Global| Oct 04 2018

Global| Oct 04 2018Strong Factory Orders and Shipments Data

Summary

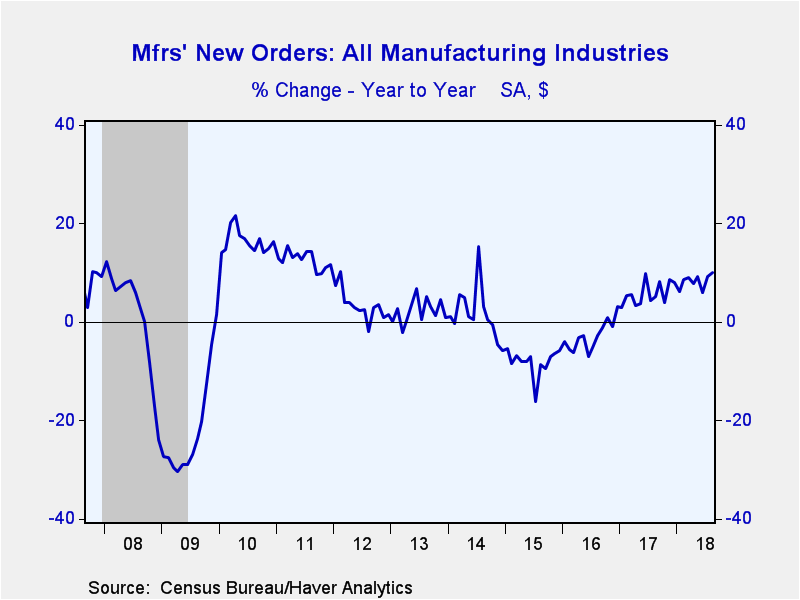

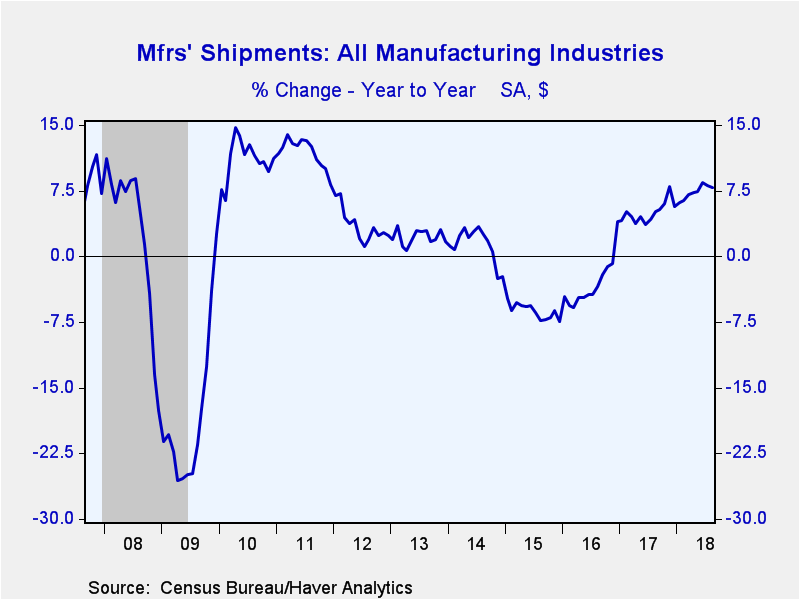

Manufacturers' orders jumped 2.3% (10.0% year-on-year) in August, following an upwardly revised 0.5% decline in July. Manufacturing shipments rose 0.5% (7.8% y/y), the 14 consecutive monthly increase. Orders in the volatile durable [...]

Manufacturers' orders jumped 2.3% (10.0% year-on-year) in August, following an upwardly revised 0.5% decline in July. Manufacturing shipments rose 0.5% (7.8% y/y), the 14 consecutive monthly increase.

Orders in the volatile durable goods sector surged 4.4% (11.8% y/y) after a 1.2% decline in July. Orders for transportation equipment soared 13.1% (20.7% y/y) due to a 69.1% takeoff in volatile civilian aircraft bookings (20.6% y/y). Total factory orders excluding transportation edged up 0.1% (7.8% y/y). Machinery orders declined 0.8% (+5.7% y/y) after a 0.4% increase. Orders for computers & electronic products decreased 0.3% (+6.9% y/y).

Shipments of durable goods grew 0.7% (7.5% y/y) in August. Shipments of transportation equipment increased 2.0% (8.0% y/y) reflecting an 18.2% jump in civilian aircraft & parts (0.6% y/y). Machinery shipments declined 0.6% (+5.9% y/y) reversing July's gain. Computer & electronic product shipments edged up 0.1% (6.5% y/y).

Nondurable goods shipments, which equal nondurable goods orders because nondurables are shipped in the same period they are ordered, rose 0.2% (8.1% y/y). While the largest nondurable category, food products, was flat (0.8% y/y), basic chemicals, the second largest, rose 0.4% (5.9% y/y). Shipments of petroleum & coal shipments edged down 0.1% (+27.5% y/y). Energy prices, in particular oil prices, have a significant role on the value of energy product activity in this report. West Texas intermediate oil prices were up 41.5% in the year ending August.

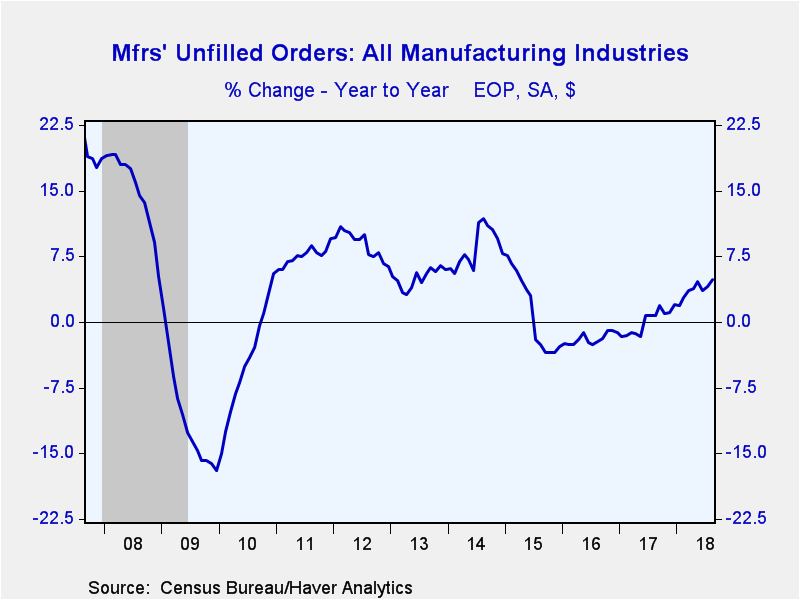

Unfilled orders of durable goods, which as implied above equals unfilled factory orders, increased 0.9% (4.9% y/y). Transportation equipment backlogs rose 1.2% (4.7% y/y). Excluding the transportation sector, unfilled orders gained 0.3% (5.4% y/y). Non-transportation unfilled orders have been on a steady rise since early 2017. Machinery backlogs edged up 0.1% (2.7% y/y), while the computer & electronic sector increased 0.2% (3.6% y/y).

Inventories of manufactured products edged down 0.1% (+5.1% y/y) as durable goods inventories--which are roughly 60% of total inventories--declined 0.3% (+4.7% y/y). Transportation fell 1.4% (+3.4% y/y). Inventories outside of transportation grew 0.2% (5.5% y/y). The machinery sector rose 0.5% (4.6% y/y). Computer & electronic product inventories declined 0.4% (+1.8% y/y). Nondurable goods inventories increased 0.3% (5.7% y/y). Basic chemical inventories, which have the largest nondurable inventories, rose 0.3% (4.6% y/y). Meanwhile, food product inventories, the second largest category, declined 0.2% (-0.4% y/y). Petroleum refinery inventories improved 1.1% (23.5% y/y).

All these factory sector figures and West Texas intermediate oil prices are available in Haver's USECON database.

| Factory Sector (% chg) - NAICS Classification | Aug | Jul | Jun | Aug Y/Y | 2017 | 2016 | 2015 |

|---|---|---|---|---|---|---|---|

| New Orders | 2.3 | -0.5 | 0.6 | 10.0 | 5.7 | -2.9 | -8.2 |

| Shipments | 0.5 | 0.0 | 1.0 | 7.8 | 5.0 | -3.2 | -6.2 |

| Unfilled Orders | 0.9 | 0.1 | 0.4 | 4.9 | 2.0 | -1.2 | -2.7 |

| Inventories | -0.1 | 0.9 | 0.2 | 5.1 | 4.5 | -0.7 | -0.8 |

Gerald D. Cohen

AuthorMore in Author Profile »Gerald Cohen provides strategic vision and leadership of the translational economic research and policy initiatives at the Kenan Institute of Private Enterprise.

He has worked in both the public and private sectors focusing on the intersection between financial markets and economic fundamentals. He was a Senior Economist at Haver Analytics from January 2019 to February 2021. During the Obama Administration Gerald was Deputy Assistant Secretary for Macroeconomic Analysis at the U.S. Department of Treasury where he helped formulate and evaluate the impact of policy proposals on the U.S. economy. Prior to Treasury, he co-managed a global macro fund at Ziff Brothers Investments.

Gerald holds a bachelor’s of science from the Massachusetts Institute of Technology and a Ph.D. in Economics from Harvard University and is a contributing author to 30-Second Money as well as a co-author of Political Cycles and the Macroeconomy.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates