Global| Oct 01 2020

Global| Oct 01 2020Strong Growth in U.S. Construction in August; Meaningful Upward Revisions to Previous Months

Summary

• Construction spending increased 1.4% in August with June and July now showing healthy gains. • Residential jumps 3.7%; continued weakness in nonresidential. • The 2.0% decline in construction since February looks similar to previous [...]

• Construction spending increased 1.4% in August with June and July now showing healthy gains.

• Residential jumps 3.7%; continued weakness in nonresidential.

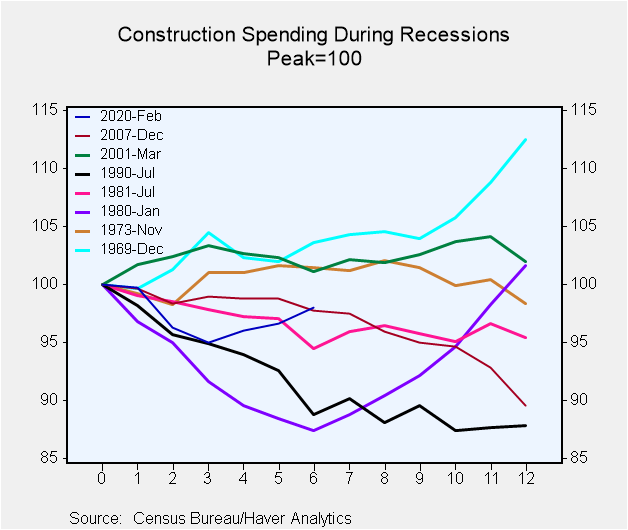

• The 2.0% decline in construction since February looks similar to previous recessions.

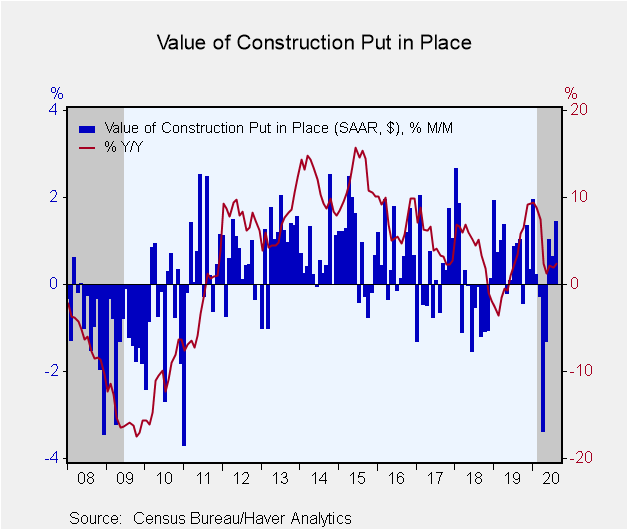

The value of construction put-in-place increased a greater-than-expected 1.4% in August (2.5% year-on-year). The Action Economics Forecast Survey anticipated a 0.7% gain. Spending in June and July were revised to 1.0% and 0.7% respectively from -0.5% and 0.1%. This leaves the level of construction down just 2.0% since its February peak, which in contrast to consumer spending, is similar to previous recessions.

In the revised second quarter GDP report released this week private construction spending (nonresidential + residential) subtracted 2.71 percentage points from GDP growth. Today's data points to a healthy positive contribution in Q3.

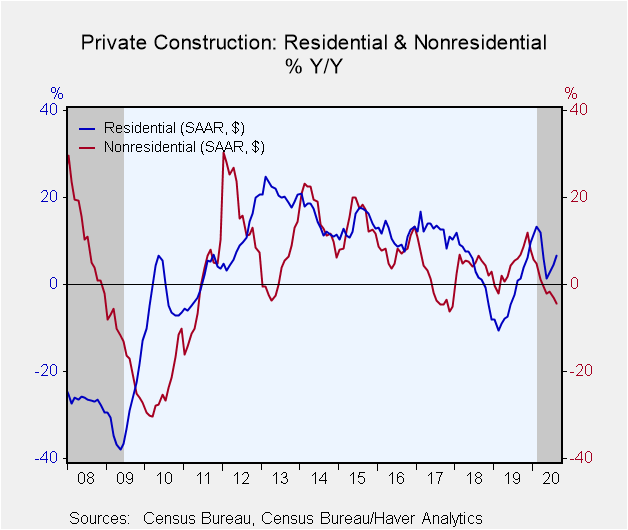

Private construction increased 1.9% in August (1.5% y/y). Residential construction jumped 3.7% (6.7% y/y) driven by strong gains in both single family and home improvement, up 5.5% (2.9% y/y) and 3.0% (11.2% y/y) respectively. Multifamily edged down 0.1% (+8.9% y/y). Nonresidential private construction decreased 0.3% in August (-4.3% y/y) with the three of the four largest sectors -- commercial, office and power -- down. Manufacturing grew 2.2% (-4.6% y/y).

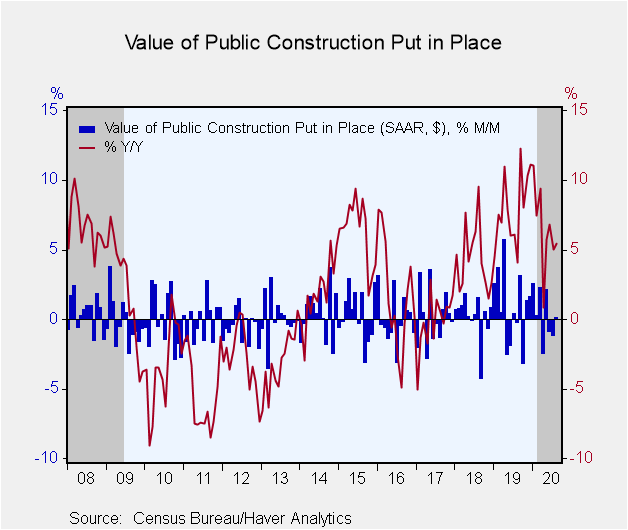

Public construction ticked up 0.1% (5.5% y/y) with nonresidential, which makes up 97% of public construction, growing 0.2% (4.8% y/y); the difference is only 0.02 percentage points when rounded to two decimal places. The two largest sectors road and school building showed healthy gains after two months of large declines. If not offset by federal government support, the drop in state and local government revenues resulting from the COVID related collapse hole in economic activity will likely lead to substantial weakness in public construction.

The construction spending figures, some of which date back to 1946 can be found in Haver's USECON database. The expectations reading is in the AS1REPNA database.

| Construction Put in Place (SA, %) | Aug | Jul | Jun | Aug Y/Y | 2019 | 2018 | 2017 |

|---|---|---|---|---|---|---|---|

| Total | 1.4 | 0.7 | 1.0 | 2.5 | 2.4 | 4.2 | 4.6 |

| Private | 1.9 | 1.3 | 1.7 | 1.5 | 0.8 | 4.0 | 6.1 |

| Residential | 3.7 | 2.6 | 2.6 | 6.7 | -2.4 | 3.4 | 12.4 |

| Nonresidential | -0.3 | -0.2 | 0.7 | -4.3 | 4.5 | 4.8 | -0.7 |

| Public | 0.1 | -1.2 | -0.9 | 5.5 | 7.8 | 4.6 | -0.1 |

Gerald D. Cohen

AuthorMore in Author Profile »Gerald Cohen provides strategic vision and leadership of the translational economic research and policy initiatives at the Kenan Institute of Private Enterprise.

He has worked in both the public and private sectors focusing on the intersection between financial markets and economic fundamentals. He was a Senior Economist at Haver Analytics from January 2019 to February 2021. During the Obama Administration Gerald was Deputy Assistant Secretary for Macroeconomic Analysis at the U.S. Department of Treasury where he helped formulate and evaluate the impact of policy proposals on the U.S. economy. Prior to Treasury, he co-managed a global macro fund at Ziff Brothers Investments.

Gerald holds a bachelor’s of science from the Massachusetts Institute of Technology and a Ph.D. in Economics from Harvard University and is a contributing author to 30-Second Money as well as a co-author of Political Cycles and the Macroeconomy.