Global| Dec 30 2019

Global| Dec 30 2019TT

by:Sandy Batten

|in:Economy in Brief

Summary

The Federal Reserve Bank of Dallas reported in its Texas Manufacturing Outlook Survey that the General Business Activity Index of -1.3 during November......... Each index is calculated by subtracting the percentage reporting a [...]

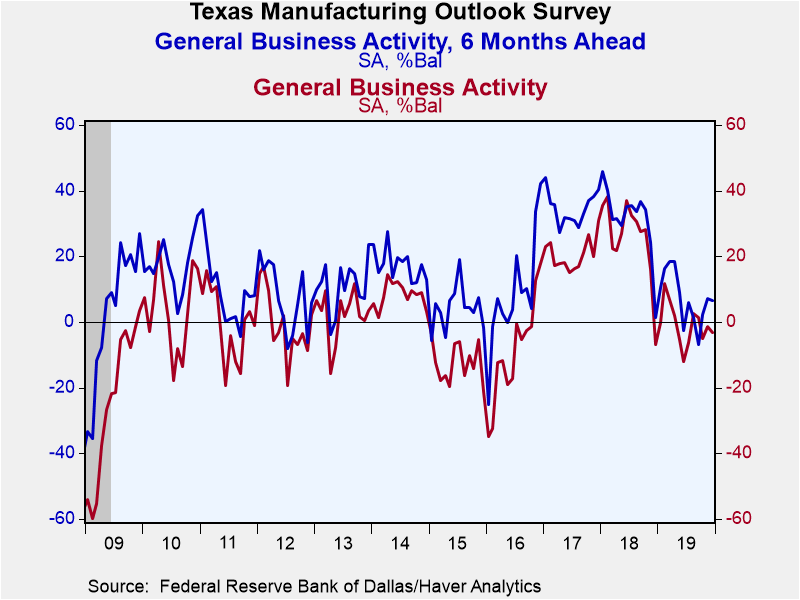

The Federal Reserve Bank of Dallas reported in its Texas Manufacturing Outlook Survey that the General Business Activity Index of -1.3 during November.........

Each index is calculated by subtracting the percentage reporting a decrease from the percentage reporting an increase. When all firms report rising activity, an index will register 100. An index will register -100 when all firms report a decrease. An index will be zero when the number of firms reporting an increase or decrease is equal. Items may not add up to 100% because of rounding. Data for the Texas Manufacturing Outlook can be found in Haver's SURVEYS database.

| Texas Manufacturing Outlook Survey (SA, % Balance) | Dec | Nov | Oct | Dec'18 | 2018 | 2017 | 2016 |

|---|---|---|---|---|---|---|---|

| Current General Business Activity Index | -1.3 | -5.1 | 1.5 | 16.1 | 25.8 | 20.6 | -8.9 |

