Global| Oct 11 2007

Global| Oct 11 2007Tighter Monetary Policy in South Africa, Where Inflation, Growth and Credit Expansion All Look Strong

Summary

The South African Reserve Bank bucked the current trend among world central banks by tightening monetary policy today. They raised their key policy rate, the repurchase rate, by 50 basis points to 10.50%. The Bank conducts an [...]

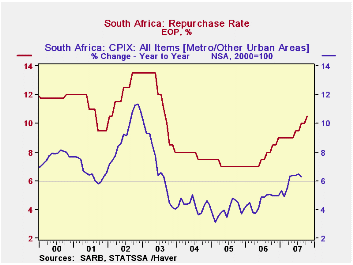

The South African Reserve Bank bucked the current trend among world central banks by tightening monetary policy today. They raised their key policy rate, the repurchase rate, by 50 basis points to 10.50%. The Bank conducts an inflation-target style monetary policy, and the specific CPI measure, "CPIX", has been running above the upper band of the target 3%-6% range since April.

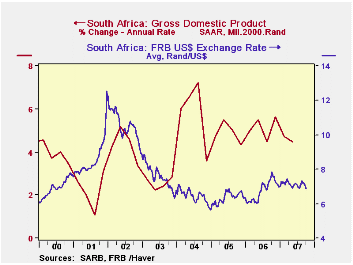

The tightening cycle began in June 2006, when inflation started to move higher and the Bank first became concerned that it was indeed likely to breach the upper end of the target range. This was occurring in the context of consistent economic growth at around a 5% annual rate, but a declining currency, this latter adding to inflation worries, according to the Bank's monetary policy statement at the time. Thus, it raised the key repo rate from 7% to 7.5% and has continued to increase the rate in 0.5% steps to today's 10.5% level.

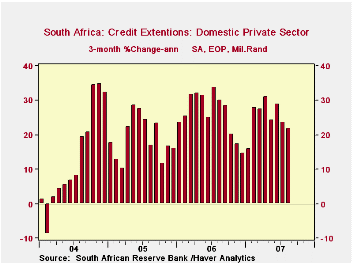

As we browsed the South African data in Haver's EMERGEMA database, we were impressed with the breadth as well as the persistence of good growth trends in the country. Consumer spending has been strong, in excess of 7% growth during 2006 and into 2007, although it has moderated more recently, with "just" 5.5% expansion in Q2 and evidence of some flattening in monthly retail sales. However, capital investment has remained quite vigorous. A nearly 22% rate of expansion in Q1 was hardly sustainable, but the slowing in Q2 still left it at over a 14% annualized pace then. In addition to the real demand growth, credit growth has been rapid. Monetary financial institutions' lending to the "domestic private sector" has been surging at rates of 20% - 25% over the past two years.

Thus, it is not surprising that the central bank would want to take action to rein in inflationary forces. At the same time, they are cognizant of world financial factors as well, and the opening lines of the statement accompanying today's rate hike (found here) indicate that some settling of world markets had the highest priority in their decision-making. They note that the Johannesburg Stock Exchange All Shares Index has reached new highs and that the rand, which had suffered a bit during the worst of the turmoil, has also recovered. They seem then today to be taking advantage of a relatively attractive international financial position presently to get their interest rates where they want them for the longer-term benefit of their domestic economy.

In contrast, the Bank of Japan, in its monetary policy meeting today, determined that it should not rock the boat in the sea of its domestic markets and left its own rates unchanged.

| SOUTH AFRICA: Select Indicators |

Latest | Q2 2007 | Q1 2007 | 2006 | 2005 | 2004 |

|---|---|---|---|---|---|---|

| GDP Growth, SAAR1 | -- | 4.5 | 4.7 | 5.0 | 5.1 | 4.8 |

| Consumption | -- | 5.5 | 7.4 | 7.3 | 6.6 | 6.7 |

| Gross Domestic Fixed Investment | -- | 14.2 | 21.8 | 12.7 | 9.6 | 8.9 |

| Repo Rate | 10.50 | 9.13 | 9.00 | 7.63 | 7.15 | 7.81 |

| CPIX2 Yr/Yr | 6.3 | 6.4 | 5.2 | 4.6 | 3.9 | 4.3 |

| CPI - Food Yr/Yr | 11.3 | 9.1 | 8.0 | 6.7 | 2.1 | 2.0 |

| Credit Growth3 | 22.9 | 24.8 | 24.1 | 25.8 | 19.5 | 13.8 |

1 Quarters are Qtr/Qtr-SAAR; annual figures are based on NSA data

2 CPI excluding mortgage interest rates, the measure used by the Central Bank. Yr/Yr inflation based on NSA data.

3Lending to domestic private sector borrowers

Carol Stone, CBE

AuthorMore in Author Profile »Carol Stone, CBE came to Haver Analytics in 2003 following more than 35 years as a financial market economist at major Wall Street financial institutions, most especially Merrill Lynch and Nomura Securities. She has broad experience in analysis and forecasting of flow-of-funds accounts, the federal budget and Federal Reserve operations. At Nomura Securites, among other duties, she developed various indicator forecasting tools and edited a daily global publication produced in London and New York for readers in Tokyo. At Haver Analytics, Carol is a member of the Research Department, aiding database managers with research and documentation efforts, as well as posting commentary on select economic reports. In addition, she conducts Ways-of-the-World, a blog on economic issues for an Episcopal-Church-affiliated website, The Geranium Farm. During her career, Carol served as an officer of the Money Marketeers and the Downtown Economists Club. She has a PhD from NYU's Stern School of Business. She lives in Brooklyn, New York, and has a weekend home on Long Island.