Global| Nov 22 2016

Global| Nov 22 2016U.K. Industrial Orders Strengthen in an Unimpressive Way

Summary

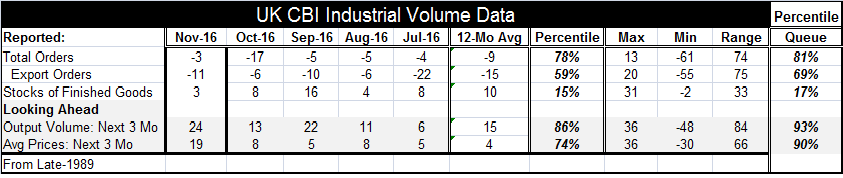

Despite the ongoing weakness in the British pound sterling, U.K. industrial orders are 'losing ground.' However, at -3 the net balance for November is much better than last month's -17 and better than the series 12-month average of [...]

Despite the ongoing weakness in the British pound sterling, U.K. industrial orders are 'losing ground.' However, at -3 the net balance for November is much better than last month's -17 and better than the series 12-month average of -9. Oddly, despite sterling's weakness, the net export orders reading at -11 is its weakest reading since July (-22). But it is better than its 12-month average (-15).

Despite the ongoing weakness in the British pound sterling, U.K. industrial orders are 'losing ground.' However, at -3 the net balance for November is much better than last month's -17 and better than the series 12-month average of -9. Oddly, despite sterling's weakness, the net export orders reading at -11 is its weakest reading since July (-22). But it is better than its 12-month average (-15).

Orders, a sort of positive mixed signal

Still, orders - quite apart from their actual diffusion value - are relatively strong since that headline of a -3 reading has been stronger only 19% of the time, historically. The export order reading at -11 is at its 69th queue percentile and has been stronger about 31% of the time. Clearly, the orders side is more of a positive than the raw diffusion values seem to suggest.

Sale volume outlook is upbeat

The outlook for sales volume over the next three months is especially strong. Its reading of 24 is its strongest reading since February 2015. The reading compares to a 12-month average of 15. It sits in the 93rd percentile of its historic queue of values, marking it as stronger only 7% of the time. The outlook for volume is especially impressive. And its diffusion value and percentile standing are much stronger than orders are or have been.

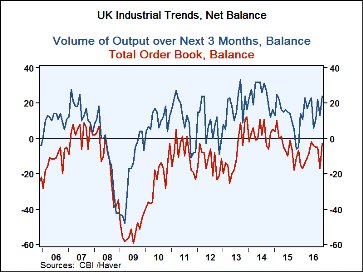

Orders vs. expected volumes

The chart plots orders and output expectations. Clearly, the two series move together over time. But they also have their moments of separation. Even without an exhaustive statistical inspection, it is clear that the volume expectations series leads the orders series. That makes its greater relative strength reassuring.

Inflation?

The weakness in sterling also has price expectations on the rise. Average prices expected over the next three months have a diffusion reading of 19, up sharply from 8 in October and from the 12-month average of 4. The 19 diffusion reading for expected prices is the highest reading since January 2014. Expectations for prices rising are higher than this only about 10% of the time historically. And the Bank of England is on alert.

Summing up

On balance, the U.K. industrial sector is seeing orders pick up and quite upbeat on prospects for volumes to expand over the next 3 months. Businesses also expect prices will be higher with a strong sense of certainty. Despite weakness in sterling, the optimism on volume does not appear to be linked to the international sector, at least not judging from the behavior of export orders.

Outlook and Brexit

The U.K. industrial sector is surprisingly upbeat given that Brexit talks are hovering in the background even though there appears to be still a lot of political skirmishing about how that is going to play out. The rhetoric from the EU side has been rather strident and anything but accommodating. However, spewing rhetoric is still part of the negotiating and posturing game at this point.

More destabilization?

What is also going to be interesting is the Italian referendum. So far, voting schemes and elections have been putting forth the unexpected results and there has turned out to be more of a constituency for change in the relatively high-income countries with Brexit carrying the day in the U.K. and Trump riding into office on the back of voter discontent in the United States. Italian politics have had their growing factions of discontent too. Will that spill over at the referendum or will Italy turn the heat down before that pot boils over? Italian PM Renzi is under fire there. If the referendum on political reform does not pass, it will be taken as a vote of no support for Renzi and the wheels could be set in motion to put the rogue Five Star movement in power in Italy. And that movement has a secessionist agenda for Italy. It wants to bring back the Italian lira. Were the Italian referendum to fail, the pressures in Europe would intensify and the blow back to the U.K. over Brexit would also emerge. If a 'worst case' scenario developed, if PM Renzi left and Five Star became part of the formal government, all bets would be off for Europe. Should Italy become destabilized and rock the boat of the EMU not just the EU, it would be a terrible blow for 'European unity' if there is such a thing left.

Precedents and Presidents

The Brexit vote has in some ways made it easier for Italy to act as it set the precedent; Brexit already has sent waves through the system to rock the boats. But most of the rest of the world looks at the elevation of Donald Trump in the U.S. and shakes its head. Will Brexit embolden Italian voters or will the elevation of Trump in the U.S. make them more wary of the consequences of disruption? The unthinkable is no longer unthinkable and maybe not even undoable. We have no idea what will happen next. But all eyes are glued to Italy and its referendum because of its potential to breed chaos.

Robert Brusca

AuthorMore in Author Profile »Robert A. Brusca is Chief Economist of Fact and Opinion Economics, a consulting firm he founded in Manhattan. He has been an economist on Wall Street for over 25 years. He has visited central banking and large institutional clients in over 30 countries in his career as an economist. Mr. Brusca was a Divisional Research Chief at the Federal Reserve Bank of NY (Chief of the International Financial markets Division), a Fed Watcher at Irving Trust and Chief Economist at Nikko Securities International. He is widely quoted and appears in various media. Mr. Brusca holds an MA and Ph.D. in economics from Michigan State University and a BA in Economics from the University of Michigan. His research pursues his strong interests in non aligned policy economics as well as international economics. FAO Economics’ research targets investors to assist them in making better investment decisions in stocks, bonds and in a variety of international assets. The company does not manage money and has no conflicts in giving economic advice.