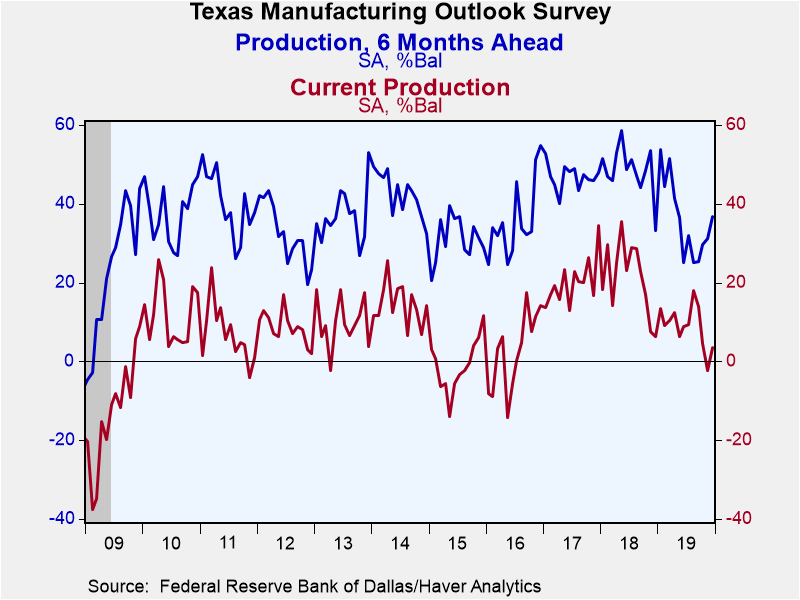

| Production | -2.4 | 4.5 | 13.9 | 7.7 | 21.4 | 20.2 | 2.4 |

| Growth Rate of New Orders | -9.3 | -5.9 | 4.4 | 4.7 | 14.8 | 11.4 | -7.3 |

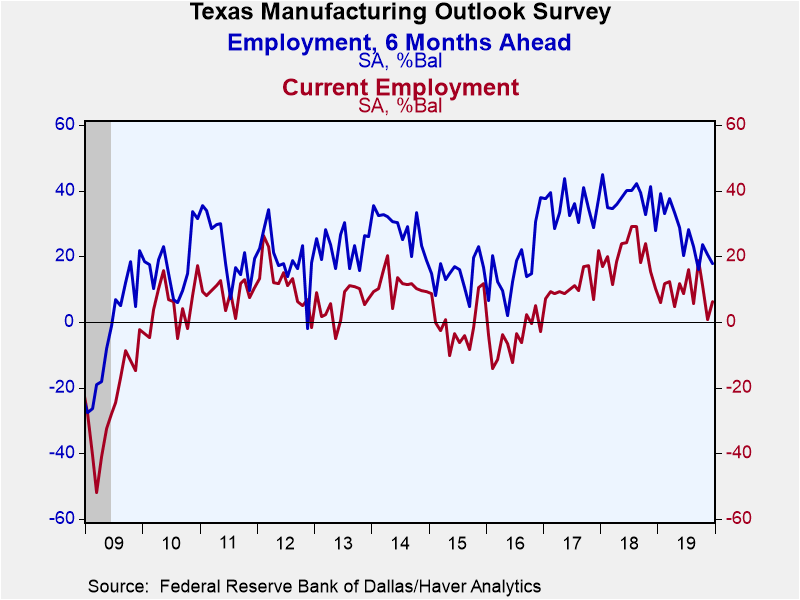

| Employment | 0.9 | 11.0 | 18.8 | 15.5 | 20.0 | 11.4 | -4.9 |

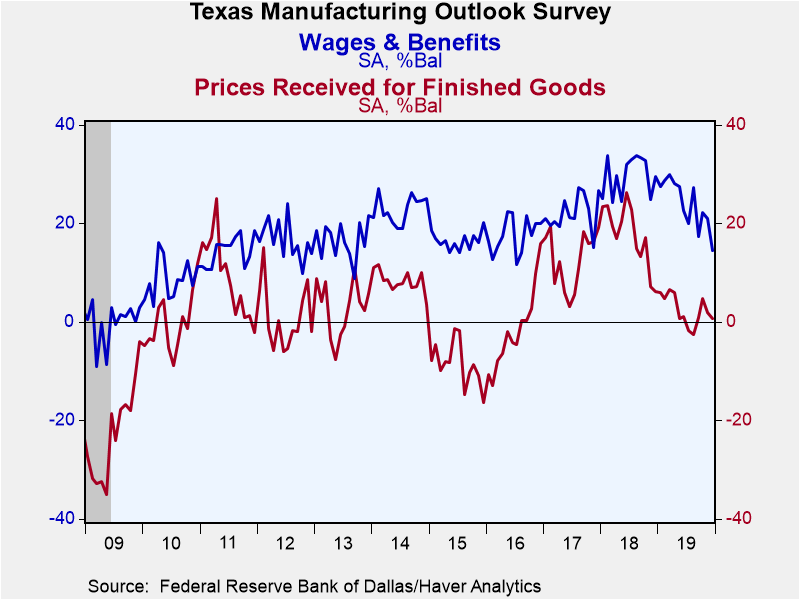

| Wages & Benefits | 21.1 | 22.2 | 17.4 | 24.8 | 29.7 | 22.2 | 17.6 |

| Prices Received for Finished Goods | 1.9 | 4.8 | 1.0 | 7.2 | 17.6 | 12.7 | -1.6 |

| General Business Activity Index Expected in Six Months | 7.3 | 2.4 | -6.8 | 24.1 | 31.6 | 34.5 | 8.9 |

| Production | 31.3 | 29.6 | 25.4 | 53.6 | 48.5 | 46.8 | 35.8 |

| Growth Rate of New Orders | 19.3 | 26.1 | 18.8 | 31.7 | 35.9 | 37.7 | 24.3 |

| Employment | 20.6 | 23.6 | 15.9 | 41.4 | 37.6 | 35.2 | 16.7 |

| Wages & Benefits | 36.5 | 39.0 | 35.6 | 44.3 | 50.4 | 43.4 | 34.9 |

Sandy Batten

AuthorMore in Author Profile »Sandy Batten has more than 30 years of experience analyzing industrial economies and financial markets and a wide range of experience across the financial services sector, government, and academia. Before joining Haver Analytics, Sandy was a Vice President and Senior Economist at Citibank; Senior Credit Market Analyst at CDC Investment Management, Managing Director at Bear Stearns, and Executive Director at JPMorgan. In 2008, Sandy was named the most accurate US forecaster by the National Association for Business Economics. He is a member of the New York Forecasters Club, NABE, and the American Economic Association. Prior to his time in the financial services sector, Sandy was a Research Officer at the Federal Reserve Bank of St. Louis, Senior Staff Economist on the President’s Council of Economic Advisors, Deputy Assistant Secretary for Economic Policy at the US Treasury, and Economist at the International Monetary Fund. Sandy has taught economics at St. Louis University, Denison University, and Muskingun College. He has published numerous peer-reviewed articles in a wide range of academic publications. He has a B.A. in economics from the University of Richmond and a M.A. and Ph.D. in economics from The Ohio State University.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates