Global| Oct 17 2007

Global| Oct 17 2007TIC Data Show Foreign Investors Made the Same Kinds of Decisions in August that Domestic Investors Did

Summary

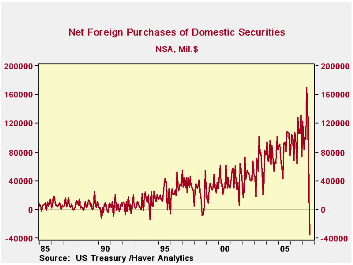

News stories have already highlighted the substantial liquidation of US securities by foreign investors that is portrayed in the monthly Treasury International Capital System (TIC) data for August. As reported yesterday, investors [...]

News stories have already highlighted the substantial liquidation of US securities by foreign investors that is portrayed in the monthly Treasury International Capital System (TIC) data for August. As reported yesterday, investors from outside the US were net sellers of $34.9 billion worth of US long-term securities during the financial market chaos that plagued much of that month. By type, they sold equities most, $40.6 billion, and also Treasuries, $2.6 billion, and corporates, $1.2 billion; they bought $9.6 billion in Agency notes and bonds. Several aspects of this and other segments of the Treasury's TIC release are worthy of note.

First, we, as others, must comment on the dramatic change these figures show from the record net purchases in May. Then, foreign investors scooped up $170.1 billion in US securities, including sizable purchases of all four categories, especially equities at $42.0 billion and corporate bonds at $78.3 billion. Obviously the environment was different then.

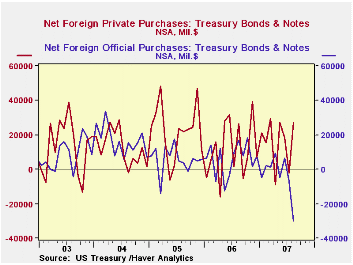

Second, the behavior of private and official foreign investors differed considerably from each other in August. While each group has its own investment objectives, we are impressed with how this led them to act then. The net sales of Treasury securities were concentrated at foreign official institutions, at $29.7 billion. In almost a mirror image, private investors abroad were net purchasers of $27.3 billion. We'd attribute the private purchases to the risk-aversion that became so important during the month, favoring the least risky assets, but that can't quite explain the net sales by central banks and governmental accounts elsewhere. A puzzle, like much of financial market activity in that period.

Third, there were also dramatic differences among countries. Investors in the UK remained net purchasers of total US securities, to the tune of $31.7 billion; as ever, this reflects the "clearinghouse" nature of the London markets, crisscrossing trades from around the world. Among other countries, the Chinese were net sellers, as might be expected, but "just" $10.1 billion. International parties in the offshore market centers of Bermuda and the Cayman Islands were also sizable sellers, as were the Japanese.

Fourth, through it all, Americans continued to buy foreign securities. See in the table, there was even a mild pickup in August relative to the previous couple of months.

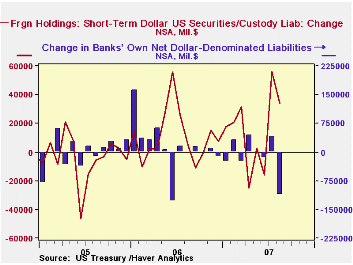

Fifth, besides long-term securities, of course, foreigners can certainly also invest in short-term securities. The TIC data system doesn't emphasize this, perhaps because those investments are, by definition, short-term. The recently revised format of the TIC press release does give this information. Sure enough, August – and even more in July – saw net purchases of short-term instruments, $33.9 billion in August and $56.2 billion in July. These compare with an average of $11.3 billion monthly during 2006 and net disinvestment of $4.0 billion in 2005. Private investors moved into Treasury bills in August while selling other short-term items.

Finally, the Treasury also reports monthly data on banks' net dollar-denominated liabilities. These had a net reduction of $111.4 billion in August, a swing from an increase of $40.9 billion in July. We point this out to grab still another opportunity to repeat our own mantra about capital flows and the nation's current account. The differential pattern of all these assets movements compared to each other and to prior months should indicate that a variety of motives influence funds flows in world markets and among world institutions. During August, foreign investors were net sellers of US long-term securities, but so were US investors. Private foreign investors and US investors ran to Treasuries, both long-term and Treasury bills. There is no specific aspect of any of these flows that relates to financing of US trade activity. There is lots of it that relates to the financing of US housing markets and corporate activities. Those had been attractive investment sectors for everyone; they are less so now, regardless of where investors are domiciled.

| Net Foreign Purchases from US Residents, Bil $ | August 2007 | July 2007 |

June 2007 |

May 2007 |

Monthly Averages

|||

|---|---|---|---|---|---|---|---|

| Last 12 Months | 2006 | 2005 | |||||

| "Headline": Net Foreign Purchases = 1 + 2 + Other* |

-85.5 | -2.7 | 84.4 | 117.2 | 49.5 | 62.0 | 58.0 |

| 1. Domestic Securities | -34.9 | 25.0 | 121.7 | 170.1 | 92.1 | 97.2 | 84.3 |

| Treasuries | -2.6 | -9.4 | 24.7 | 22.7 | 15.3 | 17.3 | 28.2 |

| Agencies | 9.6 | 8.7 | 35.6 | 27.0 | 22.3 | 24.5 | 18.3 |

| Corporate Bonds | -1.2 | 4.5 | 28.5 | 78.3 | 41.0 | 42.8 | 31.0 |

| Equities | -40.6 | 21.2 | 28.8 | 42.0 | 13.4 | 12.6 | 6.8 |

| 2. Foreign Securities | -34.5 | -5.5 | -21.8 | -37.6 | -26.6 | -21.0 | -14.4 |

| 3. Short-Term Sec's & Custody Holdings | 33.9 | 56.2 | -16.0 | 2.5 | 11.1 | 11.3 | -4.0 |

| 4. Banks' Liabilities | -111.4 | 40.9 | -15.4 | -3.6 | -4.7 | 15.4 | 1.4 |

| Total TIC Flows** | -163.0 | 94.3 | 53.1 | 116.0 | 55.9 | 88.6 | 55.4 |

| China | -10.1 | 4.5 | 21.2 | 11.1 | 10.0 | 9.7 | 7.4 |

| United Kingdom | 31.7 | 25.1 | 55.4 | 65.5 | 35.7 | 26.5 | 26.4 |

| Cayman Islands | -14.7 | -16.4 | 9.6 | 1.0 | 7.3 | 12.1 | 4.1 |

Carol Stone, CBE

AuthorMore in Author Profile »Carol Stone, CBE came to Haver Analytics in 2003 following more than 35 years as a financial market economist at major Wall Street financial institutions, most especially Merrill Lynch and Nomura Securities. She has broad experience in analysis and forecasting of flow-of-funds accounts, the federal budget and Federal Reserve operations. At Nomura Securites, among other duties, she developed various indicator forecasting tools and edited a daily global publication produced in London and New York for readers in Tokyo. At Haver Analytics, Carol is a member of the Research Department, aiding database managers with research and documentation efforts, as well as posting commentary on select economic reports. In addition, she conducts Ways-of-the-World, a blog on economic issues for an Episcopal-Church-affiliated website, The Geranium Farm. During her career, Carol served as an officer of the Money Marketeers and the Downtown Economists Club. She has a PhD from NYU's Stern School of Business. She lives in Brooklyn, New York, and has a weekend home on Long Island.