Global| Nov 15 2018

Global| Nov 15 2018U.K. Retail Sales Implode As Theresa May Shops Her Brexit Deal

Summary

The world has not come to an end. Nor is it clear that it is an auspicious new post-Brexit beginning. But with a Brexit deal now in hand, the details are trickling out as the ‘rats' desert what they perceive to be a sinking ship. [...]

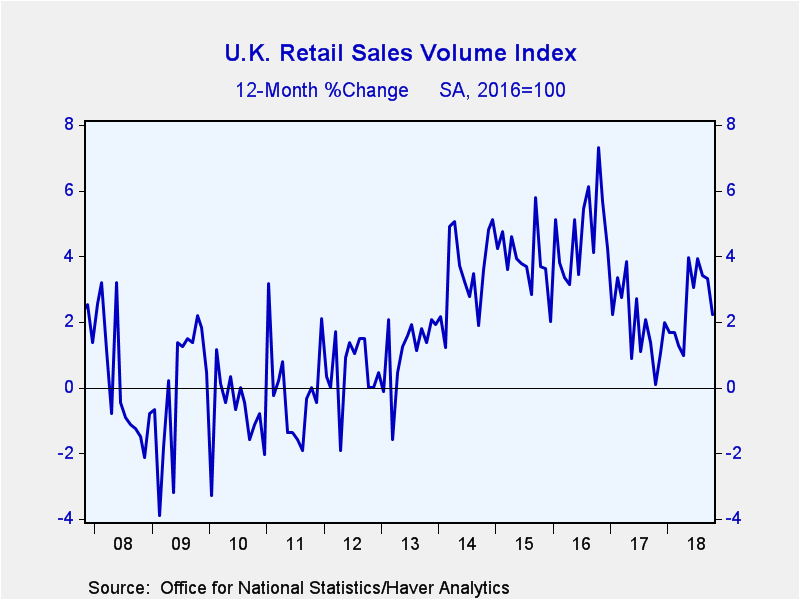

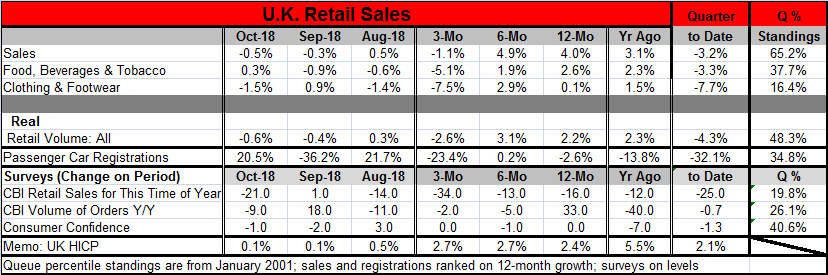

The world has not come to an end. Nor is it clear that it is an auspicious new post-Brexit beginning. But with a Brexit deal now in hand, the details are trickling out as the ‘rats' desert what they perceive to be a sinking ship. Theresa May did get her cabinet to approve her plan, but that also cost her several ministers who up and left. Against this background, U.K. retail sales in October lost 0.5%, their second monthly drop in a row. While year-on-year sales still are up by 4.0% and six-month sales still expand at a pace of 4.9%, over three months sales are falling at a 1.1% annual rate. And there will be a reaction to Brexit by consumers and in the financial markets. And from this vantage point, that reaction seems unlikely to be good.

The world has not come to an end. Nor is it clear that it is an auspicious new post-Brexit beginning. But with a Brexit deal now in hand, the details are trickling out as the ‘rats' desert what they perceive to be a sinking ship. Theresa May did get her cabinet to approve her plan, but that also cost her several ministers who up and left. Against this background, U.K. retail sales in October lost 0.5%, their second monthly drop in a row. While year-on-year sales still are up by 4.0% and six-month sales still expand at a pace of 4.9%, over three months sales are falling at a 1.1% annual rate. And there will be a reaction to Brexit by consumers and in the financial markets. And from this vantage point, that reaction seems unlikely to be good.

With two declines in sales in a row, retail sales, with their measure taken early in Q4, are quite weak. Headline sales are falling at 3.2% annual rate with one month's data in for Q4.

The queue (Q) standings for sales rank year-on-year growth rates from January 2001. They find overall sales at a 65th percentile standing (sales have been as weak, or weaker than their current growth rate 65% of the time or stronger only 35% of the time – however, you want to look at it.) On this metric, the statistical media occurs at a percentile ranking of 50. A ranking of 65 is therefore moderately solid and well above the series' median. The food category has a ranking in its 37th percentile while clothing has a very low ranking in its 16th percentile. Both are disappointing.

In volume terms, retail sales also are lower for two months in a row and sequential growth rates show expansion except over the recent three months. In the quarter-to-date, real retail sales are falling at a sizeable 4.3% annualized rate and the real year-on-year growth rate has a 48th percentile standing, below its median on this timeline back to early 2001. Of course, real sales are a more important yard stock than nominal sales.

Brexit decisions against a weakening background

Despite solid enough sales growth over 12 months, the profile of retail sales growth is slipping. And measured anyway you like, sales are weak over three months and over the quarter-to-date (QTD). This is not a preferred position for sales on the verge of setting the Brexit parameters out for the public and for a vote.

Passenger car registrations have been spotty with sharply negative three-month growth and a decline over 12 months. Registrations are falling sharply in the QTD period. And beyond that, the year-on-year sales standing is at its 34.8 percentile, barely out of the grip of the lower one third of all results.

The retail sales survey from the CBI shows slippage over the last three months and weak survey values that are well below their respective medians.

Changes in consumer confidence have been small and given to no new trend. The level of confidence is itself below its median value with a 40th percentile standing.

These are not strong levels of sales or of consumer confidence trends or a strong start to Q4 as the Brexit plan is about to be laid out. It appears that the Brexit plan is quite limited and that the EU has, in fact, stonewalled the U.K. and given in on very few areas.

Other assessments

The financial sector seems to have been shut out except for the most perfunctory access. Markets in the U.K. are falling. Stocks, especially bank stocks, the pound sterling are giving way. Interest rates are moving higher. While Theresa May's cabinet did approve the plan, at least two key ministers have quit and there is speculation that one of them may have done so to prepare to run against her in opposition. The Brexit plan still must pass muster in Parliament and that passage is not a foregone conclusion, leaving a hard Brexit as a ‘fall back' option, much as if ‘death' is the fallback option for ‘life.'

In Scotland, once again Brexit is being taken as a reason to renew its referendum on staying in the United Kingdom. It is being portrayed as yet another reason for Scotland to decouple from the U.K., on the assumption that the EU would have them. And the way the EU has been behaving that is no clear assumption.

Across the channel, EU members are preparing for the possibility of a hard Brexit. At home, the BOE has been meeting with financial market participants to gauge their reaction. All wheels are in motion. Despite PM May getting cabinet approval for her plan, that approval has come at a cost and the cost is high. While a lot of people are opposed to what she has negotiated, it is unlikely that anyone could have done better since the EU held almost all of the cards in this game. That realization is underscored by the extent of opposition that May has had to deal with at home, but with no one willing to pull the plug on her administration. No one else wanted the job she had, the task to which she was set. But now that the die will soon be cast and the ‘blame' can be rested at one person's feet, the vultures are circling for a go at governing in the wake of a done deal on Brexit where bad outcomes can be blamed on somebody else.

Ain't politics grand? The Brits may speak with greater eloquence, but they play politics with elbows every bit as sharp as anyone else's including Mr. Trump's. In for a penny, in for a pound, May's in trouble, vultures circle ‘round.

Robert Brusca

AuthorMore in Author Profile »Robert A. Brusca is Chief Economist of Fact and Opinion Economics, a consulting firm he founded in Manhattan. He has been an economist on Wall Street for over 25 years. He has visited central banking and large institutional clients in over 30 countries in his career as an economist. Mr. Brusca was a Divisional Research Chief at the Federal Reserve Bank of NY (Chief of the International Financial markets Division), a Fed Watcher at Irving Trust and Chief Economist at Nikko Securities International. He is widely quoted and appears in various media. Mr. Brusca holds an MA and Ph.D. in economics from Michigan State University and a BA in Economics from the University of Michigan. His research pursues his strong interests in non aligned policy economics as well as international economics. FAO Economics’ research targets investors to assist them in making better investment decisions in stocks, bonds and in a variety of international assets. The company does not manage money and has no conflicts in giving economic advice.