Global| Dec 30 2013

Global| Dec 30 2013Spain's Retail Sales Snap Back

Summary

There have only been a few months of sales increases. But Spain's retail sales are advancing and that is good news since sales have been falling year over year since 2007- almost without exception. Retail sales are up monthly for the [...]

There have only been a few months of sales increases. But Spain's retail sales are advancing and that is good news since sales have been falling year over year since 2007- almost without exception.

There have only been a few months of sales increases. But Spain's retail sales are advancing and that is good news since sales have been falling year over year since 2007- almost without exception.

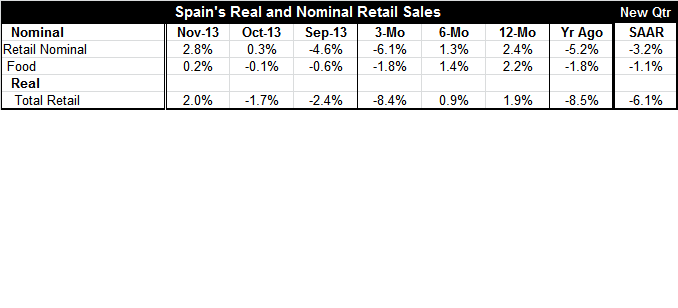

Retail sales are up monthly for the second month in a row as well as in four of the past five months. Still sales are dropping two months into the new quarter compared to the previous quarter.

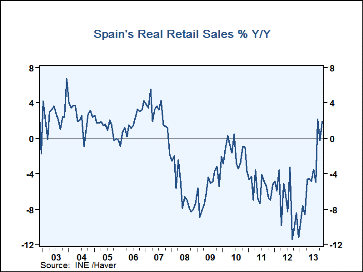

But the real story is told by the chart which shows the inflation adjusted 12-month change in sales. On that chart the past few months are a solid and significant break from the past when the financial crisis dominated the landscape. Austerity that dogged Spain's economy for far too long is finally giving way to growth. Compared to their late 2007 peak sales in November are 26% lower in 2013.

Retail sales write a clear shorthand for what has gone on in Spain over that period. A 26% drop in sales over a period of six years, a drop of over 4.3% per year in real terms, is devastating. Putting Spain, the fifth largest EMU economy, back in the growth column for real will be a big boost to EMU.

Even so Spain is going to continue to struggle. There has been a great deal of retrenching and things will not be back to normal instantly. There will be ongoing questions about Spain's budget metrics. Spain is not simply free to spend itself back to growth. But neither is it clear the sort of strictures that might yet bind Spain in the future. Growth will make it easier for Spain to hit debt-to-GDP metrics.

Retail sales have risen by 2.8% in November, their strongest gain since July. Spain is on the mend. It is in sync with an EMU-wide trend to better growth. Perhaps Europe's failed experiment with austerity is now over. The pain of that experience will never be forgotten. While Spain is stirring, it is still not on track to grow sales in the current quarter. But the surge in sales from deep negative values to a flirtation with ongoing growth is a remarkable shift and one that seems likely to endure. Spain does now seem to have turned the corner.

Robert Brusca

AuthorMore in Author Profile »Robert A. Brusca is Chief Economist of Fact and Opinion Economics, a consulting firm he founded in Manhattan. He has been an economist on Wall Street for over 25 years. He has visited central banking and large institutional clients in over 30 countries in his career as an economist. Mr. Brusca was a Divisional Research Chief at the Federal Reserve Bank of NY (Chief of the International Financial markets Division), a Fed Watcher at Irving Trust and Chief Economist at Nikko Securities International. He is widely quoted and appears in various media. Mr. Brusca holds an MA and Ph.D. in economics from Michigan State University and a BA in Economics from the University of Michigan. His research pursues his strong interests in non aligned policy economics as well as international economics. FAO Economics’ research targets investors to assist them in making better investment decisions in stocks, bonds and in a variety of international assets. The company does not manage money and has no conflicts in giving economic advice.