Global| Aug 16 2007

Global| Aug 16 2007TIC Data Show Sizable Foreign Interest in US Securities Even Through June; Hong Kong, Russia & Brazilian Investors [...]

Summary

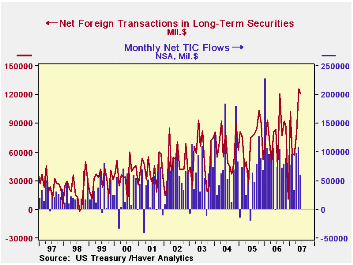

The US Treasury's monthly "TIC" data were reported yesterday for June. They indicate that foreign interest in US capital markets remained strong with the same magnitude of net flows into the US as occurred in May, the record period. [...]

The US Treasury's monthly "TIC" data were reported yesterday for June. They indicate that foreign interest in US capital markets remained strong with the same magnitude of net flows into the US as occurred in May, the record period. Foreign investors bought $148.6 billion of US securities compared with $163.7 billion in May and "just" $91.8 billion in June 2006. At the same time, US investors bought $27.8 billion of foreign securities in June, noticeably less than May's $37.6 billion, but still historically large.

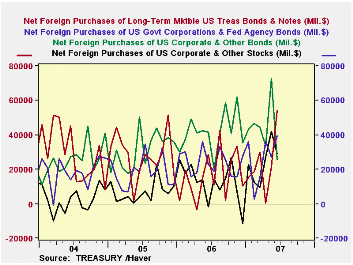

The mix of US securities purchased by foreign investors shifted considerably from May to June. After May's outsized amount of corporate bonds, $72.6 billion, they bought only about one-third as much in June, $25.9 billion. Purchases of equities also decreased, from $42.0 billion in May to $28.8 billion. But net buying of federal agency and Treasury securities both established new records: agency debt advanced from $27.5 billion to $39.7 billion and Treasury purchases from $21.6 billion to $54.3 billion.

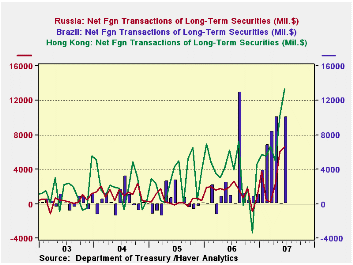

Last month, we commented here on the increased participation by Chinese investors in US markets. This expanded further in June, with $20.2 billion in net purchases, up from $10.1 billion in May. The London markets reduced their US buying, but at $66.7 billion, it remained large compared with both most previous periods and other investment centers. Speaking of other investment centers, a number of them were active in June: Hong Kong investors bought, on net, a record $13.3 billion; the Cayman Islands, $11.1 billion, about average for them; and Russia $6.6 billion, also a record and following $6.0 billion in May. The one we found interesting was Brazil, whose investors purchased $10.1 billion in June and a total of $20 billion during the second quarter. The June amount was more than accounted for with $12.2 billion in Treasuries. Euro-Zone investors, by contrast, were net sellers of $20 billion in US securities markets in June, consisting of a large portion of foreign stock sales to US investors.

| Net ForeignPurchases fromUS Residents, Bil $ | June 2007 | May 2007 | June 2006 | Monthly Averages||||

|---|---|---|---|---|---|---|---|

| Last 12 Months | 2006 | 2005 | 2004 | ||||

| "Headline": Net Foreign Purchases = 1 + 2 | 120.9 | 126.0 | 83.5 | 81.4 | 73.7 | 69.9 | 63.6 |

| Domestic Securities | 148.6 | 163.7 | 91.8 | 107.0 | 94.6 | 84.3 | 76.4 |

| Treasuries | 54.3 | 21.6 | 28.7 | 22.1 | 16.3 | 28.2 | 29.3 |

| Agencies | 39.7 | 27.5 | 23.0 | 24.5 | 24.1 | 18.3 | 18.9 |

| Corporate Bonds | 25.9 | 72.6 | 41.7 | 43.6 | 41.7 | 31.0 | 25.8 |

| Equities | 28.8 | 42.0 | -1.6 | 16.9 | 12.5 | 6.8 | 2.4 |

| Foreign Securities | -27.8 | -37.6 | -8.3 | -25.7 | -20.9 | -14.4 | -12.7 |

| Net Foreign Acquisition | 107.0 | 112.5 | 67.8 | 67.9 | 60.7 | 58.3 | 60.4 |

| Total TIC Flows | 58.8 | 107.3 | -2.6 | 73.6 | 87.4 | 55.7 | 81.6 |

| Select Countries Net Purchases of US Securities | |||||||

| China | 20.2 | 10.1 | 12.2 | 11.0 | 9.1 | 7.2 | 3.9 |

| United Kingdom | 66.7 | 92.7 | 57.2 | 47.0 | 38.7 | 30.3 | 21.2 |

Carol Stone, CBE

AuthorMore in Author Profile »Carol Stone, CBE came to Haver Analytics in 2003 following more than 35 years as a financial market economist at major Wall Street financial institutions, most especially Merrill Lynch and Nomura Securities. She had broad experience in analysis and forecasting of flow-of-funds accounts, the federal budget and Federal Reserve operations. At Nomura Securities, among other duties, she developed various indicator forecasting tools and edited a daily global publication produced in London and New York for readers in Tokyo. At Haver Analytics, Carol was a member of the Research Department, aiding database managers with research and documentation efforts, as well as posting commentary on select economic reports. In addition, she conducted Ways-of-the-World, a blog on economic issues for an Episcopal-Church-affiliated website, The Geranium Farm. During her career, Carol served as an officer of the Money Marketeers and the Downtown Economists Club. She had a PhD from NYU's Stern School of Business. She lived in Brooklyn, New York, and had a weekend home on Long Island.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates