Global| Oct 15 2014

Global| Oct 15 2014U.S. Business Inventories Have Smaller Increase, While Sales Back Off in August

Summary

Total business inventories rose 0.2% in August (5.7% y/y) after an unrevised 0.4% rise in July. Total sales, though, fell 0.4% in August (4.5% y/y) following 0.7% in July, which was revised slightly from 0.8% reported initially. The [...]

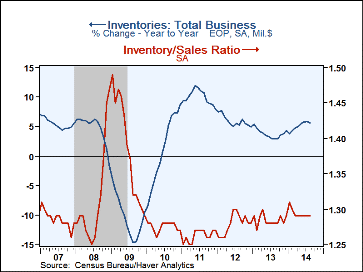

Total business inventories rose 0.2% in August (5.7% y/y) after an unrevised 0.4% rise in July. Total sales, though, fell 0.4% in August (4.5% y/y) following 0.7% in July, which was revised slightly from 0.8% reported initially. The resulting inventory/sales ratio remained at 1.29 for a sixth consecutive month.

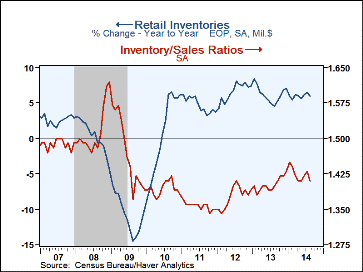

By sector, retail inventories declined 0.3% in August (+5.9% y/y) after growing 0.9% in July. Motor vehicle & parts dealers' stocks largely accounted for the August fall as they shrank 0.7% (+12.0% y/y) following a 2.2% jump in July. Nonauto inventories were virtually unchanged, -0.03% (3.1% y/y), after a 0.3% increase in July. Building materials inventories rose 0.4% (2.8% y/y) after 0.6% in July. General merchandise store inventories edged up 0.1% (2.9% y/y) after a 0.3% rise in July. Food & beverage store inventories were up 0.2%, the same as July (3.1% y/y). Furniture & home furnishings inventories fell 0.3% (5.8% y/y) after 0.1% in July. Clothing stores inventories also fell, by 0.7% (+1.3% y/y) after a 0.2% decline in July.

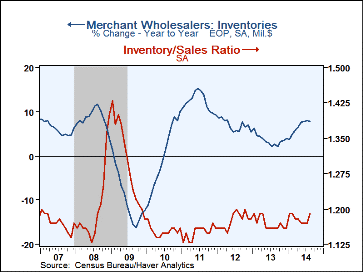

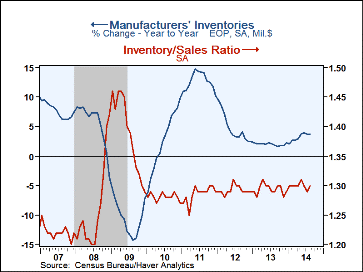

In the manufacturing sector, inventories were up 0.1% in August (3.7% y/y) and July was revised slightly from a 0.1% rise to unchanged. Durable goods stocks rose 0.4% for a third straight month (6.3% y/y) while nondurable goods were off 0.3% (also -0.3% y/y) following a 0.7% fall in July. In contrast, wholesalers' inventories rose 0.7% (7.9% y/y) after 0.3% in July. Those durable goods stocks were up 0.8% in August (8.5% y/y) and nondurable goods stocks were up 0.5% (6.9% y/y).

The August decline in business sales hit manufacturers, down 1.0% (+3.1% y/y) reversing July's 1.4% gain. Wholesalers' sales were also down, by 0.7% (+5.8% y/y) following a 0.4% increase in each June and July. Retail sales gained 0.6% in August (4.8% y/y) and as noted elsewhere on Haver.com, they gave part of that back in September.

While the overall inventory-to-sales ratio remained at 1.29 in August for a sixth straight month, there was some mix by sector. Retailers' I/S ratio fell from 1.43 in July to 1.41, but wholesalers' ratio rose to 1.19 from 1.17 and that at manufacturers ticked up to 1.30 from 1.29.

The manufacturing and trade data are in Haver's USECON database.

| Manufacturing & Trade (%) | Aug | Jul | Jun | Aug Y/Y | 2013 | 2012 | 2011 |

|---|---|---|---|---|---|---|---|

| Business Inventories | 0.2 | 0.4 | 0.4 | 5.7 | 4.3 | 4.9 | 7.9 |

| Retail | -0.3 | 0.9 | 0.7 | 5.9 | 7.1 | 7.4 | 3.7 |

| Retail excl. Motor Vehicles | 0.0 | 0.3 | 0.3 | 3.1 | 3.8 | 3.2 | 3.5 |

| Merchant Wholesalers | 0.7 | 0.3 | 0.2 | 7.9 | 4.0 | 5.5 | 9.2 |

| Manufacturing | 0.1 | 0.0 | 0.2 | 3.7 | 2.3 | 2.4 | 10.2 |

| Business Sales (%) | |||||||

| Total | -0.4 | 0.7 | 0.6 | 4.5 | 3.4 | 4.5 | 10.9 |

| Retail | 0.6 | 0.2 | 0.4 | 4.8 | 4.3 | 5.0 | 7.7 |

| Retail excl. Motor Vehicles | 0.2 | 0.1 | 0.5 | 3.4 | 3.0 | 4.0 | 7.1 |

| Merchant Wholesalers | -0.7 | 0.4 | 0.4 | 5.8 | 4.3 | 4.8 | 12.4 |

| Manufacturing | -1.0 | 1.4 | 0.8 | 3.1 | 2.0 | 4.0 | 12.1 |

| I/S Ratio | |||||||

| Total | 1.29 | 1.29 | 1.29 | 1.28 | 1.28 | 1.28 | 1.26 |

| Retail | 1.41 | 1.43 | 1.42 | 1.40 | 1.40 | 1.38 | 1.36 |

| Retail Excl. Motor Vehicles | 1.22 | 1.22 | 1.22 | 1.22 | 1.22 | 1.21 | 1.23 |

| Merchant Wholesalers | 1.19 | 1.17 | 1.17 | 1.16 | 1.17 | 1.18 | 1.15 |

| Manufacturing | 1.30 | 1.29 | 1.30 | 1.29 | 1.29 | 1.29 | 1.29 |

Carol Stone, CBE

AuthorMore in Author Profile »Carol Stone, CBE came to Haver Analytics in 2003 following more than 35 years as a financial market economist at major Wall Street financial institutions, most especially Merrill Lynch and Nomura Securities. She has broad experience in analysis and forecasting of flow-of-funds accounts, the federal budget and Federal Reserve operations. At Nomura Securites, among other duties, she developed various indicator forecasting tools and edited a daily global publication produced in London and New York for readers in Tokyo. At Haver Analytics, Carol is a member of the Research Department, aiding database managers with research and documentation efforts, as well as posting commentary on select economic reports. In addition, she conducts Ways-of-the-World, a blog on economic issues for an Episcopal-Church-affiliated website, The Geranium Farm. During her career, Carol served as an officer of the Money Marketeers and the Downtown Economists Club. She has a PhD from NYU's Stern School of Business. She lives in Brooklyn, New York, and has a weekend home on Long Island.