Global| May 03 2006

Global| May 03 2006U.S. Auto Sales Up, Light Truck Sales Down

by:Tom Moeller

|in:Economy in Brief

Summary

US light vehicle sales rose a slight 0.9% during April to 16.74M units according to the Autodata Corporation. The sales level matched Consensus expectations. The rough month-to-month stability of the total, however, masked divergent [...]

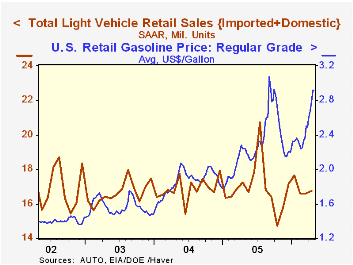

US light vehicle sales rose a slight 0.9% during April to 16.74M units according to the Autodata Corporation. The sales level matched Consensus expectations.

The rough month-to-month stability of the total, however, masked divergent underlying patterns.

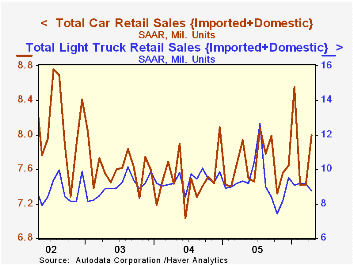

Perhaps reflecting the effects of higher fuel costs, sales of domestic trucks fell a sharp 6.6% (-9.3% y/y) and that decline pulled overall light truck sales down 4.8% (-6.1% y/y) last month. Sales of the relatively fuel efficient imported light trucks, in contrast, rose 5.6% (15.0% y/y).

Auto sales during April rose 7.8% (0.8% y/y) led by an 11.3% jump in imported car sales (12.3% y/y) to 2.58M units, the highest level since early 1990. Sales of domestic autos also improved 6.3% (-3.8% y/y).

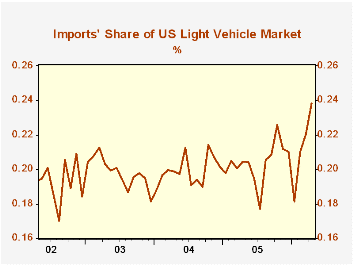

Imports' share of the US light vehicle market surged to another record level, at 23.8%. For the first four months of 2006 imports' share averaged 21.2% versus 20.3% during all of last year.

Inventories of domestically made autos fell 10.2% y/y through February while truck inventories, domestics & imports, through March were off 2.7% y/y.

Production of autos was up 14.5% through March though the GDP estimate of total real motor vehicle output through 1Q was down 2.5% y/y.

The U.S. auto supplier industry in transition from the Federal Reserve Bank of Chicago is available here.

| Light Vehicle Sales (SAAR, Mil. Units) | April | Mar | Y/Y | 2005 | 2004 | 2003 |

|---|---|---|---|---|---|---|

| Total | 16.74 | 16.59 | -2.9% | 16.92 | 16.87 | 16.63 |

| Autos | 8.00 | 7.42 | 0.8% | 7.65 | 7.49 | 7.62 |

| Trucks | 8.74 | 9.17 | -6.1% | 9.27 | 9.37 | 9.01 |

Tom Moeller

AuthorMore in Author Profile »Prior to joining Haver Analytics in 2000, Mr. Moeller worked as the Economist at Chancellor Capital Management from 1985 to 1999. There, he developed comprehensive economic forecasts and interpreted economic data for equity and fixed income portfolio managers. Also at Chancellor, Mr. Moeller worked as an equity analyst and was responsible for researching and rating companies in the economically sensitive automobile and housing industries for investment in Chancellor’s equity portfolio. Prior to joining Chancellor, Mr. Moeller was an Economist at Citibank from 1979 to 1984. He also analyzed pricing behavior in the metals industry for the Council on Wage and Price Stability in Washington, D.C. In 1999, Mr. Moeller received the award for most accurate forecast from the Forecasters' Club of New York. From 1990 to 1992 he was President of the New York Association for Business Economists. Mr. Moeller earned an M.B.A. in Finance from Fordham University, where he graduated in 1987. He holds a Bachelor of Arts in Economics from George Washington University.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates