Global| Mar 22 2007

Global| Mar 22 2007South Africa Retail Sales Pick Up; Construction Activity and Vehicle Sales Also Show Gains

Summary

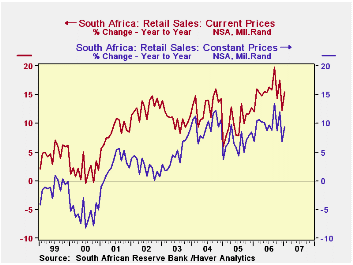

Retail sales in South Africa grew 9.4% in constant 2000 prices in January from a year ago, a resumption of stronger growth after December's gain slowed to 6.7%. For all of 2006, sales were up 9.6%. In current prices, they rose 15.6% [...]

Retail sales in South Africa grew 9.4% in constant 2000 prices in January from a year ago, a resumption of stronger growth after December's gain slowed to 6.7%. For all of 2006, sales were up 9.6%. In current prices, they rose 15.6% from January 2006, also similar to the overall 2006 gain of 15.3%.

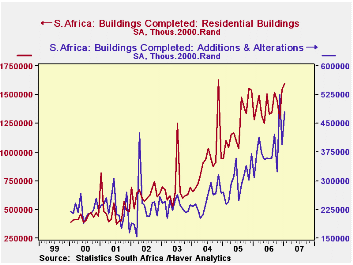

A breakout of sales into store groups is only available since 2005. Among the various groups, the greatest strength has been in household goods and building materials; these surged 25.5% (current prices) in January from the year-ago amount and were up 20.1% for all of 2006. The push for this growth has come from new construction and remodeling. The accompanying graph of construction data shows the expansion in residential buildings completed and in additions and alterations (some of which can be nonresidential, too, of course). The latter item continues to grow rapidly. The former, new homes, has flattened in recent months after a sustained rise that lasted from the spring of 2004 through last summer. But filling these homes with furniture and appliances and adding various amenities is supporting retail sales.

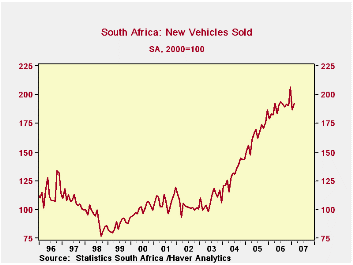

People have also been buying cars in good numbers. The index of vehicles sold was up 3.0% in February, following a drop of 9.6% in January, which in turn came after an 8.5% increase n December; these are month-to-month changes in seasonally adjusted data. These erratic monthly swings are still yielding year-to-year advances; for February, it was 5.1%. The last three years have been extraordinary for vehicle sales, up 14.4% for 2006, 25.7% in 2005 and 22.0% in 2004. It's hardly surprising that some hesitation is developing. But overall, the consumer sector is pulling the South African economy ahead with some vigor.

| South Africa, NSA ex as noted | Feb 2007 | Jan 2007 | Dec 2006 | Year Ago | 2006 | 2005 | 2004 |

|---|---|---|---|---|---|---|---|

| Retail Sales, Mil.Rand | -- | 34,018 | 49,608 | 29,440 | 418,450 | 362,796 | 329,238 |

| Yr/Yr % Chg | -- | 15.6% | 12.2% | 12.0% | 15.3% | 10.2% | 13.1% |

| Mil.2000.Rand | -- | 24,126 | 35,485 | 22,052 | 303,535 | 276,945 | 259,502 |

| Yr/Yr % Chg | -- | 9.4% | 6.7% | 6.9% | 9.6% | 6.7% | 9.7% |

| Furniture, Appliances & Building Matl, Yr/Yr % Chg | -- | 25.5% | 12.4% | 19.5% | 20.1% | -- | -- |

| Vehicles Sold (SA, 2000=100) | 192.3 | 186.7 | 206.6 | 182.9 | 189.5 | 165.6 | 131.8 |

Carol Stone, CBE

AuthorMore in Author Profile »Carol Stone, CBE came to Haver Analytics in 2003 following more than 35 years as a financial market economist at major Wall Street financial institutions, most especially Merrill Lynch and Nomura Securities. She had broad experience in analysis and forecasting of flow-of-funds accounts, the federal budget and Federal Reserve operations. At Nomura Securities, among other duties, she developed various indicator forecasting tools and edited a daily global publication produced in London and New York for readers in Tokyo. At Haver Analytics, Carol was a member of the Research Department, aiding database managers with research and documentation efforts, as well as posting commentary on select economic reports. In addition, she conducted Ways-of-the-World, a blog on economic issues for an Episcopal-Church-affiliated website, The Geranium Farm. During her career, Carol served as an officer of the Money Marketeers and the Downtown Economists Club. She had a PhD from NYU's Stern School of Business. She lived in Brooklyn, New York, and had a weekend home on Long Island.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates