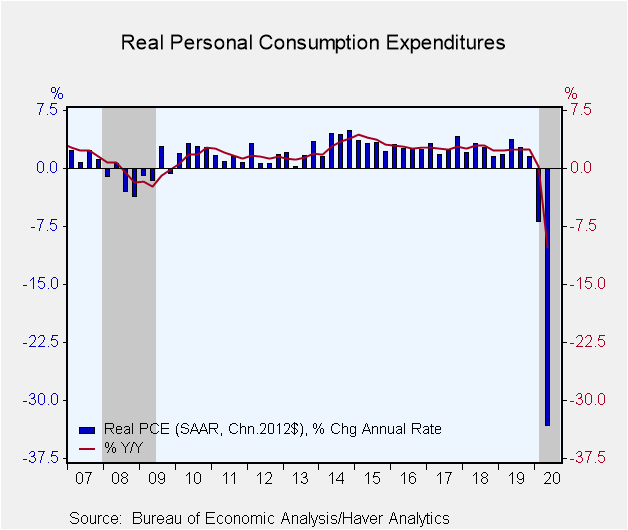

The slump in Q2 domestic final sales was slightly smaller, now -28.1% saar versus -28.5%. The Q2 decline continued to be led by a 33.2% collapse in consumer spending (previously -34.1%) which reflected a 10.8% drop in spending on goods and a 41.8% cratering in spending on services. The prior record quarterly decline in spending on services was -3.0% annualized.

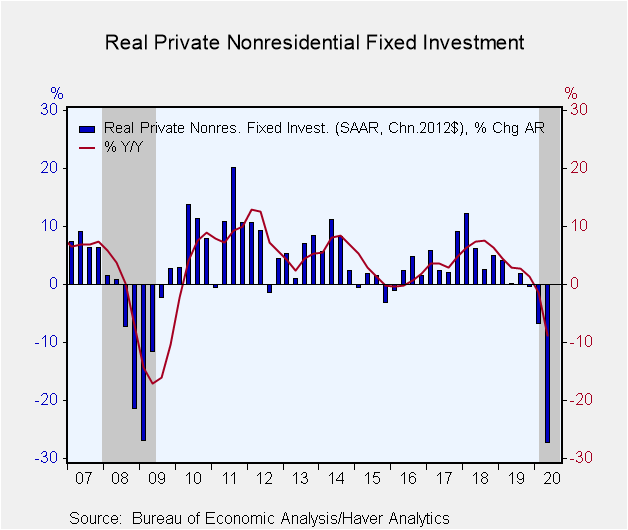

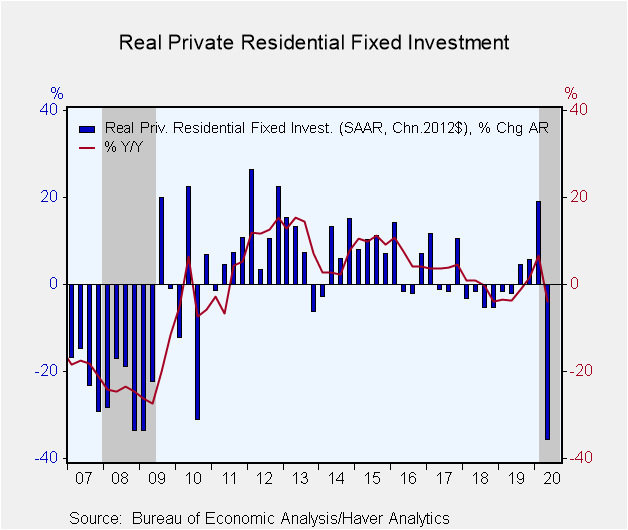

Nonresidential business fixed investment was revised down to -27.2 from -26.0%. The downward revision was predominantly the result of a lower estimate of spending on intellectual property which was down at a 11.4% rate versus 7.7%. Outlays for structures were off 33.6% while equipment plummeted 35.9%. The previously reported 37.9% drop in residential investment was revised to -35.5%.

Government spending rose 2.5% in the third estimate versus 2.8% in the second take. This reflected a 16.5% jump in federal government spending which was somewhat offset by a 5.4% drop in spending by cash-strapped state and local governments.

Inventory liquidation continued to subtract 3.5 percentage points from GDP. The foreign trade deficit narrowed less in the third estimate than it had in the second and thereby added 0.6%-point versus the previously estimated 0.9%-point. Exports and imports were down an unprecedented 64.4% and 54.1% respectively. The trade deficit narrowed by only a bit because the dollar value of imports is 25% larger than exports.

Economic profits -- corporate profits before tax with inventory valuation (IVA) and capital consumption adjustments (CCA) -- fell $208.9 billon (-10.3% q/q not annualized) in Q2 versus a previously reported -11.1%. This was the second consecutive double-digit quarterly drop, following a 12.0% q/q not annualized decline in Q1. These are the largest quarterly declines in profits since 2008Q4, in the midst of the global financial crisis. After tax profits without IVA and CCA, which more closely aligns with reported corporate earnings, was down 10.2% in Q2 (initially reported as -11.7%) after -13.1% in Q1.

