Global| Jun 22 2007

Global| Jun 22 2007South Africa Maintains 5% GDP Growth Trend, with 20% Gains in Fixed Investment

Summary

The South African economy is moving ahead vigorously, according to Q1 GDP data released yesterday by the South African Reserve Bank. Growth actually slowed to "just" 4.7% from Q4 at an annual rate, following 5.6%. Year-on-year growth [...]

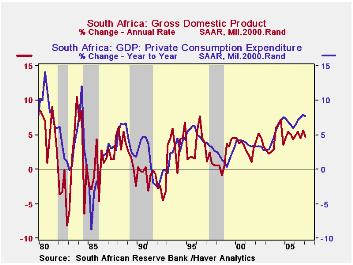

The South African economy is moving ahead vigorously, according to Q1 GDP data released yesterday by the South African Reserve Bank. Growth actually slowed to "just" 4.7% from Q4 at an annual rate, following 5.6%. Year-on-year growth was 5.4%. The trend has hovered around a 5% pace since 2004, a pick-up from about 3-1/2% in the previous four years. In the first graph, we show GDP and consumption since 1980, along with recession shading for South African business cycles. Recent GDP growth has been lower than in some periods, but much more consistent, so that highs are not soon offset by lows. The last recession ended in late 1998.

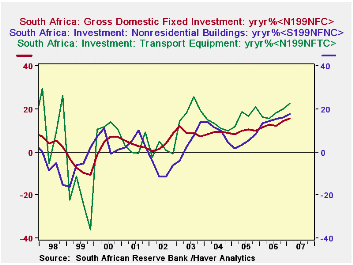

Investment has been the driving force over the last couple of years and expanded at nearly a 22% annual rate in Q1. Further detail (see second graph) shows substantial increases in nonresidential buildings and infrastructure, and additional detail on these expenditures by industry indicates that they are in transportation, communication and utilities. Some of these are coming off a low base, but expanding very rapidly, a sign of the vigor of development efforts in South Africa. Gross value added in the construction industry parallels this growth.

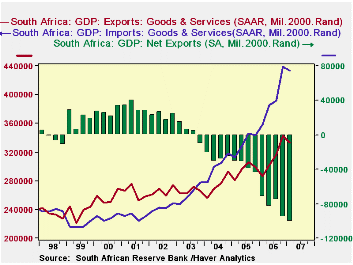

Consumer spending is hardly weak, either, with gains across the last five quarter exceeding 7% and even 8%. These are concentrated in goods, with spending on services less rapid. If there's a problem in South Africa's spending mix, it's in net exports. Exports themselves are fairly strong; they declined a bit in Q1 from Q4, but are still up 16.2% on the year-ago period. Imports are even stronger, though, with four-quarter growth right at 20%. Obviously much of the consumer and investment spending is sourced from foreign goods and services. A quick look at trade data shows marked growth in imports of metals, machinery, textiles, chemicals and even food products. As the South African economy moves ahead, we'd guess that this dependence on foreign goods would diminish.

| SOUTH AFRICA | Q1 2007* | Q4 2006* | Q3 2006* | Q1 2006 Yr/Yr | 2006 | 2005 | 2004 |

|---|---|---|---|---|---|---|---|

| Real GDP | 4.7 | 5.6 | 4.5 | 5.4 | 5.0 | 5.1 | 4.8 |

| Private Consumption | 7.4 | 7.8 | 7.6 | 7.6 | 7.3 | 6.6 | 6.7 |

| Fixed Investment | 21.8 | 16.4 | 14.0 | 15.6 | 12.7 | 9.6 | 8.9 |

| Net Exports (Bil.Rand) | -100.3 | -95.8 | -75.1 | -72.5 | -81.8 | -36.9 | -26.6 |

| GVA: Construction | 21.3 | 16.5 | 16.1 | 16.6 | 13.7 | 11.9 | 11.1 |

| Manufacturing | 4.7 | 8.3 | 4.7 | 5.7 | 4.8 | 5.0 | 4.7 |

Carol Stone, CBE

AuthorMore in Author Profile »Carol Stone, CBE came to Haver Analytics in 2003 following more than 35 years as a financial market economist at major Wall Street financial institutions, most especially Merrill Lynch and Nomura Securities. She had broad experience in analysis and forecasting of flow-of-funds accounts, the federal budget and Federal Reserve operations. At Nomura Securities, among other duties, she developed various indicator forecasting tools and edited a daily global publication produced in London and New York for readers in Tokyo. At Haver Analytics, Carol was a member of the Research Department, aiding database managers with research and documentation efforts, as well as posting commentary on select economic reports. In addition, she conducted Ways-of-the-World, a blog on economic issues for an Episcopal-Church-affiliated website, The Geranium Farm. During her career, Carol served as an officer of the Money Marketeers and the Downtown Economists Club. She had a PhD from NYU's Stern School of Business. She lived in Brooklyn, New York, and had a weekend home on Long Island.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates