Global| Sep 13 2007

Global| Sep 13 2007Survey Shows Net Reduction in House Prices; Construction Orders Already Down

Summary

The UK housing market, too, seems to be faltering. The monthly survey of the Royal Institute of Chartered Surveyors, RICS, shows a net decline in house prices in its August reading of -1.8%, the first decline since October 2005. The [...]

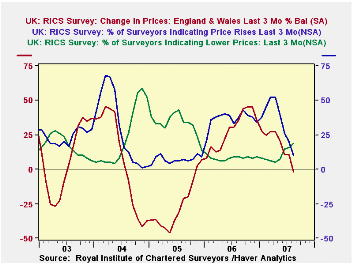

The UK housing market, too, seems to be faltering. The monthly survey of the Royal Institute of Chartered Surveyors, RICS, shows a net decline in house prices in its August reading of -1.8%, the first decline since October 2005. The survey questions asks about developments over the past three months, so this is no quirk. The raw data show a drop from 20% in July to 10% in August in the portion of RICS members reporting higher home prices and an increase from 16% to 19% in the portion reporting lower prices. [Net balance figures are seasonally adjusted by RICS.]

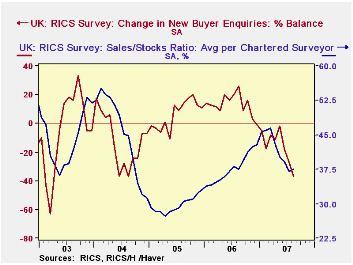

In August, the average number of home sales per surveyor was 23.3 over three months. The average number of homes in their inventory at the end of August was 62.2, making a turnover ratio of 37.6%. While this is almost the same as in August 2006, it is down from a recent high of 46.6% in March.

Further, buyer enquiries were reduced at a net 37% of firms, a deterioration from July's 27% and June's 19%. The raw response data showed a lower volume of enquiries at 61% of firms, the highest figure for August since 2004, which was 62%, the highest August value in the nine-year history of the survey.

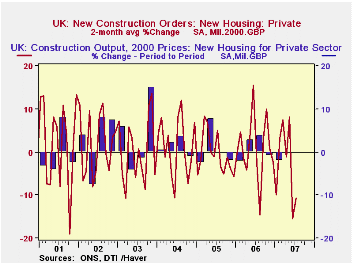

A separate report from the UK Government's Department of Trade and Industry shows that orders for construction have already weakened. They fell 7.5% in July, following on 16.0% in June (seasonally adjusted in 2000 prices). These orders move widely from month to month, and looking at a 2-month % change gives an average of -11.9% in June and July, the weakest period since May/June 2003, -12.2%. Orders for new housing rose in July, by 15.7%, but they had dropped 32.7% in June. The two months had an average decline of 11.8%, the weakest performance since September/October 2001. Nonresidential construction orders, called here "other work", fell 15.3% in July and 8.4% in June.

Construction output is measured in the UK in quarterly data, reported for Q2 just a week ago. It looked pretty good. The total, "all work", rose 0.8% from Q1 and 3.5% from a year ago. This was the strongest outcome since Q2 2004. However, the housing portion has already flattened out. New private housing output was virtually unchanged in Q2 after declining 2.1% in Q1; the year-on-year change showed modest growth of 1.1%. Obviously the customer traffic reported in the RICS survey and the downward path of orders for new housing don't suggest that an improvement is imminent.

| UK: RICS Survey, SA | Aug 2007* | July 2007* | June 2007* | Year Ago* | 2006 | 2005 | 2004 |

|---|---|---|---|---|---|---|---|

| House Prices: % Balance | -1.8 | +10.8 | +10.7 | +36.2 | +28.3 | -25.9 | +6.8 |

| Sales/Stock Ratio, % | 37.5 | 37.1 | 39.1 | 37.7 | 37.7 | 29.7 | 45.3 |

| New Buyer Enquiries % Balance |

-37 | -27 | -19 | +26 | +13 | +6 | -12 |

| SA*, % Change | |||||||

| Construction Orders | -- | -7.5 | -16.0 | -3.7 | +6.0 | +6.0 | +8.3 |

| New Housing | -- | +15.7 | -32.7 | -0.3 | +1.7 | +4.7 | +15.2 |

| Other Work | -- | -15.3 | -8.4 | -5.2 | +8.0 | +6.6 | +5.4 |

Carol Stone, CBE

AuthorMore in Author Profile »Carol Stone, CBE came to Haver Analytics in 2003 following more than 35 years as a financial market economist at major Wall Street financial institutions, most especially Merrill Lynch and Nomura Securities. She had broad experience in analysis and forecasting of flow-of-funds accounts, the federal budget and Federal Reserve operations. At Nomura Securities, among other duties, she developed various indicator forecasting tools and edited a daily global publication produced in London and New York for readers in Tokyo. At Haver Analytics, Carol was a member of the Research Department, aiding database managers with research and documentation efforts, as well as posting commentary on select economic reports. In addition, she conducted Ways-of-the-World, a blog on economic issues for an Episcopal-Church-affiliated website, The Geranium Farm. During her career, Carol served as an officer of the Money Marketeers and the Downtown Economists Club. She had a PhD from NYU's Stern School of Business. She lived in Brooklyn, New York, and had a weekend home on Long Island.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates