Global| Dec 12 2008

Global| Dec 12 2008U.S. Business Inventories Decrease in October, But Sales Plunge, Leaving a Still Larger Overhang

Summary

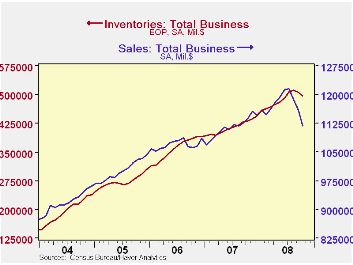

October business inventories dropped 0.6% from September. That month, in turn, was revised from a 0.2% decline to 0.4%. Total business sales -- manufacturers, wholesalers and retailers -- dropped a whopping 3.5% in October, following [...]

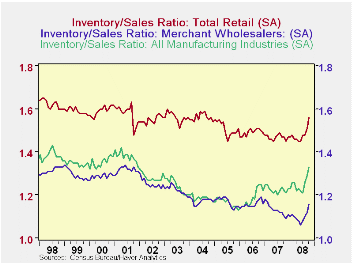

October business inventories dropped 0.6% from September. That month, in turn, was revised from a 0.2% decline to 0.4%. Total business sales -- manufacturers, wholesalers and retailers -- dropped a whopping 3.5% in October, following a 2.4% decline in September and 2.2% in August. So despite the reduction in inventories, the big drops in sales mean that the inventory/sales ratio increased to 1.34 in October from 1.30 and 1.27 in September and August, respectively. While 1.34 is not high by historical standards -- it was in fact always higher that than prior to mid-2003 -- the two successive monthly increases in the ratio indicate the worst deterioration in the aggregate inventory position since the midst of the 1981-82 recession.

Manufacturers' stocks fell 0.6% in October and the previous month was revised down slightly, making a 0.8% drop instead of 0.7% reported initially. The combined decline of 1.4% basically reverses the 1.2% increase of the prior two months.

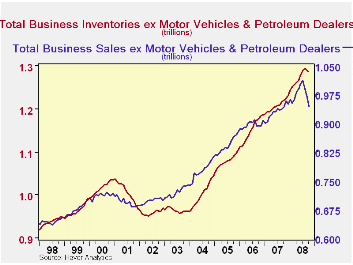

Inventories at wholesalers plunged 1.1% in the latest month, following 0.4% the month before, also producing a 1.4% drop over the two months. As Tom Moeller pointed out here a month ago, these moves have been heavily influenced by falling petroleum prices, as "tank farms" are included among the rolls of wholesalers. However, large as these price declines have been, they didn't account for the entire decline in wholesale inventories, which otherwise was still 0.4% in October and 0.3% in September.

At retailers, stocks edged down just 0.1%, following a 0.2% increase in September and a 0.7% decline in August. Here, of course, it's the motor vehicle sector that pushes things around the most. But recent anecdotes about dealers running out of parking lot for all of their unsold merchandise, even if true on a broad scale, are too recent to be covered in these data. In this report, inventories show little change, down 0.4% in September and just 0.1% in October. Among other retailers, inventories rose 0.4% in September but then also declined 0.1% in October. The weaker October sales meant that the inventory/sales ratio rose, though, to 1.32 from 1.28 in September, the largest month-to-month increase since December 1991.

Since petroleum prices are so important at this time, we made some calculations subtracting sales of petroleum products from wholesale and retail sectors and also netting out the relevant inventories. We're disappointed to see that the resulting sales figure is still down 2.5%, even as inventories fall just 0.4% for October. So the I/S ratio still rises sharply, to 1.36 months from 1.33 in September and 1.27 back in July. Possibly lower interest rates will help businesses finance these inventory positions, cushioning the blow to production that such an increase in the overhang might portend. But one thing we have learned in recent months is that it's best not to draw a firm conclusion on this.

| Business Inventories | Oct | Sept | August | Y/Y | 2007 | 2006 | 2005 |

|---|---|---|---|---|---|---|---|

| Total | -0.6% | -0.4% | 0.2% | 4.6% | 3.8% | 5.9% | 6.0% |

| Retail | -0.1% | 0.2% | -0.7% | 0.1% | 2.6% | 3.5% | 2.3% |

| Retail excl. Auto | -0.1% | 0.4% | -0.2% | 1.3% | 2.7% | 4.9% | 3.9% |

| Wholesale | -1.1% | -0.1% | 0.6% | 8.0% | 5.5% | 8.3% | 7.3% |

| Manufacturing | -0.6% | -0.8% | 0.7% | 6.2% | 3.7% | 6.4% | 8.9% |

Carol Stone, CBE

AuthorMore in Author Profile »Carol Stone, CBE came to Haver Analytics in 2003 following more than 35 years as a financial market economist at major Wall Street financial institutions, most especially Merrill Lynch and Nomura Securities. She has broad experience in analysis and forecasting of flow-of-funds accounts, the federal budget and Federal Reserve operations. At Nomura Securites, among other duties, she developed various indicator forecasting tools and edited a daily global publication produced in London and New York for readers in Tokyo. At Haver Analytics, Carol is a member of the Research Department, aiding database managers with research and documentation efforts, as well as posting commentary on select economic reports. In addition, she conducts Ways-of-the-World, a blog on economic issues for an Episcopal-Church-affiliated website, The Geranium Farm. During her career, Carol served as an officer of the Money Marketeers and the Downtown Economists Club. She has a PhD from NYU's Stern School of Business. She lives in Brooklyn, New York, and has a weekend home on Long Island.