Global| Mar 11 2011

Global| Mar 11 2011U.S. Business Inventories Grow Even as I/S Ratios Hover at Record Lows

Summary

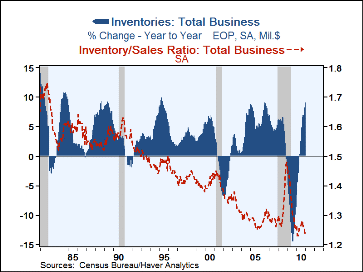

Business inventories grew further in January, according to U.S. Census Bureau data. The January gain was 0.9% and December was revised from 0.8% to 1.1%. Over the last three months, total inventories have expanded at a 10.1% [...]

Business inventories grew further in January, according to U.S. Census Bureau data. The January gain was 0.9% and December was revised from 0.8% to 1.1%. Over the last three months, total inventories have expanded at a 10.1% annualized rate. This performance is impressive as it accompanies also decent growth in total business sales, which grew at a 22.3% annual rate over the last three months. The resulting inventory/sales ratio is thus still low: 1.23, down from 1.25 in December and tied with last March and April 2010 at the lowest level on record; these data begin in December 1980.

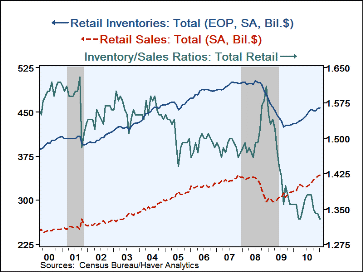

The major sectors of the distribution chain all participated in both the good January growth and the upward revision to already decent December increases, as we highlight in our table at bottom here. Retail stocks grew 0.4% in January, a bit less than December's 0.6%, although that figure was revised from 0.4% reported initially. The resulting inventory/sales ratio was 1.33, also tied as the lowest ratio on record. Excluding motor vehicle dealers, January inventories also grew 0.4%; stocks in the motor vehicle sector turned up by 0.1% following three months of declines. For the entire sector, the inventory/sales ratio (I/S) was 1.33, tied for an all-time low. The ratio for motor vehicles stocks was 1.83, a level within the recent range, and well above historic lows, which prevailed back in the 1970s and 1980s. The subtotal excluding motor vehicles is then quite low, at 1.20 in January; this compares to pre-recession levels that averaged about 1.33. The differing patterns of these ratios suggest differing practices in retailing, relative to both historical experience and relative to various types of stores and non-stores. Most non-auto retailers seem to keep very slim inventories compared with history, but car dealers now have much larger stocks.

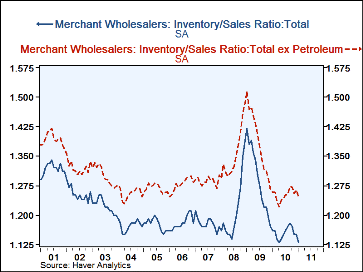

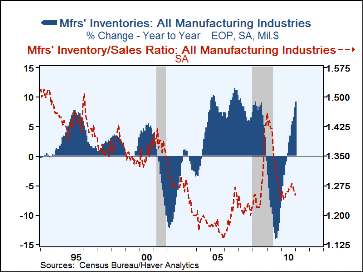

In the wholesale sector, inventories rose 1.1% in December, just a bit smaller than the upward revised 1.3% in December and stronger than the original December 1.0%. Petroleum stocks are a big input here, and with rising prices, those inventories grew by 3.5% in January. But other wholesale stocks were hardly weak; they rose 1.0%, following 1.3% in December and stand 11.8% above a year ago. In the factory sector, inventories advanced 1.3%, up from December's upwardly revised 1.4% gain. The inventory/sales ratio in this sector is 1.25, not at all near record lows, but a third month of retreat after a build-up last summer and autumn. Throughout the manufacturing and distribution channels, the prevalence of inventory growth and low inventory/sales ratios depicts deliberate efforts at inventory building, a welcome development after the massive recession-driving contraction from late 2008 until well into 2010.

The business sales and inventory data are available in Haver's USECON database. Note that in a value-added feature, the database includes series calculated by Haver database managers showing sales, inventories and I/S ratios for total business less motor vehicle dealers and related wholesale operations.

| Business Inventories (%) | Jan | Dec(r) | Dec | Nov | Jan Y/Y | 2010 | 2009 | 2008 |

|---|---|---|---|---|---|---|---|---|

| Total | 0.9 | 1.1 | 0.8 | 0.4 | 9.1 | 8.0 | -9.9 | 0.8 |

| Retail | 0.4 | 0.6 | 0.4 | 0.0 | 6.3 | 5.9 | -10.4 | -3.3 |

| Retail ex Motor Vehicles | 0.4 | 1.0 | 0.7 | 0.4 | 4.2 | 3.3 | -4.8 | -1.9 |

| Wholesale | 1.1 | 1.3 | 1.0 | -0.0 | 11.9 | 10.5 | -10.8 | 3.7 |

| Manufacturing | 1.3 | 1.4 | 1.1 | 0.9 | 9.4 | 7.9 | -8.8 | -0.8 |

Carol Stone, CBE

AuthorMore in Author Profile »Carol Stone, CBE came to Haver Analytics in 2003 following more than 35 years as a financial market economist at major Wall Street financial institutions, most especially Merrill Lynch and Nomura Securities. She has broad experience in analysis and forecasting of flow-of-funds accounts, the federal budget and Federal Reserve operations. At Nomura Securites, among other duties, she developed various indicator forecasting tools and edited a daily global publication produced in London and New York for readers in Tokyo. At Haver Analytics, Carol is a member of the Research Department, aiding database managers with research and documentation efforts, as well as posting commentary on select economic reports. In addition, she conducts Ways-of-the-World, a blog on economic issues for an Episcopal-Church-affiliated website, The Geranium Farm. During her career, Carol served as an officer of the Money Marketeers and the Downtown Economists Club. She has a PhD from NYU's Stern School of Business. She lives in Brooklyn, New York, and has a weekend home on Long Island.