Global| Feb 19 2010

Global| Feb 19 2010The Fed De-Eases Bank Lending Terms

Summary

Yesterday, February 18, the Federal Reserve Board announced several changes to the extraordinary liquidity measures it instituted to help alleviate the recent financial crisis. Just last week, Tom Moeller described here how extensive [...]

Yesterday,

February 18, the Federal Reserve Board announced several changes to the

extraordinary liquidity measures it instituted to help alleviate the

recent financial crisis. Just last week, Tom Moeller described here how

extensive those liquidity provisions have been for just one part of the

program, the Term Auction Facility. Even as that effort winds down – it

will be concluded altogether with a final auction on March 8,

yesterday’s announced said – the Fed Board is also pulling back or

diminishing some of its other emergency operations. In particular, the

old “discount window”, which is now also called “primary credit”, sees

its rate raised from 50 basis points (0.50%) to 75 basis points

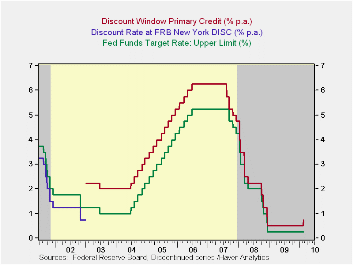

(0.75%). · As the Fed’s statement explains, this move increases the

spread of the primary credit, or discount, rate to 50 basis points over

the high end of the FOMC’s target for the federal funds rate, as shown

in the chart. The chart also shows the altered treatment of the

discount window beginning in 2003. Previously, the discount rate

hovered just below coincident fed funds rates, but it was changed in

January that year to a penalty rate, pegged at some spread over the

funds rate.

Yesterday,

February 18, the Federal Reserve Board announced several changes to the

extraordinary liquidity measures it instituted to help alleviate the

recent financial crisis. Just last week, Tom Moeller described here how

extensive those liquidity provisions have been for just one part of the

program, the Term Auction Facility. Even as that effort winds down – it

will be concluded altogether with a final auction on March 8,

yesterday’s announced said – the Fed Board is also pulling back or

diminishing some of its other emergency operations. In particular, the

old “discount window”, which is now also called “primary credit”, sees

its rate raised from 50 basis points (0.50%) to 75 basis points

(0.75%). · As the Fed’s statement explains, this move increases the

spread of the primary credit, or discount, rate to 50 basis points over

the high end of the FOMC’s target for the federal funds rate, as shown

in the chart. The chart also shows the altered treatment of the

discount window beginning in 2003. Previously, the discount rate

hovered just below coincident fed funds rates, but it was changed in

January that year to a penalty rate, pegged at some spread over the

funds rate.  Generally this has been 1 percentage point, 100 basis

points. Part of the emergency liquidity boost beginning in August 2007

was making these funds cheaper for borrowing banks by cutting the

spread, first to 50 basis points, and then in March 2008, to 25 basis

points, where it has been until today, when the hike to 50 took

effect.

Generally this has been 1 percentage point, 100 basis

points. Part of the emergency liquidity boost beginning in August 2007

was making these funds cheaper for borrowing banks by cutting the

spread, first to 50 basis points, and then in March 2008, to 25 basis

points, where it has been until today, when the hike to 50 took

effect.

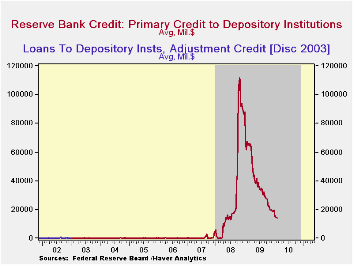

The second graph shows the amount of this primary credit. This is similar to, but not exactly the same as the old “adjustment credit” in the pre-2003 procedures. The idea then was that banks avoided the discount window like the plague, so there was rarely any use of it at all. You can see the spike over the 9/11 period, which was, up to mid-2008, by far the record amount of borrowing. The philosophy was changing though; the rate was made higher than other sources of funds, but banks theoretically wouldn’t be stigmatized by availing themselves of it. In the easy-money period of those mid-2000s, hardly any ever needed to anyway. All this changed in 2007 and 2008. The Fed Board cut the spread with the express intention of helping banks get money. At the peak in late October and early November 2008, banks were borrowing more than $100 billion in this one facility alone. More recently, this has shrunk markedly, to “just” $14.3 billion in the Fed’s statement week ended this past Wednesday.

Some wonder if this action by the Fed is a “tightening”, even though their statement argues that it is not. It certainly is the first action involving a rate. But they have already reined in their “quantitative” easing substantially, and this newest can thus be seen as part of a progression toward non-emergency conditions. They further indicated that the maturity of the primary credit borrowing, which has been as long as 90 days, will be shortened to the more typical overnight on March 18. So there are several steps here, and in one sense, they are reactive, not pro-active. They seem to be a response to smoother money market conditions rather that an attempt to disrupt the markets and alter the underlying demand conditions. So technically, this would not be a “tightening”. But it is a “de-easing”, which must, by definition, come first.

The Fed’s statement is here . The rates and borrowing amounts are contained in Haver’s DAILY and WEEKLY databases, with monthly averages in USECON.

Carol Stone, CBE

AuthorMore in Author Profile »Carol Stone, CBE came to Haver Analytics in 2003 following more than 35 years as a financial market economist at major Wall Street financial institutions, most especially Merrill Lynch and Nomura Securities. She had broad experience in analysis and forecasting of flow-of-funds accounts, the federal budget and Federal Reserve operations. At Nomura Securities, among other duties, she developed various indicator forecasting tools and edited a daily global publication produced in London and New York for readers in Tokyo. At Haver Analytics, Carol was a member of the Research Department, aiding database managers with research and documentation efforts, as well as posting commentary on select economic reports. In addition, she conducted Ways-of-the-World, a blog on economic issues for an Episcopal-Church-affiliated website, The Geranium Farm. During her career, Carol served as an officer of the Money Marketeers and the Downtown Economists Club. She had a PhD from NYU's Stern School of Business. She lived in Brooklyn, New York, and had a weekend home on Long Island.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates