Global| Mar 03 2009

Global| Mar 03 2009Swiss GDP: In The Soup With The Rest Of Europe

Summary

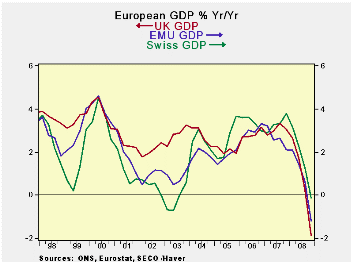

Swiss GDP is taking a hit like the rest of European GDP. Capital formation in Switzerland is being hit especially hard. Switzerland, the graph above shows, has been somewhat resistant to decline in its GDP aggregate until recently [...]

Swiss GDP is taking a hit like the rest of European GDP.

Capital formation in Switzerland is being hit especially hard.

Switzerland, the graph above shows, has been somewhat resistant to

decline in its GDP aggregate until recently when the drop has been very

severe. With banking as a key Swiss industry and the economy hit so

hard, it is no wonder than Switzerland has been drawn into the vortex

of European decline. Switzerland is also a trade-dependent country with

exports plus imports topping aggregate GDP in value. Exports are more

than 50% of GDP by themselves. With the European economy in a shambles,

Swiss exports are being clobbered. Of course Switzerland imports a lot

too, and imports have fallen in percentage terms even more than exports

for the year, but not for the quarter. The trade situation is a big

detractor to Swiss GDP over the quarter as well as over the year due to

the relative size of exports in the Swiss economy.

So far Switzerland has weathered the storm of European

weakness by pumping up government spending. Public sector spending was

up at a 2.9% pace in Q4 and is up by 3.4% Yr/Yr. That helped to drive

up domestic demand in the quarter but Yr/Yr domestic demand is still

dropping. Europe’s weakness has Switzerland fully in its grasp and the

troubles in Swiss banking will pose an added problem for the Swiss

authorities, trying to the keep the economy afloat.

Longer term, Switzerland’s banking sector may prove to be even

more of a problem. With a global banking crisis in full bloom the rest

of the world is pushing hard for transparency. Switzerland has long

held a unique position in the global markets with bank secrecy. But

banking problems have become so severe that in the European summit of

one week ago the Europeans called for strong actions against tax

havens. UBS, a major Swiss bank, currently is embroiled in a major

fight in the US where it helped US citizens perpetrate tax fraud. The

Americans are pushing for the release of the names of about 50,000

American citizens that have accounts at UBS. UBS has offered up a much

smaller number of about 250 names. US authorities are pressing UBS and

do not seem likely to accept interventions by the Swiss authorities as

cover. Although the situation gets complicated because a suit filed in

Switzerland is trying to enjoin UBS from releasing these names as it is

a crime – a violation of Swiss bank secrecy laws - to do so. The issue

and question of bank secrecy and whether it will remain a right is now

under a full court press. With so many scandals and allegations of

fraud in play the international banking authorities do not want to

encounter and black box of secrecy at the end of their chase- as is

happening to the US right now. To Switzerland this is a very important

issue- but it is also important to other banking sectors where

authorities have become increasing suspicious of secrecy anywhere.

| Swiss GDP | |||||||

|---|---|---|---|---|---|---|---|

| Consumption | Capital | Trade Domestic | |||||

| GDP | Private | Public | Formation | Exports | Imports | Demand | |

| % change Q/Q | |||||||

| Q4-08 | -1.2% | 0.4% | 2.9% | -12.0% | -28.5% | -21.3% | 7.6% |

| Q3-08 | -0.3% | 0.5% | 5.7% | -7.2% | 1.1% | -2.9% | -2.5% |

| Q2-08 | 0.5% | 2.5% | 3.2% | -2.9% | 14.0% | 14.0% | -1.1% |

| Q1-08 | 0.5% | 0.6% | 1.7% | 1.1% | -2.7% | -12.0% | -4.2% |

| % change Yr/Yr | |||||||

| Q4-08 | -0.1% | 1.0% | 3.4% | -5.4% | -5.4% | -6.4% | -0.1% |

| Q3-08 | 1.3% | 1.5% | 1.2% | -1.3% | 4.9% | 2.0% | -0.6% |

| Q2-08 | 2.3% | 2.2% | -1.8% | -2.0% | 6.5% | 3.4% | 0.3% |

| Q1-08 | 3.1% | 2.2% | -2.6% | 1.9% | 3.7% | 0.3% | 1.4% |

| 5-Yrs | 2.5% | 1.7% | 0.1% | 2.0% | 5.5% | 3.5% | 1.3% |

Robert Brusca

AuthorMore in Author Profile »Robert A. Brusca is Chief Economist of Fact and Opinion Economics, a consulting firm he founded in Manhattan. He has been an economist on Wall Street for over 25 years. He has visited central banking and large institutional clients in over 30 countries in his career as an economist. Mr. Brusca was a Divisional Research Chief at the Federal Reserve Bank of NY (Chief of the International Financial markets Division), a Fed Watcher at Irving Trust and Chief Economist at Nikko Securities International. He is widely quoted and appears in various media. Mr. Brusca holds an MA and Ph.D. in economics from Michigan State University and a BA in Economics from the University of Michigan. His research pursues his strong interests in non aligned policy economics as well as international economics. FAO Economics’ research targets investors to assist them in making better investment decisions in stocks, bonds and in a variety of international assets. The company does not manage money and has no conflicts in giving economic advice.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates