Global| May 29 2012

Global| May 29 2012The Euro Decline : Good News for the Periphery

Summary

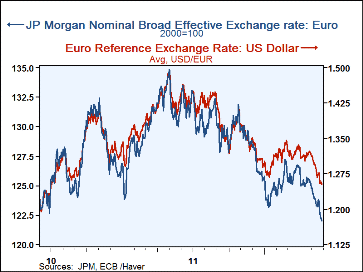

The value of the Euro has declined 10% from May 4, 2011 to 1.2523 today. Over roughly the same time period, the broad nominal effective exchange rate has declined 18% to 122.32(2000=100). The daily values of the euro and the broad [...]

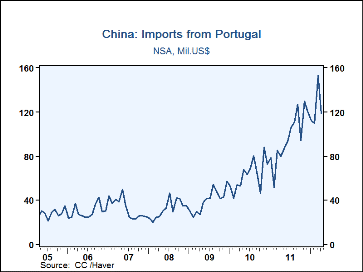

The value of the Euro has declined 10% from May 4, 2011 to 1.2523 today. Over roughly the same time period, the broad nominal effective exchange rate has declined 18% to 122.32(2000=100). The daily values of the euro and the broad effective nominal exchange rate are shown in the first chart. The decline is beginning to have a meaningful positive effect on the export prospects of not only Germany but also some of the problem countries in the Euro Area. An article in the May 29, 2012 Financial Times "Made in Portugal: black loo roll and 'royal' shoes" illustrates some of the positive developments in Portugal from the decline in the Euro. Among these has been a sharp rise in Portugal's trade with Non EU countries. China, for instance, sharply increased its imports from Portugal in the last year, as can be seen in the second chart.

In some ways, the Euro has acted like the Gold Standard. A strong Euro prevented individual countries from the time honored remedy of devaluation in the face of an economic decline. However, if the Euro weakens, as it has over the past year, it becomes less of a straight jacket and more of a stimulus that is badly needed.

The decline in the Euro is not a cure all for the area, but it is another positive development, like the recent wage settlements in Germany that begin to address some of the structural problems in the area. It weighs in on the side of growth in the growth vs. austerity debate.