Global| May 30 2018

Global| May 30 2018U.S. ADP Private Payroll Growth Decelerating

Summary

The ADP/Moody's National Employment Report indicated that private nonfarm payrolls increased 178,000 during May following a downwardly revised 163,000 gain in April (was 204,000). A 188,000 rise had been expected in the Action [...]

The ADP/Moody's National Employment Report indicated that private nonfarm payrolls increased 178,000 during May following a downwardly revised 163,000 gain in April (was 204,000). A 188,000 rise had been expected in the Action Economics Forecast Survey. During the last three months, ADP payrolls have grown an average of 180,000 versus 244,000 in the prior three months and a 185,000 monthly average during 2017. During the last ten years, there has been a 95% correlation between the change in the ADP figure and the change in nonfarm private-sector payrolls as measured by the Bureau of Labor Statistics.

The Automatic Data Processing Research Institute survey is based on ADP's business payroll transaction system covering 411,000 companies and nearly 24 million employees. The data are processed by Moody's Analytics Inc., then calibrated and aligned with the BLS establishment survey data. The ADP data cover private sector employment only.

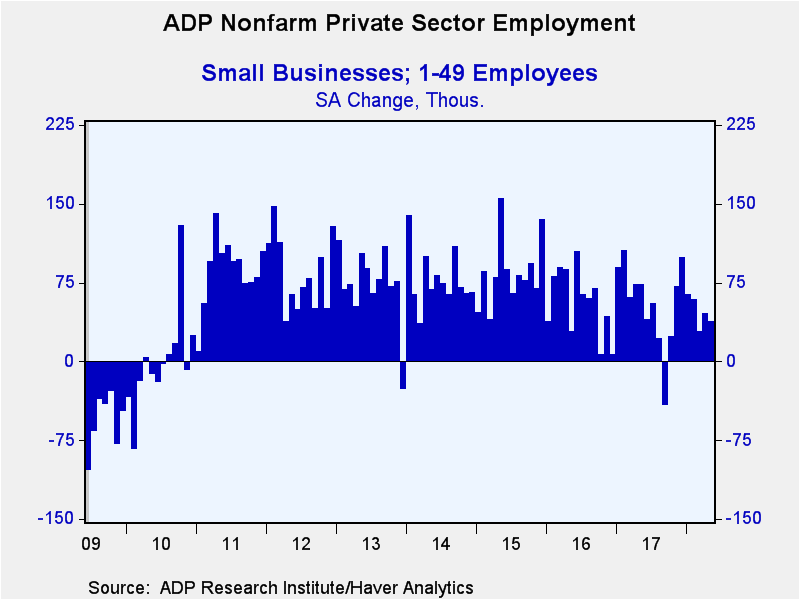

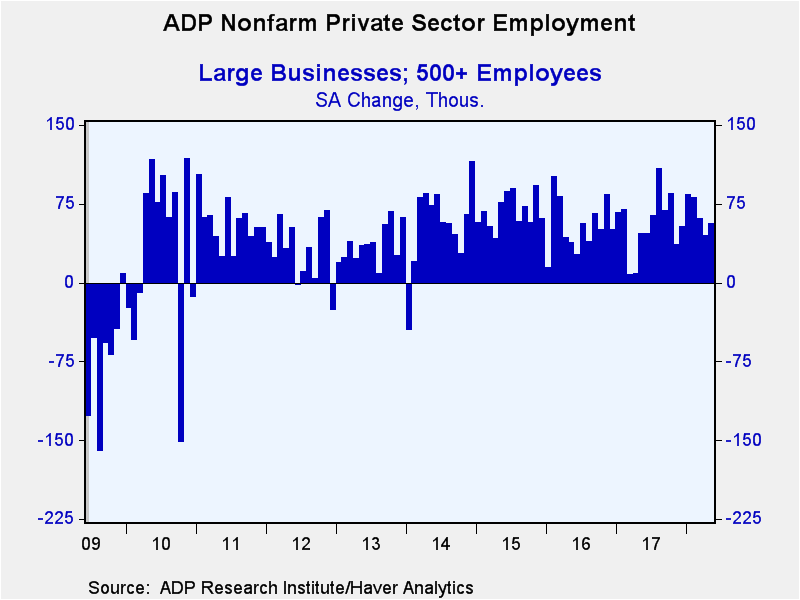

Small-sized business hiring increased 38,000 (1.0% y/y) in May down from last year's 56,000 average. Medium-sized payrolls gained 84,000 (2.1% y/y) versus 74,000 per month in 2017. Large-sized payrolls improved 56,000 (2.8% y/y) in contrast to an average of 55,000 last year.

Private service-sector payrolls increased 114,000 (1.7% y/y), the smallest gain since last September and down from last year's average of 148,000. Professional & business services payrolls rose an improved 61,000 (2.7% y/y). Education & health services employment rose a weakened 35,000 (2.0% y/y). Employment in the leisure & hospitality sector gained a faster 33,000 (1.9% y/y). The number of trade, transportation and utilities jobs fell 23,000 (+0.9% y/y), the first decline since last October. Financial activities jobs edged up just 2,000 (1.4% y/y), the weakest gain since October. Employment in the information sector grew a slower 2,000 (-0.2% y/y).

