Global| Aug 15 2018

Global| Aug 15 2018Strong Second Quarter U.S. Productivity; Unit Labor Costs Decline

Summary

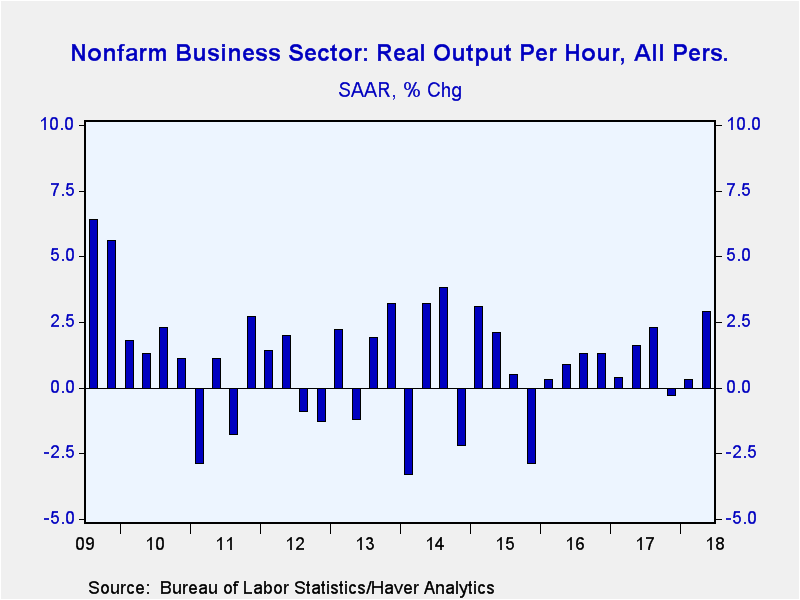

Output per hour in the nonfarm business sector grew at a healthier-than expected 2.9% seasonally adjusted annual rate in Q2'18 (1.3% year-on-year), following a slightly downwardly revised 0.3% gain in Q1. In Q4'17 productivity [...]

Output per hour in the nonfarm business sector grew at a healthier-than expected 2.9% seasonally adjusted annual rate in Q2'18 (1.3% year-on-year), following a slightly downwardly revised 0.3% gain in Q1. In Q4'17 productivity declined at a 0.3% pace (was +0.3%). The consensus in the Action Economics Forecast Survey looked for an increase of 2.5% in Q2. As a result of last month's benchmark revisions to GDP, productivity was revised for previous years, with 2017 slightly lower (1.1% vs. 1.3%) and 2016 and 2015 a touch higher (0.1% vs. unchanged and 1.3% vs 1.2%).

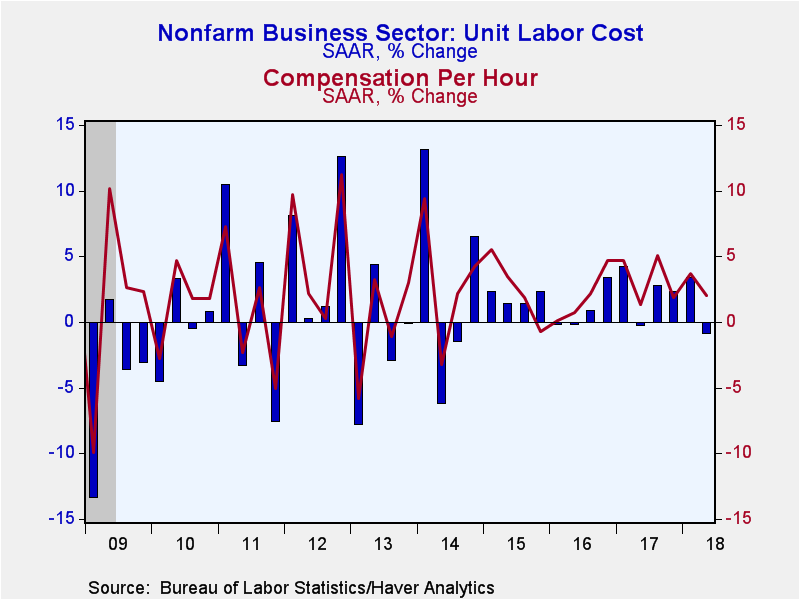

Unit labor costs fell at a weaker-than expected 0.9% rate in Q2'18 (1.9% y/y) following an upwardly revised 3.4% gain in Q1 (was 2.9%). The Action Economics Survey expected an unchanged reading in the second quarter. Costs were revised meaningfully higher in 2017 (2.2% vs. 0.4%), slightly lower in 2016 (0.9% vs. 1.1%) and remained at 1.8% in 2015. Compensation increased 2.0% in Q2'18 (3.2% y/y), following an upwardly revised 3.7% gain in the first quarter (was 3.3%).

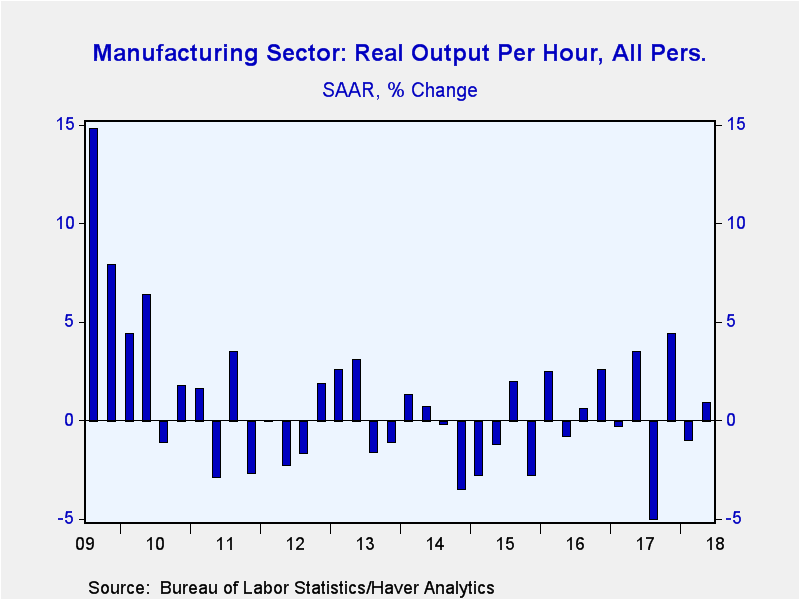

In the manufacturing sector, productivity grew at just a 0.9% pace in Q2'18 (-0.2% y/y) following a 1.0% decline in Q1 (was -1.2%). The fourth quarter's advance was revised slightly higher to 4.4%. Output increased at a 1.9% rate in Q2 (1.8% y/y) matching Q1's upwardly revised gain of 1.9%. Hours worked grew 1.0% in Q2 following 2.9% growth in Q1.

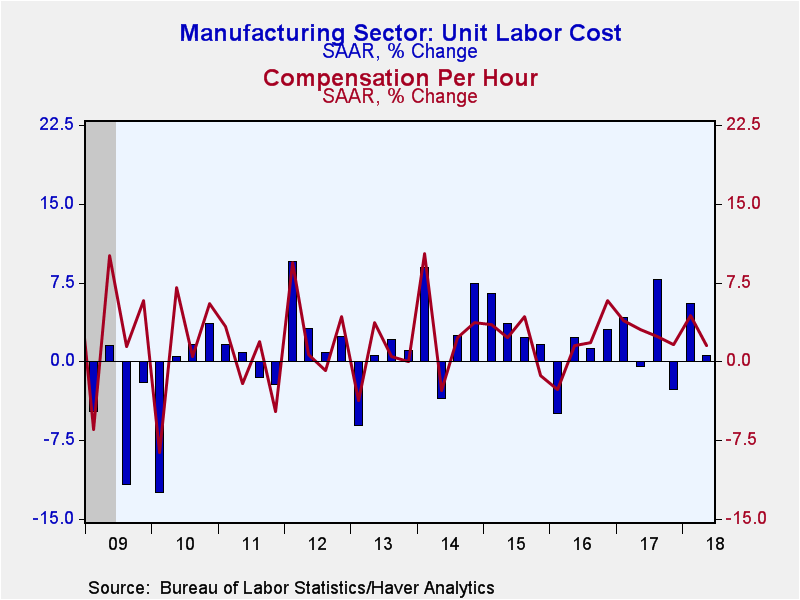

Unit labor costs in the factory sector rose at a 0.6% rate in Q2 (2.7% y/y), after an upwardly revised 5.5% increase in Q1 (was 5.2%). While output in the manufacturing sector was unaffected by the benchmark revisions, compensation was updated. As a result, unit labor costs in 2017 were revised meaningfully higher (2.6% vs. 1.0%). Costs in 2016 were revised slightly lower (0.3% vs. 0.4%), while 2015 remained at 4.1%.

The productivity & cost figures are available in Haver's USECON database. The expectations figures are from the Action Economics Forecast Survey and are found in the AS1REPNA database.

| Productivity & Costs (SAAR, %) | Q2'18 | Q1'18 | Q4'17 | Q2'18 Y/Y | 2017 | 2016 | 2015 |

|---|---|---|---|---|---|---|---|

| Nonfarm Business Sector | |||||||

| Output per Hour (Productivity) | 2.9 | 0.3 | -0.3 | 1.3 | 1.1 | 0.1 | 1.3 |

| Compensation per Hour | 2.0 | 3.7 | 1.9 | 3.2 | 3.4 | 1.1 | 3.1 |

| Unit Labor Costs | -0.9 | 3.4 | 2.3 | 1.9 | 2.2 | 0.9 | 1.8 |

| Manufacturing Sector | |||||||

| Output per Hour (Productivity) | 0.9 | -1.0 | 4.4 | -0.2 | 0.7 | 0.3 | -1.5 |

| Compensation per Hour | 1.5 | 4.4 | 1.6 | 2.5 | 3.3 | 0.6 | 2.5 |

| Unit Labor Costs | 0.6 | 5.5 | -2.7 | 2.7 | 2.6 | 0.3 | 4.1 |

Gerald D. Cohen

AuthorMore in Author Profile »Gerald Cohen provides strategic vision and leadership of the translational economic research and policy initiatives at the Kenan Institute of Private Enterprise.

He has worked in both the public and private sectors focusing on the intersection between financial markets and economic fundamentals. He was a Senior Economist at Haver Analytics from January 2019 to February 2021. During the Obama Administration Gerald was Deputy Assistant Secretary for Macroeconomic Analysis at the U.S. Department of Treasury where he helped formulate and evaluate the impact of policy proposals on the U.S. economy. Prior to Treasury, he co-managed a global macro fund at Ziff Brothers Investments.

Gerald holds a bachelor’s of science from the Massachusetts Institute of Technology and a Ph.D. in Economics from Harvard University and is a contributing author to 30-Second Money as well as a co-author of Political Cycles and the Macroeconomy.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates