Global| Nov 07 2007

Global| Nov 07 2007Turkey Foreign Trade Volumes Moderate in September, While Sustaining Double-Digit Year/Year Growth

Summary

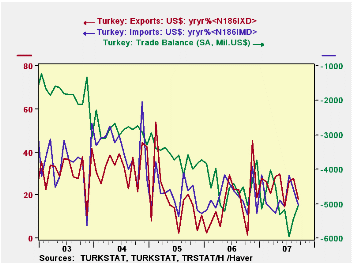

Turkey's economic fortunes currently are tied to their export activities. Through Q2 2007, GDP was up 3.9% from a year ago, while exports of goods and services according to the national accounts definition were up 12.7% in 1987 [...]

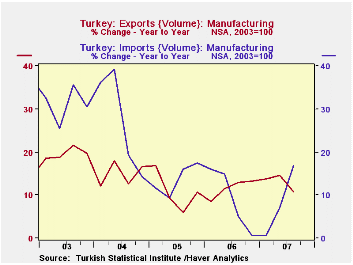

Turkey's economic fortunes currently are tied to their export activities. Through Q2 2007, GDP was up 3.9% from a year ago, while exports of goods and services according to the national accounts definition were up 12.7% in 1987 prices. Exports of goods in the trade accounts remained quite strong in Q3 through August, although they slowed in September. A volume index was up 16.1% in August from the corresponding 2006 value; it trailed off in September to just a 3.5% gain, making Q3 by this measure up 10.4% from Q3 2006. The manufacturing sector remains vigorous for the most part, as a slower September, up 4.1%, followed 15.4% in August, making a Q3 average of 10.9% growth. As we noted here last winter, the automobile industry is a particular highlight; September detail is not yet available, but July and August were up nearly 15% from the year earlier.

Imports too are expanding in Turkey. In Q2, the national

accounts measure showed 8.4% growth from a year ago, actually somewhat

slower than other recent periods; this coincided with an 8.1% gain in

the volume index. But Q3 saw a surge in the latter, by 15.3%. The

acceleration is in manufactured goods, up 16.8% in the quarter.

Agricultural imports are small, but they have been expanding greatly,

and were up almost 45% in the first nine months of this year from the

year earlier.

Turkey's overall trade balance has sustained a declining

trend, despite the strength in exports, since imports remain noticeably

larger. So a much larger percentage increase in exports is needed to

produce a big enough dollar amount to overcome a more moderate increase

in imports. The numbers that have obtained put the September deficit

right at $5.0 billion, down somewhat from July and August's $6.2 and

$6.3 billion, respectively, and mildly worse than the $4.5 billion

deficit during 2006.

| TURKEY, Seas. Adj. | Sept 2007 | Aug 2007 | July 2007 | Monthly Averages | ||

|---|---|---|---|---|---|---|

| 2006 | 2005 | 2004 | ||||

| Trade Balance, SA, Mil.US$ | -$5.0 | -$6.3 | -$6.2 | -$4.5 | -$3.6 | -$2.9 |

| Exports, SA, Mil.US$ | $8.7 | $9.6 | $8.8 | $7.1 | $6.1 | $5.3 |

| Volume Index* | 3.5% | 16.1% | 12.5% | 12.2% | 10.4% | 13.7% |

| Imports, SA, Mil.US$ | $13.7 | $15.0 | $14.8 | $11.6 | $9.7 | $8.1 |

| Volume Index* | 6.5% | 19.4% | 20.5% | 8.4% | 12.2% | 20.6% |

Carol Stone, CBE

AuthorMore in Author Profile »Carol Stone, CBE came to Haver Analytics in 2003 following more than 35 years as a financial market economist at major Wall Street financial institutions, most especially Merrill Lynch and Nomura Securities. She had broad experience in analysis and forecasting of flow-of-funds accounts, the federal budget and Federal Reserve operations. At Nomura Securities, among other duties, she developed various indicator forecasting tools and edited a daily global publication produced in London and New York for readers in Tokyo. At Haver Analytics, Carol was a member of the Research Department, aiding database managers with research and documentation efforts, as well as posting commentary on select economic reports. In addition, she conducted Ways-of-the-World, a blog on economic issues for an Episcopal-Church-affiliated website, The Geranium Farm. During her career, Carol served as an officer of the Money Marketeers and the Downtown Economists Club. She had a PhD from NYU's Stern School of Business. She lived in Brooklyn, New York, and had a weekend home on Long Island.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates