Global| Jun 06 2011

Global| Jun 06 2011The Price of Wheat and EFTs

Summary

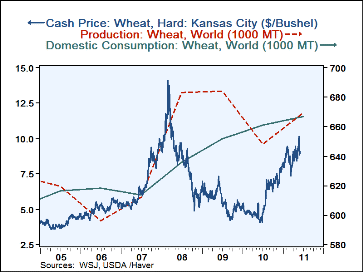

Although there is some improvement in the world wide supply of wheat, the price has begun to creep up again, Kansas city hard wheat, for example, has risen 5% in the last month and is now $9.06 a bushel. World supply and demand for [...]

Although there is some improvement in the world wide supply of wheat, the price has begun to creep up again, Kansas city hard wheat,

for example, has risen 5% in the last month and is now $9.06 a bushel. World supply and demand for wheat together with daily prices are

shown in the first chart. Recently the UN's Conference on Trade and Development warned that increased financial investment in

markets has encouraged "herding behavior" that leads to the creation of bubbles. Facilitating the financial investment in

commodity

markets has been the development of exchange-traded funds (ETFs). An EFT is a security that tracks an index, a commodity or basket

of assets.

EFTs are available to individuals only through brokers and advisers and trade like stocks on an exchange.

Although there is some improvement in the world wide supply of wheat, the price has begun to creep up again, Kansas city hard wheat,

for example, has risen 5% in the last month and is now $9.06 a bushel. World supply and demand for wheat together with daily prices are

shown in the first chart. Recently the UN's Conference on Trade and Development warned that increased financial investment in

markets has encouraged "herding behavior" that leads to the creation of bubbles. Facilitating the financial investment in

commodity

markets has been the development of exchange-traded funds (ETFs). An EFT is a security that tracks an index, a commodity or basket

of assets.

EFTs are available to individuals only through brokers and advisers and trade like stocks on an exchange.

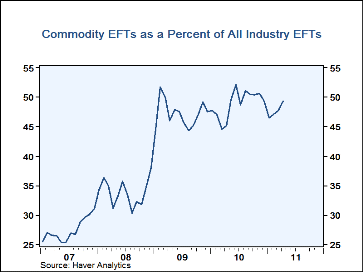

Haver Analytics provides data on the number of EFTs, the net assets of the funds, the net issuance of shares, the gross issuance of shares, and the gross redemption of shares of ETFs. All data are available for types of funds--large capital etc--and for selected industries. These data can be found in the data base ICI-TRENDS IN MUTUAL FUNDS ACTIVITY. As of April, 2011,there were 1,009 EFTs in the United States with net assets of $1,113.2 billion. Of these $655.8 billion were domestic equity funds, $305.4 billion international equity funds, $0.3 hybrid funds and $151.7 bond index funds. Of the 275 equity funds in industry, 66, or 22% were in commodities, but the net assets of the commodity EFTs were equal to 49% of the net assets of all the industry EFTs. The growth of net assets in commodity EFTs is shown in the second chart.

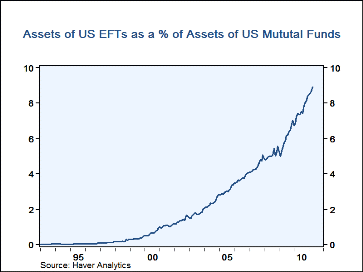

As shown in the third chart, the net assets of all ETFs are small in relation to traditional Mutual Funds--in April, 11 they were barely 9%--they are growing fast and have the potential to upset the financial markets.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates