Global| May 26 2020

Global| May 26 2020Something's Wrong: A Debt-Financed Recession

Summary

The Fed's debt-bridge policy is designed to improve the flow of credit to businesses to avoid a devastating credit crunch. Never before has one of the monetary policy solutions to combat recession been to extend credit to struggling, [...]

The Fed's debt-bridge policy is designed to improve the flow of credit to businesses to avoid a devastating credit crunch. Never before has one of the monetary policy solutions to combat recession been to extend credit to struggling, profit losing businesses.

The Fed's debt-bridge policy is designed to improve the flow of credit to businesses to avoid a devastating credit crunch. Never before has one of the monetary policy solutions to combat recession been to extend credit to struggling, profit losing businesses.

There is no precedent for record business borrowing during a recession. The scale of business failures during and after the economy exits recession will far exceed that of the Great Financial Recession.

The Fed's Debt-Bridge Policy

The traditional way for monetary policy to build a bridge from recession to recovery is through the lowering of official interest rates. In time, the reduction of interest rates triggers a refinancing cycle, lowering interest costs, and improving liquidity positions. The "reliquification" process enables firms (and individuals) to exit recession with stronger liquidity and lower debt burdens.

With official interest rates relatively low the "reliquification" process was not a viable policy option to combat the abrupt contraction in the economy. So policymakers were forced to support the flow of credit to the economy by purchasing securities and provide direct financing to sectors where it is not otherwise available or too costly.

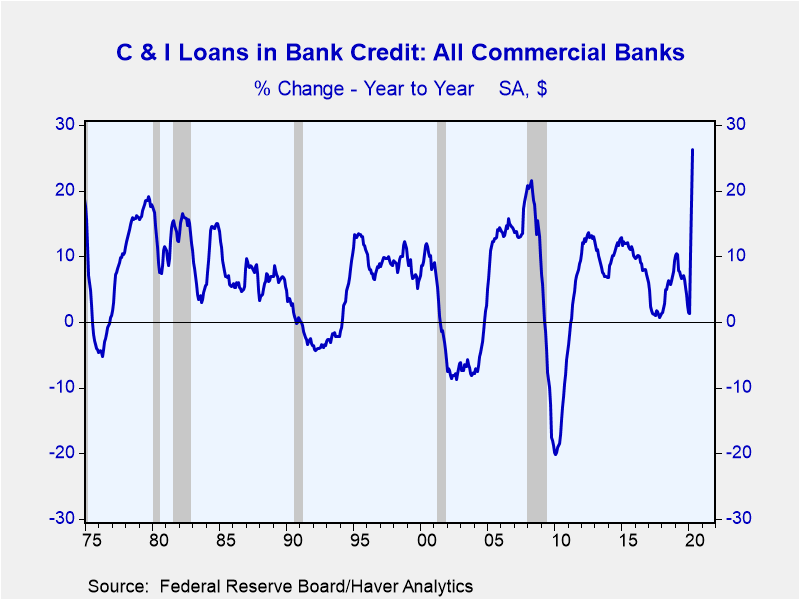

So instead of contracting, which is the typical pattern during the recession, the flow of private credit has exploded to the upside.

Since the start of 2020, commercial and industrial loans have increased over $750 billion to a record $3.1 trillion. That increase nearly matches the cumulative increase in corporate bank borrowing of the past 6 years.

At the same time, US corporations have tapped the capital markets for hundreds of billions of new debt. Through early May corporations have issued nearly $300 billion in new debt, twice as much as the comparable period one year ago.

An addition of $1 trillion of new liabilities over a few months is a big number in the best of times. Yet, record corporate borrowing during bad times increases the risk of business failures and defaults. Here's why.

A Harvard Business study released in 2010 analyzed corporate performance during three global recessions from 1980 to 2000. Sales and profit performance of 4700 public companies were analyzed three years before and three years after the recession.

The findings paint a grim picture of the devastating and lasting impact recession has on corporate performance. To be sure, a shocking seventeen percent of the companies failed were acquired or decided to go private.

Meanwhile, three years after the recession forty percent of the companies hadn't recovered to precession sales and profit levels. And, approximately 80% of public companies had not rebounded to their pre-recession growth rates in sales and profits a full three years after the recession.

Almost all business people agree that the current crisis marks an inflection point. The business world has changed and firms need to remake (i.e., downsize) their organizations to fit in the new normal. Companies will operate with a smaller footprint, but more debt.

There is no precedent for record corporate borrowing during a recession. As a result, investors need to brace for an economy unlikely to resemble the one before, with an uneven and slow growth, and record corporate failures.

Joseph G. Carson

AuthorMore in Author Profile »Joseph G. Carson, Former Director of Global Economic Research, Alliance Bernstein. Joseph G. Carson joined Alliance Bernstein in 2001. He oversaw the Economic Analysis team for Alliance Bernstein Fixed Income and has primary responsibility for the economic and interest-rate analysis of the US. Previously, Carson was chief economist of the Americas for UBS Warburg, where he was primarily responsible for forecasting the US economy and interest rates. From 1996 to 1999, he was chief US economist at Deutsche Bank. While there, Carson was named to the Institutional Investor All-Star Team for Fixed Income and ranked as one of Best Analysts and Economists by The Global Investor Fixed Income Survey. He began his professional career in 1977 as a staff economist for the chief economist’s office in the US Department of Commerce, where he was designated the department’s representative at the Council on Wage and Price Stability during President Carter’s voluntary wage and price guidelines program. In 1979, Carson joined General Motors as an analyst. He held a variety of roles at GM, including chief forecaster for North America and chief analyst in charge of production recommendations for the Truck Group. From 1981 to 1986, Carson served as vice president and senior economist for the Capital Markets Economics Group at Merrill Lynch. In 1986, he joined Chemical Bank; he later became its chief economist. From 1992 to 1996, Carson served as chief economist at Dean Witter, where he sat on the investment-policy and stock-selection committees. He received his BA and MA from Youngstown State University and did his PhD coursework at George Washington University. Honorary Doctorate Degree, Business Administration Youngstown State University 2016. Location: New York.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates