Global| Jun 11 2014

Global| Jun 11 2014U.S. Budget Deficit Continues to Shrink

by:Tom Moeller

|in:Economy in Brief

Summary

The Federal Government posted a $130.0 billion budget deficit during May of FY 2014. The latest figure compared to expectations for a $143.9 billion deficit in the Action Economics Forecast Survey. In the first eight months of this [...]

The Federal Government posted a $130.0 billion budget deficit during

May of FY 2014. The latest figure compared to expectations for a $143.9

billion deficit in the Action Economics Forecast Survey. In the first

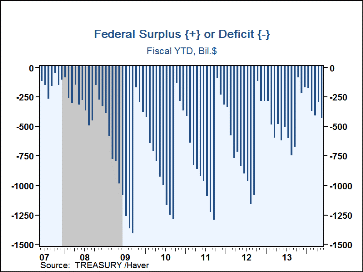

eight months of this fiscal year, the deficit totaled $436.4 billion

compared to $626.3 billion last year. It was the smallest budget deficit

during the first eight months of any fiscal year since 2008. For FY 2014,

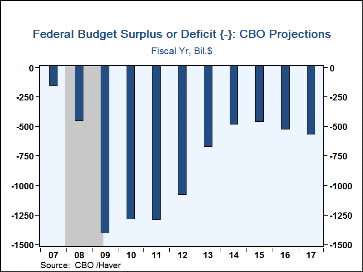

the Congressional Budget Office projects the budget deficit will total

$492 billion then $469 billion in FY 2015. Thereafter, the deficit is

forecast to increase.

The Federal Government posted a $130.0 billion budget deficit during

May of FY 2014. The latest figure compared to expectations for a $143.9

billion deficit in the Action Economics Forecast Survey. In the first

eight months of this fiscal year, the deficit totaled $436.4 billion

compared to $626.3 billion last year. It was the smallest budget deficit

during the first eight months of any fiscal year since 2008. For FY 2014,

the Congressional Budget Office projects the budget deficit will total

$492 billion then $469 billion in FY 2015. Thereafter, the deficit is

forecast to increase.

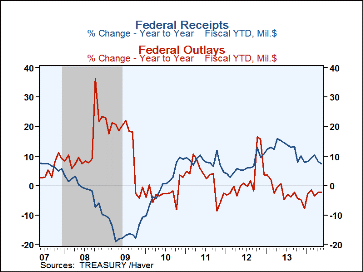

Net revenues for this fiscal year-to-date increased 7.5% y/y with the stronger economy. Corporate income taxes increased 15.6% y/y while the improved labor market raised social insurance taxes by 10.1% y/y. Individual income taxes increased a lesser 3.3% y/y but excise taxes declined 2.1% y/y.

The smaller budget deficit in FY'14 also reflects a 2.3% y/y decline in net outlays versus last year. Outlays were led lower by a 5.9% y/y reduction in defense outlays and a 3.9% y/y falloff in income security outlays. Interest payments slipped 0.2% y/y. Working the other way, veterans benefits increased 9.9% y/y and health outlays, which include health services, research & training, increased 9.6% y/y. Also to the upside, social security outlays gained 4.7% y/y and Medicare spending grew 0.8% y/y.

Haver's basic data on Federal Government outlays and receipts, and summary presentations of the Budget from both OMB and CBO are contained in USECON. Considerable detail is given in the separate GOVFIN database.

| US Government Finance | May | FY'13 | FY'12 | FY'11 | FY'10 | |

|---|---|---|---|---|---|---|

| Budget Balance | -- | $-130.0 bil. | $-680.3 bil. | $-1,089.2 bil. | $-1,296.8 bil. | $-1,294.2 bil. |

| As a percent of GDP | -- | -- | 4.1 | 6.8 | 8.4 | 8.8 |

| % of Total | YTD FY'14 | |||||

| Net Revenues (Y/Y % Change) | 100 | 7.5% | 13.3% | 6.4% | 6.5% | 2.7% |

| Individual Income Taxes | 47 | 3.3 | 16.3 | 3.7 | 21.5 | -1.8 |

| Corporate Income Taxes | 10 | 15.6 | 12.9 | 33.8 | -5.4 | 38.5 |

| Social Insurance Taxes | 34 | 10.2 | 12.1 | 3.2 | -5.3 | -2.9 |

| Excise Taxes | 3 | -2.1 | 6.3 | 9.2 | 8.2 | 7.1 |

| Net Outlays (Y/Y % Change) | 100 | -2.3 | -2.4 | -1.7 | 4.1 | -1.8 |

| National Defense | 18 | -5.9 | -6.3 | -3.9 | 1.7 | 4.6 |

| Health | 10 | 9.6 | 3.1 | -7.0 | 1.0 | 10.4 |

| Medicare | 14 | 0.8 | 5.5 | -2.8 | 7.5 | 5.0 |

| Income Security | 16 | -3.9 | -1.1 | -9.1 | -4.1 | 16.7 |

| Social Security | 24 | 4.7 | 5.2 | 5.8 | 3.4 | 3.5 |

| Veterans Benefits | 4 | 9.9 | 11.5 | -2.0 | 17.3 | 13.6 |

| Interest | 6 | -0.2 | 0.4 | -3.0 | 15.8 | 2.9 |

Tom Moeller

AuthorMore in Author Profile »Prior to joining Haver Analytics in 2000, Mr. Moeller worked as the Economist at Chancellor Capital Management from 1985 to 1999. There, he developed comprehensive economic forecasts and interpreted economic data for equity and fixed income portfolio managers. Also at Chancellor, Mr. Moeller worked as an equity analyst and was responsible for researching and rating companies in the economically sensitive automobile and housing industries for investment in Chancellor’s equity portfolio. Prior to joining Chancellor, Mr. Moeller was an Economist at Citibank from 1979 to 1984. He also analyzed pricing behavior in the metals industry for the Council on Wage and Price Stability in Washington, D.C. In 1999, Mr. Moeller received the award for most accurate forecast from the Forecasters' Club of New York. From 1990 to 1992 he was President of the New York Association for Business Economists. Mr. Moeller earned an M.B.A. in Finance from Fordham University, where he graduated in 1987. He holds a Bachelor of Arts in Economics from George Washington University.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates