Global| Mar 04 2021

Global| Mar 04 2021Super Fast Commodity Price Cycle Is A Harbinger Of Sudden Jump In Inflation

Summary

A super-fast rise in commodity prices is underway. It should not be a surprise that as the world economy re-opens, commodity prices start to rise to reflect more robust demand conditions. But what has been surprising is the speed and [...]

A super-fast rise in commodity prices is underway. It should not be a surprise that as the world economy re-opens, commodity prices start to rise to reflect more robust demand conditions. But what has been surprising is the speed and breadth of the increase.

The current commodity cycle shows an economic cycle's characteristics underway for a few years, not just getting started. That creates the potential for a quicker cost-push price cycle for products that coincides with an uptick in service prices, resulting in a lift in general inflation sooner and by more than what is currently expected by the markets and policymakers.

Manufacturing & Commodity Cycle

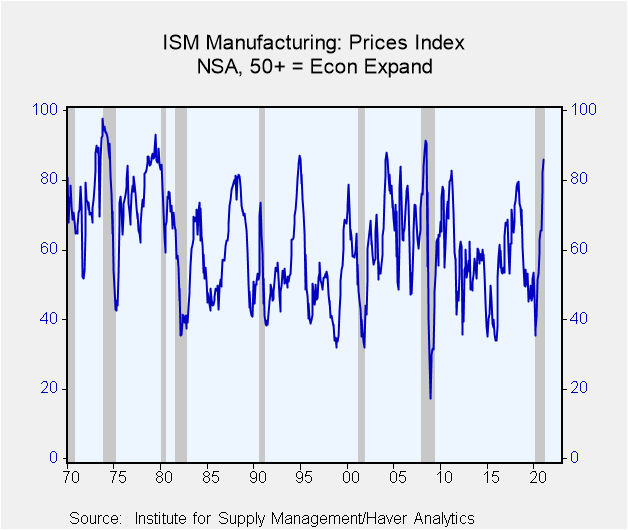

The Institute of Supply Management (ISM) reported that its composite index of prices for the manufacturing sector increased four percentage points to 86%. That represents the highest reading since July 2008. Although numerically the same, the economic and commodity price environments between 2008 and 2021 are fundamentally different.

February 2021 represents the early months of an economic recovery, while in 2008, the economic cycle which had been running for several years had already turned down. Also, high oil prices dominated the commodity cycle of 2008. Oil in July 2008 averaged $133, a record high and nearly double year-ago levels. In 2021, ISM"s February report listed 50 commodities rising in price, and the cost of oil was $59 a barrel, up from $50 one year earlier.

Broad-based commodity cycles have more significant momentum and staying power, unlike those driven by a single item, such as the case of 2008.

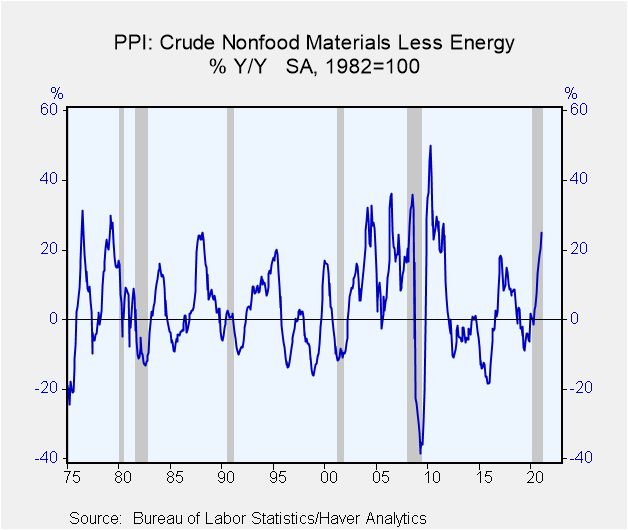

The sharp and broad-based rise in commodity prices is evident in the Bureau of Labor Statistics (BLS) producer price report. Prices for crude goods, excluding food and energy, have risen 25% in the past year. Other than the sharp bounce in 2010, following the record plunge in 2009, the recent 12-month increase in core crude prices represents the most abrupt and substantial increase for the start of an economic recovery in 50 years.

Consumer products represent a little more than a third of the basket of goods and services that make up the consumer price index. But products (or goods) are the cyclical component, and any uptick in prices would coincide with upward pressure on service prices.

In February, the ISM price index for the service industries jumped 7 points to 72%. The ISM service sector survey started in 1997, so it does not have its brother's (manufacturing survey) long history. Nonetheless, in the past 25 years, no business cycle started with a higher price index reading for the service sector.

The price information coming surveys of manufacturers and service firms paint a broader uptick in general inflation, much more than what expressed in Federal Reserve officials' future price expectations. Based on current trends, consumer price inflation could easily top 3% in 2021. And while policymakers may characterize the inflation uptick as transitory, broad inflation cycles are not transitory and require monetary tightening to reverse.

Viewpoint commentaries are the opinions of the author and do not reflect the views of Haver Analytics.Joseph G. Carson

AuthorMore in Author Profile »Joseph G. Carson, Former Director of Global Economic Research, Alliance Bernstein. Joseph G. Carson joined Alliance Bernstein in 2001. He oversaw the Economic Analysis team for Alliance Bernstein Fixed Income and has primary responsibility for the economic and interest-rate analysis of the US. Previously, Carson was chief economist of the Americas for UBS Warburg, where he was primarily responsible for forecasting the US economy and interest rates. From 1996 to 1999, he was chief US economist at Deutsche Bank. While there, Carson was named to the Institutional Investor All-Star Team for Fixed Income and ranked as one of Best Analysts and Economists by The Global Investor Fixed Income Survey. He began his professional career in 1977 as a staff economist for the chief economist’s office in the US Department of Commerce, where he was designated the department’s representative at the Council on Wage and Price Stability during President Carter’s voluntary wage and price guidelines program. In 1979, Carson joined General Motors as an analyst. He held a variety of roles at GM, including chief forecaster for North America and chief analyst in charge of production recommendations for the Truck Group. From 1981 to 1986, Carson served as vice president and senior economist for the Capital Markets Economics Group at Merrill Lynch. In 1986, he joined Chemical Bank; he later became its chief economist. From 1992 to 1996, Carson served as chief economist at Dean Witter, where he sat on the investment-policy and stock-selection committees. He received his BA and MA from Youngstown State University and did his PhD coursework at George Washington University. Honorary Doctorate Degree, Business Administration Youngstown State University 2016. Location: New York.