Employment in the goods-producing sector rose faster 64,000 (2.3% y/y). The 39,000 increase (3.2% y/y) in construction sector payrolls was improved from last year's 19,000 average. Jobs in the factory sector rose 14,000 (1.6% y/y) relatively unchanged from last year's 15,000 monthly pace. The rise in oil prices is spurring job growth in the natural resource & mining sector, with jobs up an increased 11,000 (6.8% y/y) in May versus a 3,000 average gain in 2017 and an 8,000 average loss in 2016.

The ADP National Employment Report data can be found in Haver's USECON database; historical figures date back to April 2001 for the total and industry breakdown, and back to January 2005 for the business size breakout. The expectation figure is available in Haver's AS1REPNA database

| ADP/Moody's National Employment Report | May | Apr | Mar | May Y/Y | 2017 | 2016 | 2015 |

|---|---|---|---|---|---|---|---|

| Nonfarm Private Payroll Employment (m/m chg, 000s) | 178 | 163 | 198 | 1.8% | 1.8% | 1.9% | 2.3% |

| Small Payroll (1-49) | 38 | 46 | 28 | 1.0 | 1.3 | 1.9 | 1.9 |

| Medium Payroll (50-499) | 84 | 72 | 109 | 2.1 | 1.9 | 1.5 | 2.3 |

| Large Payroll (>500) | 56 | 45 | 61 | 2.8 | 2.3 | 2.7 | 3.0 |

| Goods-Producing | 64 | 34 | 49 | 2.3 | 1.5 | 0.8 | 2.0 |

| Construction | 39 | 11 | 19 | 3.2 | 3.1 | 4.3 | 5.3 |

| Manufacturing | 14 | 15 | 25 | 1.6 | 0.7 | 0.2 | 1.2 |

| Service-Producing | 114 | 129 | 149 | 1.7 | 1.8 | 2.2 | 2.3 |

Gerald D. Cohen

AuthorMore in Author Profile »Gerald Cohen provides strategic vision and leadership of the translational economic research and policy initiatives at the Kenan Institute of Private Enterprise.

He has worked in both the public and private sectors focusing on the intersection between financial markets and economic fundamentals. He was a Senior Economist at Haver Analytics from January 2019 to February 2021. During the Obama Administration Gerald was Deputy Assistant Secretary for Macroeconomic Analysis at the U.S. Department of Treasury where he helped formulate and evaluate the impact of policy proposals on the U.S. economy. Prior to Treasury, he co-managed a global macro fund at Ziff Brothers Investments.

Gerald holds a bachelor’s of science from the Massachusetts Institute of Technology and a Ph.D. in Economics from Harvard University and is a contributing author to 30-Second Money as well as a co-author of Political Cycles and the Macroeconomy.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates