Global| Oct 30 2019

Global| Oct 30 2019U.S. ADP Private Payrolls Rise with Net Downward Revisions to Previous Months

Summary

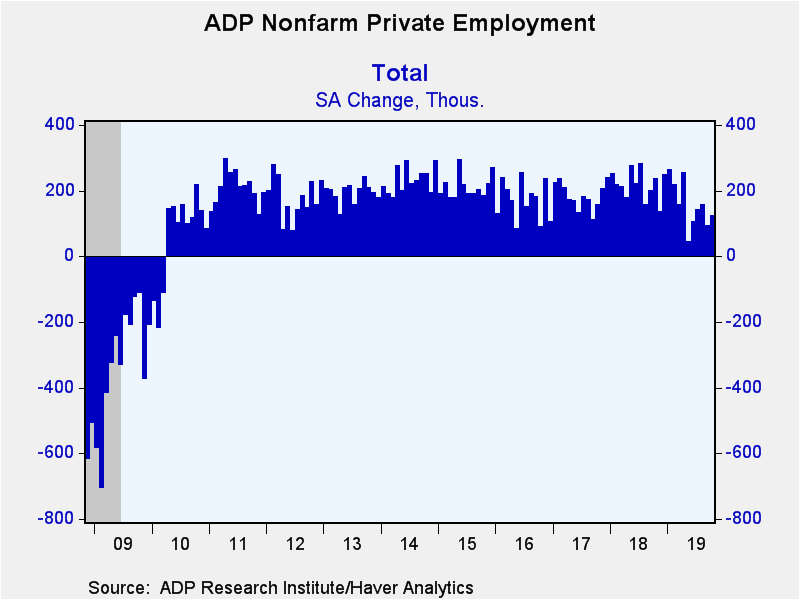

The ADP National Employment Report count of private nonfarm payrolls increased a slightly-greater-than-expected 125,000 in October (1.5% year-on-year) following a downwardly-revised 93,000 gain in September (was 135,000). The August [...]

The ADP National Employment Report count of private nonfarm payrolls increased a slightly-greater-than-expected 125,000 in October (1.5% year-on-year) following a downwardly-revised 93,000 gain in September (was 135,000). The August reading was revised up by 2,000, putting net revisions at -40,000. The Action Economics Forecast Survey had anticipated a 120,000 gain. During the last three months, ADP payrolls have grown an average of 126,000 versus 99,000 in the prior three months and a 219,000 monthly average during 2018. During the last ten years there has been a 66% correlation between the change in the ADP figure and the change in nonfarm private-sector payrolls as measured by the Bureau of Labor Statistics. However, using first-reported data the ten year correlation declines to 52%.

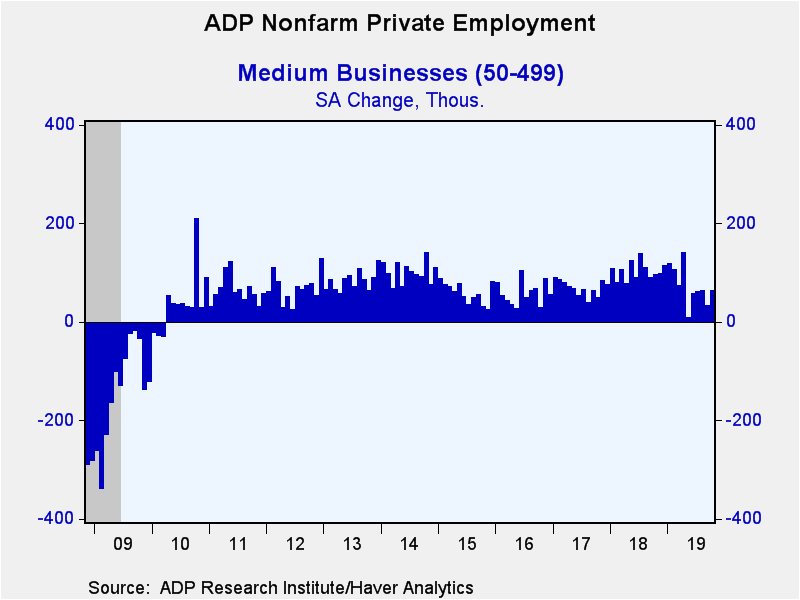

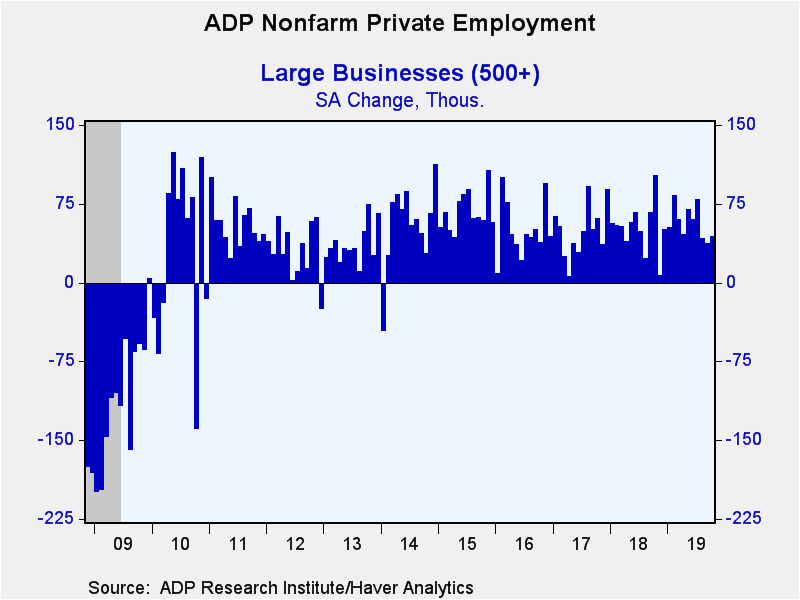

Small-sized business hiring increased 17,000 in October (0.7% y/y), medium-sized payrolls grew 64,000 (2.0% y/y) and large firm payrolls were up 44,000 (2.2% y/y).

Private service-sector payrolls increased 138,000 (1.7% y/y) driven by gains in education & health services (41,000; 2.5% y/y), trade, transportation & utilities (32,000; 0.8% y/y), leisure & hospitality (19,000; 2.0% y/y), professional & business services (18,000, 2.1% y/y), and financial activities (17,000; 1.3% y/y). The other service sectors were up by single digits.

Employment in the goods-producing sector fell 13,000 (+0.9% y/y) in October with 4,000 job declines in manufacturing, construction, and natural resource sector payrolls (+0.4%, +2.1%, -3.3% y/y respectively; monthly changes don’t add up due to rounding). The GM strike likely weighed on factory payrolls, though they were also down 3,000 in September. Lower oil prices continue to take their toll on the natural resource & mining sector as payrolls have declined for seven consecutive months.

The Automatic Data Processing Research Institute survey is based on ADP's business payroll transaction system covering 411,000 companies and nearly 24 million employees. The data are processed by Moody's Analytics Inc., then calibrated and aligned with the BLS establishment survey data. The ADP data cover private sector employment only.

The ADP National Employment Report data can be found in Haver's USECON database. Historical figures date back to 2001 for private employment and the industry breakdown, and 2005 for the business size breakout. The expectation figure is available in Haver's AS1REPNA database.

For more analysis of the track record of ADP, seeUnderstanding the Value of Point in Time and Expectations Data.

| ADP/Moody's National Employment Report | Oct | Sep | Aug | Oct Y/Y | 2018 | 2017 | 2016 |

|---|---|---|---|---|---|---|---|

| Nonfarm Private Payroll Employment (m/m chg, 000s) | 125 | 93 | 159 | 1.5 | 2.0 | 1.7 | 2.0 |

| Small Payroll (1-49) | 17 | 21 | 54 | 0.7 | 1.5 | 1.5 | 1.9 |

| Medium Payroll (50-499) | 64 | 34 | 63 | 2.0 | 2.3 | 1.8 | 1.5 |

| Large Payroll (>500) | 44 | 37 | 42 | 2.2 | 2.3 | 2.1 | 2.7 |

| Goods-Producing | -13 | -5 | 8 | 0.9 | 3.1 | 1.7 | 0.8 |

| Construction | -4 | 2 | 9 | 2.1 | 5.0 | 3.3 | 4.3 |

| Manufacturing | -4 | -3 | 4 | 0.4 | 1.8 | 0.8 | 0.1 |

| Service-Producing | 138 | 98 | 151 | 1.7 | 1.7 | 1.8 | 2.2 |

Gerald D. Cohen

AuthorMore in Author Profile »Gerald Cohen provides strategic vision and leadership of the translational economic research and policy initiatives at the Kenan Institute of Private Enterprise.

He has worked in both the public and private sectors focusing on the intersection between financial markets and economic fundamentals. He was a Senior Economist at Haver Analytics from January 2019 to February 2021. During the Obama Administration Gerald was Deputy Assistant Secretary for Macroeconomic Analysis at the U.S. Department of Treasury where he helped formulate and evaluate the impact of policy proposals on the U.S. economy. Prior to Treasury, he co-managed a global macro fund at Ziff Brothers Investments.

Gerald holds a bachelor’s of science from the Massachusetts Institute of Technology and a Ph.D. in Economics from Harvard University and is a contributing author to 30-Second Money as well as a co-author of Political Cycles and the Macroeconomy.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates