Global| Jun 17 2011

Global| Jun 17 2011Treasury TIC Data Show Moderate Foreign Purchases of U.S. Securities; Equities Remain Firm

Summary

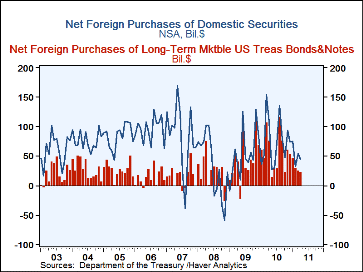

Foreign investors purchased $44.8 billion worth of U.S. long-term debt and equity securities in April, according the U.S. Treasury's International Capital ("TIC") data, which were published Wednesday. This followed $54.7 billion worth [...]

Foreign investors purchased $44.8 billion worth of U.S. long-term

debt and equity securities in April, according the U.S. Treasury's

International Capital ("TIC") data, which were published

Wednesday. This followed $54.7 billion worth in March, continuing the more

moderate pace of acquisitions first seen in February. As seen in the

table, during 2010 their monthly net purchases averaged $75.9 billion, a rate

that extended through January.

Foreign investors purchased $44.8 billion worth of U.S. long-term

debt and equity securities in April, according the U.S. Treasury's

International Capital ("TIC") data, which were published

Wednesday. This followed $54.7 billion worth in March, continuing the more

moderate pace of acquisitions first seen in February. As seen in the

table, during 2010 their monthly net purchases averaged $75.9 billion, a rate

that extended through January.

The slowdown has mainly involved Treasury debt. Monthly net purchases averaged $58.8 billion during 2010, while the last two months were $23.3 billion (April) and $26.8 billion (March). Purchases of other debt have been uneven: foreign investors seem to have picked up their acquisition of federal agency securities, with $7.5 billion and $9.5 billion in April and March, respectively, after a net liquidation in February. The $9 billion monthly pace of acquisition is a far cry from the days before 2008 when these organizations were healthier, and foreign purchases averaged $18 billion a month for several years, but this positive volume is better than the liquidation of these holdings that took place in 2008 and 2009. Foreign investors' holdings of corporate debt, by contrast, remain in the irregular pattern that has characterized that sector for the last three years, with fairly modest monthly ups and downs; the last period of sustained gain in foreign holdings of corporate bonds ended in 2007.

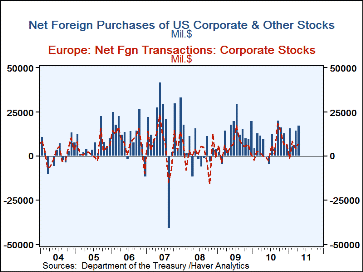

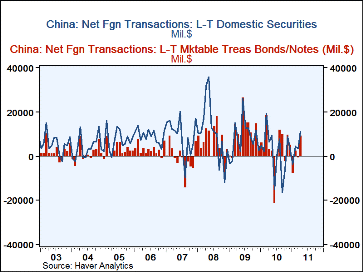

Corporate equity acquisition, though, has continued firm. Foreign net purchases of U.S. corporate stocks averaged $9.1 billion last year, and they reached $14.7 billion this March and $17.8 billion in April. It's likely that they have retreated in very recent weeks along with the downturn in stock prices, but the persistent strength in those data is encouraging. It's also interesting to note that the buyers of equities tend to be from different countries than the debt purchasers. Equity demand comes from investors in Caribbean financial centers, especially the Cayman Islands, and Europe. Buyers of significant amounts of Treasuries include China, at $9.4 billion in April, and the financial center in the U.K., with net purchases of $13.2 billion in April. April also featured a substantial $16.2 billion from Brazilian investors, who had purchased $3.9 billion in March, $3.1 billion in February and a huge $18.0 billion in January. So perhaps we need to monitor all of the BRIC countries in these financial data more than we have before.

The TIC data are found in Haver’s USINT database. The information there also includes aggregate flows in Treasury bills and other short-term assets as well as banking system data on claims on and liabilities to foreign Counterparties.

| Net Foreign Purchases of Long-Term U.S. Securities (Bil.$) | Apr | Mar | Feb | Apr'10 | Monthly Average | ||

|---|---|---|---|---|---|---|---|

| 2010 | 2009 | 2008 | |||||

| Total | 44.8 | 54.7 | 32.4 | 107.1 | 75.9 | 53.2 | 34.6 |

| Treasuries | 23.3 | 26.8 | 30.6 | 77.2 | 58.8 | 44.9 | 26.2 |

| Federal agencies | 7.5 | 9.5 | -1.5 | 12.4 | 9.0 | -1.0 | -3.2 |

| Corporate bonds | -3.8 | 3.8 | -2.5 | 7.7 | -1.0 | -3.4 | 7.8 |

| Corporate stocks | 17.8 | 14.7 | 6.1 | 9.8 | 9.1 | 12.7 | 3.7 |

| China (All security types) | 4.5 | -3.8 | 4.5 | 6.2 | 2.0 | 8.2 | 10.9 |

Carol Stone, CBE

AuthorMore in Author Profile »Carol Stone, CBE came to Haver Analytics in 2003 following more than 35 years as a financial market economist at major Wall Street financial institutions, most especially Merrill Lynch and Nomura Securities. She has broad experience in analysis and forecasting of flow-of-funds accounts, the federal budget and Federal Reserve operations. At Nomura Securites, among other duties, she developed various indicator forecasting tools and edited a daily global publication produced in London and New York for readers in Tokyo. At Haver Analytics, Carol is a member of the Research Department, aiding database managers with research and documentation efforts, as well as posting commentary on select economic reports. In addition, she conducts Ways-of-the-World, a blog on economic issues for an Episcopal-Church-affiliated website, The Geranium Farm. During her career, Carol served as an officer of the Money Marketeers and the Downtown Economists Club. She has a PhD from NYU's Stern School of Business. She lives in Brooklyn, New York, and has a weekend home on Long Island.