Global| Apr 16 2018

Global| Apr 16 2018U.S. Business Inventories Continue to Accumulate; Sales Rebound

Summary

Total business inventories increased 0.6% (4.0% year-on-year) during February, the third consecutive monthly gain of this magnitude. Total business sales rose 0.4% (+5.8% y/y), following a 0.3% decline in January. The inventory-to- [...]

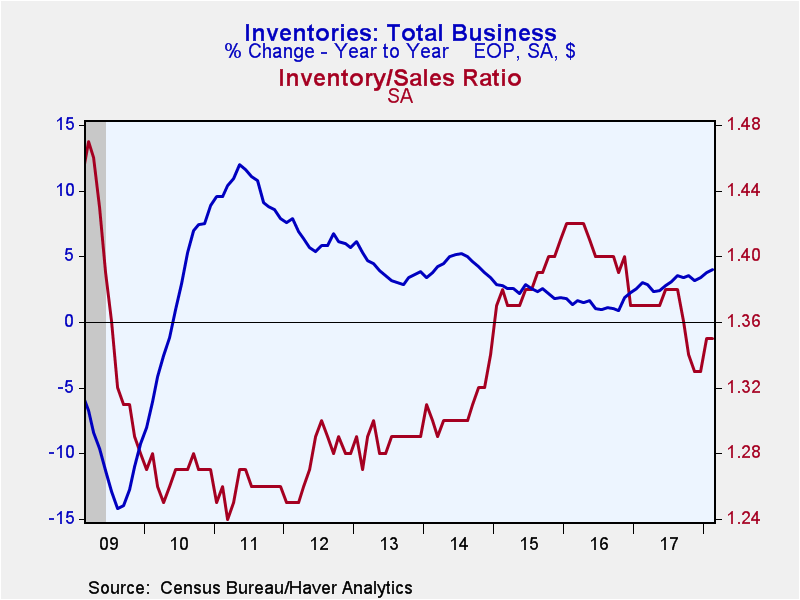

Total business inventories increased 0.6% (4.0% year-on-year) during February, the third consecutive monthly gain of this magnitude. Total business sales rose 0.4% (+5.8% y/y), following a 0.3% decline in January. The inventory-to-sales ratio was unchanged at 1.35. The inventory-to-sales ratio began to rise in 2014 peaking at 1.42 in 2016. It has fallen since then though it remains elevated relative to the 2010-to-2014 mean and median of 1.28.

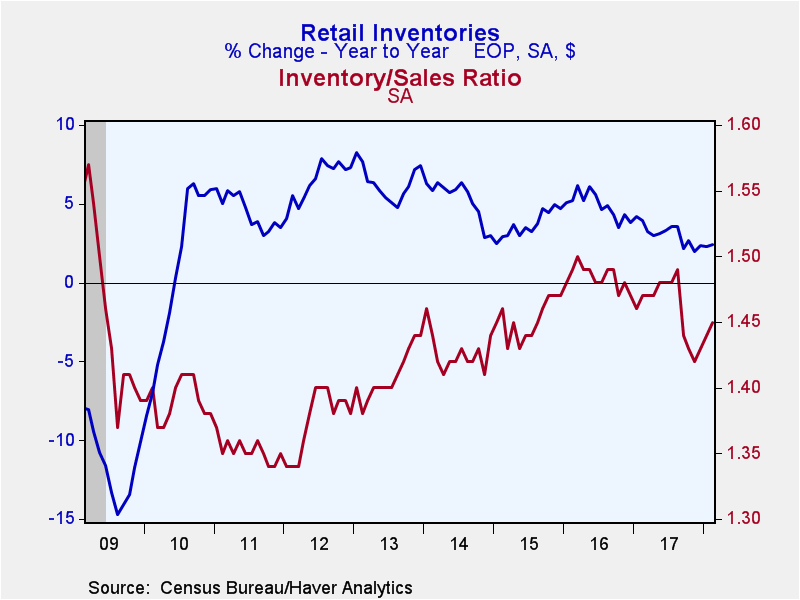

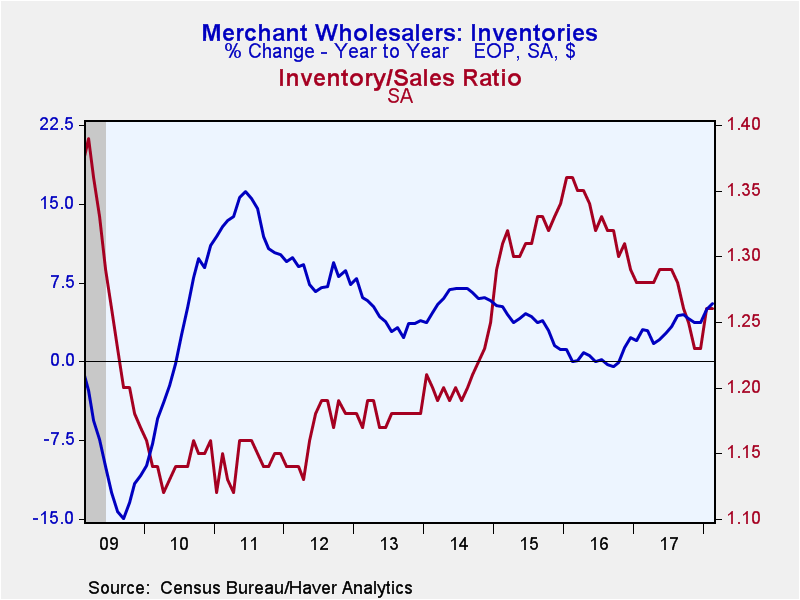

Retail inventories increased 0.4% (2.4% y/y) in February after a 0.7% rise in January. Auto inventories grew 0.9% (2.2% y/y) after a 1.7% jump. Auto inventories, which comprise 35% of retail inventories, declined late last year; thus auto inventories remain below their mid-2017 levels. Non-auto retail inventories notched 0.2% higher (2.6% y/y). General merchandise inventories, the second largest sector, rose 0.3% (+0.6% y/y) after a 0.7% increase. The troubled department store sector--a subset of general merchandise--saw inventories edge up 0.1% (-3.9% y/y). This is the third consecutive monthly gain after 11 months of decline. Building materials inventories jumped 0.9% (4.8% y/y), while clothing stores rose 0.7% (-0.2% y/y), the third consecutive monthly increase after nine months of decline. As reported last week, wholesale inventories grew 1.0% (5.5% y/y) following a 0.9% rise. Factory sector inventories rose 0.3% (4.2% y/y).

Retail sales declined 0.1% in February (+4.2% y/y) with non-auto sales up 0.2% (5.0% y/y). Note: the advanced retail sales data for March was released today showing a 0.6% gain (4.7% y/y). Wholesale sector sales rebounded 1.0% (+6.8% y/y) in February after a 1.5% drop. Shipments from the factory sector increased a 0.2% (6.1% y/y).

The inventory-to-sales (I/S) ratio in the retail sector rose to 1.45 in February, the highest level in six months. The non-auto I/S ratio held steady at 1.21 and remained near its lowest level since early-2012. The wholesale sector I/S ratio was unchanged at 1.26. The manufacturing sector the I/S ratio also held steady at 1.35, its lowest point in three years.

The manufacturing and trade data are in Haver's USECON database.

| Manufacturing & Trade | Feb | Jan | Dec | Feb Y/Y | 2017 | 2016 | 2015 |

|---|---|---|---|---|---|---|---|

| Business Inventories (% chg) | 0.6 | 0.6 | 0.6 | 4.0 | 3.4 | 2.2 | 1.8 |

| Retail | 0.4 | 0.7 | 0.3 | 2.4 | 2.4 | 3.8 | 4.7 |

| Retail excl. Motor Vehicles | 0.2 | 0.1 | 0.6 | 2.6 | 2.2 | 1.6 | 3.8 |

| Merchant Wholesalers | 1.0 | 0.9 | 0.7 | 5.5 | 3.7 | 2.3 | 1.2 |

| Manufacturing | 0.3 | 0.4 | 0.7 | 4.2 | 4.0 | 0.8 | -0.1 |

| Business Sales (% chg) | |||||||

| Total | 0.4 | -0.3 | 0.5 | 5.8 | 6.1 | -0.1 | -3.2 |

| Retail | -0.1 | -0.2 | -0.2 | 4.2 | 4.8 | 2.6 | 1.9 |

| Retail excl. Motor Vehicles | 0.2 | 0.1 | -0.2 | 5.0 | 4.8 | 2.3 | 0.4 |

| Merchant Wholesalers | 1.0 | -1.5 | 0.8 | 6.8 | 8.0 | -0.6 | -4.9 |

| Manufacturing | 0.2 | 0.7 | 0.7 | 6.1 | 5.5 | -2.0 | -5.8 |

| I/S Ratio | |||||||

| Total | 1.35 | 1.35 | 1.33 | 1.37 | 1.36 | 1.40 | 1.38 |

| Retail | 1.45 | 1.44 | 1.43 | 1.47 | 1.46 | 1.48 | 1.45 |

| Retail excl. Motor Vehicles | 1.21 | 1.21 | 1.21 | 1.24 | 1.23 | 1.27 | 1.26 |

| Merchant Wholesalers | 1.26 | 1.26 | 1.23 | 1.28 | 1.27 | 1.33 | 1.32 |

| Manufacturing | 1.35 | 1.35 | 1.35 | 1.37 | 1.37 | 1.41 | 1.39 |

Gerald D. Cohen

AuthorMore in Author Profile »Gerald Cohen provides strategic vision and leadership of the translational economic research and policy initiatives at the Kenan Institute of Private Enterprise.

He has worked in both the public and private sectors focusing on the intersection between financial markets and economic fundamentals. He was a Senior Economist at Haver Analytics from January 2019 to February 2021. During the Obama Administration Gerald was Deputy Assistant Secretary for Macroeconomic Analysis at the U.S. Department of Treasury where he helped formulate and evaluate the impact of policy proposals on the U.S. economy. Prior to Treasury, he co-managed a global macro fund at Ziff Brothers Investments.

Gerald holds a bachelor’s of science from the Massachusetts Institute of Technology and a Ph.D. in Economics from Harvard University and is a contributing author to 30-Second Money as well as a co-author of Political Cycles and the Macroeconomy.