Global| Nov 08 2011

Global| Nov 08 2011The Late Comers To The Euro-Area

Summary

After Greece joined the Euro Area in 2001, five more countries entered the Area--Slovenia in 2007, Cyprus and Malta in 2008, Slovakia in 2009 and Estonia in 2011. Little has been said about these five since the crisis in Greece has [...]

After Greece joined the Euro Area in 2001, five more countries entered

the Area--Slovenia in 2007, Cyprus and Malta in 2008, Slovakia in 2009 and

Estonia in 2011. Little has been said about these five since the crisis in Greece has arisen.

How have they fared? Some answers can be found in the Haver database

EUDATA. First, they are, for the most part, much smaller in population

than most of the original members. The population of Malta is only 418,000

and Cyprus 803,000. Estonia's population is 1,340,000, Slovenia's

2,050,000 and Slovakia's 5,435,000. These compare with Greece's

population of 11,325,000 and with Germany's, the largest in the Area, of

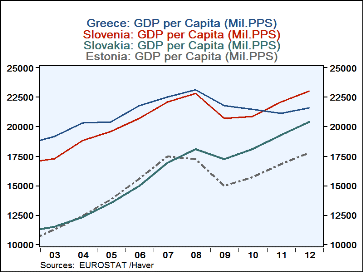

81,750,000. Per capita GDP, adjusted for purchasing power

parities, for these countries tends to be lower than the average for the

Euro Area, which is, 26,400 Euros, however, that for Cyprus was above that

for Greece in 2010.

After Greece joined the Euro Area in 2001, five more countries entered

the Area--Slovenia in 2007, Cyprus and Malta in 2008, Slovakia in 2009 and

Estonia in 2011. Little has been said about these five since the crisis in Greece has arisen.

How have they fared? Some answers can be found in the Haver database

EUDATA. First, they are, for the most part, much smaller in population

than most of the original members. The population of Malta is only 418,000

and Cyprus 803,000. Estonia's population is 1,340,000, Slovenia's

2,050,000 and Slovakia's 5,435,000. These compare with Greece's

population of 11,325,000 and with Germany's, the largest in the Area, of

81,750,000. Per capita GDP, adjusted for purchasing power

parities, for these countries tends to be lower than the average for the

Euro Area, which is, 26,400 Euros, however, that for Cyprus was above that

for Greece in 2010.

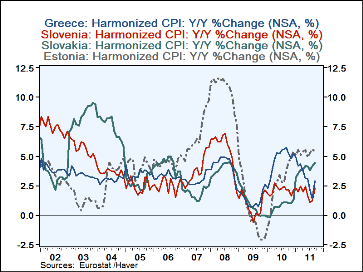

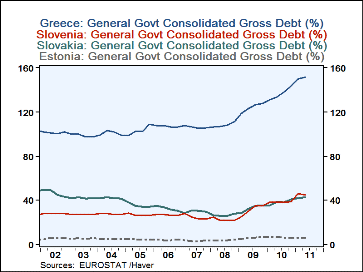

Financial conditions in these countries are in reasonably good shape. The government budget balance as a percentage of GDP in 2010 was -7.7% in Slovakia, but the Government Debt as a percentage of GDP was still only 42.5%. The budget balance to GDP was -5.8% in Slovenia where the debt to GDP ratio was 44.4% and, actually, the ratio was a plus 0.2% in Estonia where the debt to GDP ratio was a mere 6.2%. Both Cyprus and Malta had higher debt to GDP Ratios, 61.5% and 69.0% respectively and their Government budget balances were -5.3% and -3.6%, respectively. All compare favorably with Greece where the government budget balance was -10.6% of GDP and general government debt 151.9% of GDP. The government budget balance to GDP ratio and the debt to GDP ratio are shown in the first two charts.

The crisis in the financial area has not until recently begun to affect physical activity in these countries. The third chart shows that industrial production in Estonia, Slovakia, and Slovenia has only recently begun to fall off while that in Greece has been falling dramatically ever since late 2008. On the whole it appears that the late comers to the Euro Area have fared reasonably well in the Euro Area and are unlikely to be a divisive force in the union.

| 2010 | Gov Budget Balance/GDP | Gen Gov Debt/GDP | Per Capita GDP (PPS, 000) |

|---|---|---|---|

| Cyprus | -5.3% | 61.5% | 23.8 |

| Malta | -3.6 | 69.0 | 20.2 |

| Slovenia | -5.8 | 44.4 | 18.1 |

| Slovakia | -7.7 | 42.5 | 18.1 |

| Estonia | 0.2 | 6.2 | 15.7 |

| Greece | -10.6 | 151.9 | 21.5 |

| Euro Area | -- | -- | 26.4 |