Global| Oct 18 2017

Global| Oct 18 2017U.K. Unemployment Rate and Claimant Count Drop As BOE Prepared to an Uncertain Future

Summary

U.K. unemployment statistics have been pointing to labor market strength for some time. There are various measures of labor market conditions, ranging from several unemployment rate definitions to the claimant count. According to all [...]

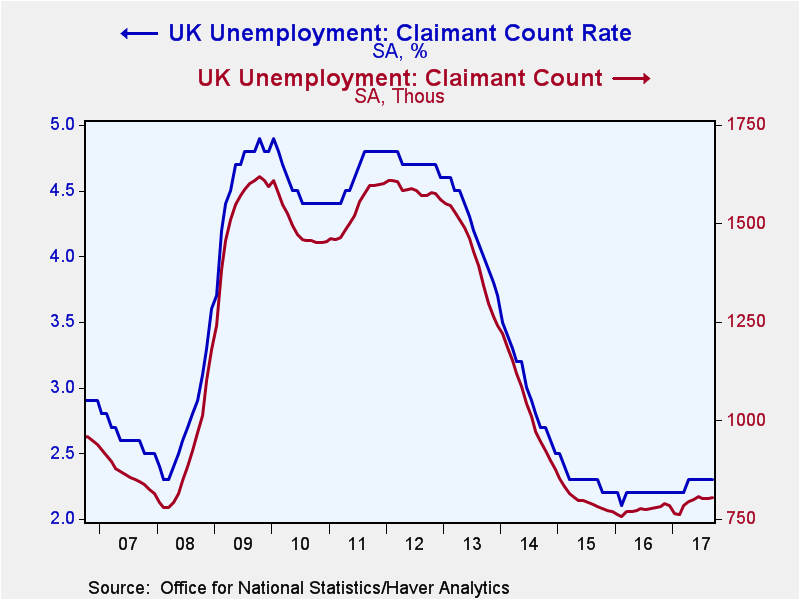

U.K. unemployment statistics have been pointing to labor market strength for some time. There are various measures of labor market conditions, ranging from several unemployment rate definitions to the claimant count. According to all these measures, U.K. unemployment is exceptionally low.

U.K. unemployment statistics have been pointing to labor market strength for some time. There are various measures of labor market conditions, ranging from several unemployment rate definitions to the claimant count. According to all these measures, U.K. unemployment is exceptionally low.

Policy and its collateral damage

In a speech given yesterday, Bank of England Governor Mark Carney characterized U.K. fiscal policy as tight and monetary policy as loose. There has been a focus on the BOE for some time since it opened the flood gates for stimulus taking action that caused the pound sterling to drop sharply. In the wake of that drop, the U.K. has been experiencing rising inflation to a pace around 3% which Governor Carney has said the bank had anticipated. But now higher inflation puts the BOE in an awkward situation and it is not the last awkward situation it is about to have to deal with.

Against a background of too high yet limited inflation

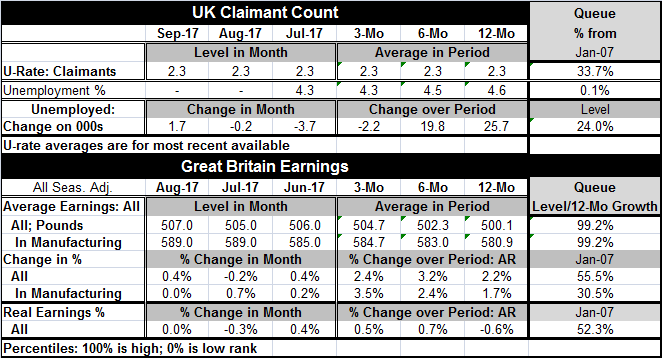

While some are concerned about the high inflation and particularly high inflation in combination with a tight jobs market (a market that has some of the lowest unemployment rates seen since 1975), the fact of it is that this inflation has come through international channels because of pound weakness making imports more expensive. And in the wake of this shot of inflation, domestic U.K. prices have largely failed to accelerate. More importantly, real wages have eroded. In the table below, we show that real earnings are lower by 0.6% over the last 12 months. Real earnings were flat in August and fell by 0.3% in July. For all industries, nominal earnings are up 2.2% over 12 months. For manufacturing, nominal earnings are up by a lighter 1.7%. The overall earnings gain does not show any clear trend while manufacturing earnings show some uptrend from 12-month to six-month to three-month.

Subdued real and nominal earnings

If we look at these readings and trends historically, we find that the 12-month real earnings gain has been lower only 16% of the time since 2014, but since January 2017 (this is the post-financial crisis period) the gain has been lower about 52% of the time. The current reading is near its post financial crisis median on this timeline (the median occurs at the 50th percentile on this metric). Turning to nominal earnings, they have been lower 55% of the time and also are a few notches above their historic median on the same timeline. In contrast, manufacturing nominal earnings have been lower only about 30% of the time, well below their median. However, over time even with modest inflation, nominal wages rise and the level of compensation in nominal terms has a 99.2 percentile standing. Calculated more meaningfully, in real terms, the level of real earnings stands at their 47% percentile, below their historic median.

Current cross-currents and future cross-currents

On balance, the U.K. situation is a complicated one. The BOE introduced inflation through the import channel when it engaged in its super stimulus in the wake of the Brexit vote to dull the impact on the economy. The combination of a tight fiscal/lax monetary policy has allowed inflation to spread through the import channel, but it has prevented it from spreading to workers' earnings. However, we have a queue of trends in train. (1) Right now, real earnings are not keeping pace with inflation's rise and that is keeping domestic prices from chasing international prices higher. (2) There still is the actual shock of Brexit ahead; that should be depressing. (3) Yet, the BOE warns that it cannot keep up this stimulus indefinitely and (4) it worries that a U.K. outside of the EU will be a less dynamic economy. A study by the OECD released yesterday made the same conclusion with a different spin noting that U.K. economy would get a jolt of stimulus if it backed off its road to Brexit.

How policy should deal with the unknown: mind the gap

The BOE is put in a bind for several reasons. (1) currently fiscal and monetary policy tug in different directions, sending conflicting pulses through the economy. Also there is the appearance of inflation and the appearance of tight labor markets, but neither of these events is creating the expected effect as wages remain subdued. (2) Upcoming, there is a real shock when the terms of Brexit are imposed as firm relocate out of the U.K. in response and U.K. firms lose some export markets, and (3) after that there will be the new future when the BOE fears that the U.K. economy will be less dynamic and will call for a tighter monetary policy. In a future, with less free trade with Europe, U.K. firms may gain market power and inflation could become more of an issue. Clearly, the BOE has a lot of future events stacked in the kitchen, ready for delivery to its plate - and with unknown timelines and only a vague idea of the various impacts on growth. It is no wonder that in this circumstance with import prices doing most of the damage to domestic inflation and domestic prices staying less affected the BOE would prefer to play the waiting game rather than to alter policy for yet another temporary event that will/may subsequently have to be unwound. Any action taken today shoots another round of lagged impulses through the economy that might be counter to the policy needs of the next shock when it arrives. The economy is about to absorb several different types and directions of shock. For a time, watching and waiting remains preferred and probably is the optimal policy. Acting off of forecasts would be dangerous since if the forecast were wrong the bank might be faced with a policy reversal and a need to be forceful in the opposite direction. And the BOE, like the Fed, still has to mind the gap between where rates are and the zero bound.

Robert Brusca

AuthorMore in Author Profile »Robert A. Brusca is Chief Economist of Fact and Opinion Economics, a consulting firm he founded in Manhattan. He has been an economist on Wall Street for over 25 years. He has visited central banking and large institutional clients in over 30 countries in his career as an economist. Mr. Brusca was a Divisional Research Chief at the Federal Reserve Bank of NY (Chief of the International Financial markets Division), a Fed Watcher at Irving Trust and Chief Economist at Nikko Securities International. He is widely quoted and appears in various media. Mr. Brusca holds an MA and Ph.D. in economics from Michigan State University and a BA in Economics from the University of Michigan. His research pursues his strong interests in non aligned policy economics as well as international economics. FAO Economics’ research targets investors to assist them in making better investment decisions in stocks, bonds and in a variety of international assets. The company does not manage money and has no conflicts in giving economic advice.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates