Global| Aug 16 2005

Global| Aug 16 2005Spain's Balance of Payments in May

Summary

Spain reported balance of payment data for May today. Spain's presentation of balance of payments data differs from that of most other countries. Included in the financial account is the category, "Bank of Spain." This item includes [...]

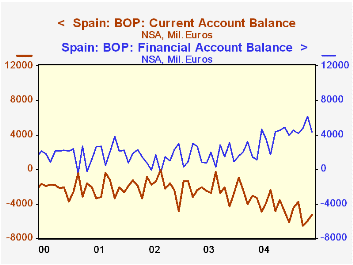

Spain reported balance of payment data for May today. Spain's presentation of balance of payments data differs from that of most other countries. Included in the financial account is the category, "Bank of Spain." This item includes the change in international reserves, which in most presentations is a separate item, in addition to international transactions of the Bank of Spain. As a result the balance on Spain's current account is completely offset by the sum of the capital account, the financial account and the residual item, "errors and omissions." The first chart shows the current account and the financial account balances.

Over the past year and a half, the current account deficit has become increasingly more negative, while the financial account has become more positive. As most developed countries have abandoned capital controls over the international flow of funds, it has become more difficult to decide whether it is the current account or the financial account that calls the tune in the eventual balancing of the accounts. Before the relaxation of capital controls, it was generally agreed that the driving force in a country's balance of payments was its balance on current account. Now, however, it is agreed that capital flows are an additional factor, or in some cases, the major factor in determining the eventual balance of the accounts.

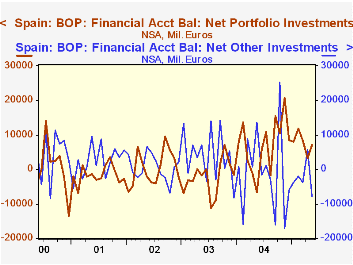

The elements of the current account, exports and imports goods, services and the balance of wages and income from foreign activities tend to show rather smooth trends. The elements of the financial account, however, exhibit very volatile trends. For example, there was a net outflow of "other investment," in May of 7,834 million euros after an inflow of 5,657 million euros in April, resulting in an negative change of 13,491 million euros between April and May. Direct and portfolio investment, derivatives and financial flows of the Bank of Spain, however, all contributed to an almost equal positive change. The volatility and the diverse movements of the various capital flows are illustrated in the second chart that shows net portfolio and net "other" investments in Spain's balance of payments.

| Spain: Balance of Payments (Mil. Euros) |

May 05 | Apr 05 | May 04 | M/M Dif | Y/Y Dif | 2004 | 2003 | 2002 |

|---|---|---|---|---|---|---|---|---|

| Current Account | -5258 | -6014 | -3314 | 756 | -1944 | -44450 | -27908 | -23812 |

| Capital Account | 990 | 308 | 1867 | 682 | -877 | 8547 | 8165 | 7663 |

| Financial Account | 4347 | 6183 | 1104 | -1836 | 3243 | 36836 | 18875 | 15988 |

| Net Direct Investment | 247 | -902 | 46 | 1149 | 201 | -26345 | -1418 | 6904 |

| Net Portfolio Investment | 7086 | 3231 | -6650 | 3855 | 13736 | 85804 | -26592 | 4727 |

| Net Other Investment | -7834 | 5657 | 13610 | -13491 | -21446 | -9776 | 48750 | 5712 |

| Derivatives | -123 | -1036 | 308 | 913 | -431 | 1162 | -3434 | -4915 |

| Bank of Spain | 4970 | -767 | -6209 | 5737 | 11179 | -14010 | 1576 | 3561 |

| Errors and Omissions | -79 | -478 | 343 | 399 | -422 | 36836 | 18875 | 15988 |