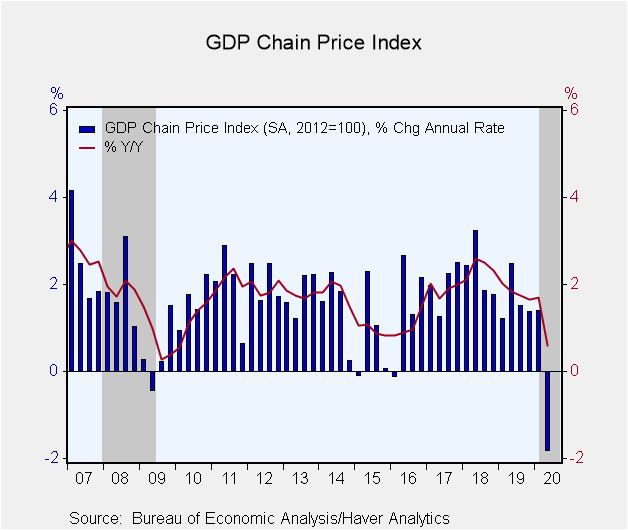

The GDP price index fell 1.8% saar in Q2 versus the previous estimate of a 2.0% decline, with the PCE price index down 1.6%. Excluding food and energy, the core PCE price index decreased at a 0.8% rate versus -1.0% in the previous estimate. This is the only quarterly core PCE deflation in on record, with data going back to 1959.

The GDP figures can be found in Haver's USECON and USNA database. USNA contains virtually all of the Bureau of Economic Analysis' detail in the national accounts. Both databases include tables of the newly published not seasonally adjusted data. The Action Economics consensus estimates can be found in AS1REPNA.

| Chained 2012 $ (%, AR) | Q2'20 (3rd Estimate) | Q2'20 (2nd Estimate) | Q1'20 | Q4'19 | Q2'20 Y/Y | 2019 | 2018 | 2017 |

|---|---|---|---|---|---|---|---|---|

| Gross Domestic Product | -31.4 | -31.7 | -5.0 | 2.4 | -9.0 | 2.2 | 3.0 | 2.3 |

| Inventory Effect (%-point) | -3.5 | -3.5 | -1.3 | -0.8 | -1.6 | 0.0 | 0.2 | 0.0 |

| Final Sales | -28.1 | -28.5 | -3.6 | 3.2 | -7.4 | 2.2 | 2.8 | 2.4 |

| Foreign Trade Effect (%-point) | 0.6 | 0.9 | 1.1 | 1.5 | 0.3 | -0.2 | -0.3 | -0.2 |

| Domestic Final Sales | -27.1 | -27.7 | -4.6 | 1.6 | -7.7 | 2.3 | 3.0 | 2.5 |

| Demand Components | ||||||||

| Personal Consumption Expenditure | -33.2 | -34.1 | -6.9 | 1.6 | -10.2 | 2.4 | 2.7 | 2.6 |

| Nonresidential Fixed Investment | -27.2 | -26.0 | -6.7 | -0.3 | -8.9 | 2.9 | 6.9 | 3.7 |

| Residential Investment | -35.5 | -37.9 | 19.0 | 5.8 | -4.0 | -1.7 | -0.6 | 4.0 |

| Government Spending | 2.5 | 2.8 | 1.3 | 2.4 | 2.1 | 2.3 | 1.8 | 0.9 |

| Chain-Type Price Index | ||||||||

| GDP | -1.8 | -2.0 | 1.4 | 1.4 | 0.6 | 1.8 | 2.4 | 1.9 |

| Personal Consumption Expenditure | -1.6 | -1.8 | 1.3 | 1.5 | 0.6 | 1.5 | 2.1 | 1.8 |

| Less Food & Energy | -0.8 | -1.0 | 1.6 | 1.3 | 1.0 | 1.7 | 2.0 | 1.7 |

| Nonresidential Investment | 0.8 | 0.9 | 1.0 | -0.4 | 0.4 | 1.3 | 0.9 | 0.9 |

| Residential Investment | 1.0 | 1.5 | 2.3 | 2.4 | 2.2 | 2.8 | 5.6 | 4.5 |

| After-Tax Corporate Profits (%) | -10.5 | -11.7 | -13.1 | 4.2 | -19.7 | 1.8 | 1.7 | 7.0 |

Gerald D. Cohen

AuthorMore in Author Profile »Gerald Cohen provides strategic vision and leadership of the translational economic research and policy initiatives at the Kenan Institute of Private Enterprise.

He has worked in both the public and private sectors focusing on the intersection between financial markets and economic fundamentals. He was a Senior Economist at Haver Analytics from January 2019 to February 2021. During the Obama Administration Gerald was Deputy Assistant Secretary for Macroeconomic Analysis at the U.S. Department of Treasury where he helped formulate and evaluate the impact of policy proposals on the U.S. economy. Prior to Treasury, he co-managed a global macro fund at Ziff Brothers Investments.

Gerald holds a bachelor’s of science from the Massachusetts Institute of Technology and a Ph.D. in Economics from Harvard University and is a contributing author to 30-Second Money as well as a co-author of Political Cycles and the Macroeconomy.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates