Global| Jan 14 2010

Global| Jan 14 2010U.S. Business Inventories Show a Second Monthly Gain

Summary

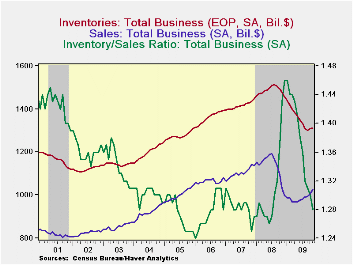

Business inventories grew again in November, expanding for a second month by 0.4%. These two gains followed 13 consecutive monthly declines. As in October, the November increase occurred at wholesalers and manufacturers; retailers [...]

Business

inventories grew again in November, expanding for a second month by

0.4%. These two gains followed 13 consecutive monthly

declines. As in October, the November increase occurred at

wholesalers and manufacturers; retailers apart from motor vehicle

dealers continued to reduce their stocks of merchandise.

Business sales also grew in November and the resulting inventory/sales

ratio fell to 1.28 from 1.30 in October.

Business

inventories grew again in November, expanding for a second month by

0.4%. These two gains followed 13 consecutive monthly

declines. As in October, the November increase occurred at

wholesalers and manufacturers; retailers apart from motor vehicle

dealers continued to reduce their stocks of merchandise.

Business sales also grew in November and the resulting inventory/sales

ratio fell to 1.28 from 1.30 in October.

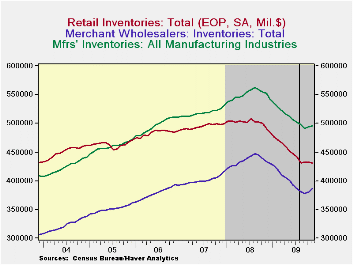

The manufacturing and wholesale inventories gains were, as in October, largest for petroleum and also food and farm products. We presume these are mostly price-driven. In both sectors, there were also some buildup in stocks of computer equipment and scattered increases in various metals industries.

Total retail inventories resumed downward movement in November after being flat in October. Cuts were widespread in the nonautomotive segments, especially including furniture, building materials, clothing and general merchandise. Auto dealer inventories edged up, but just 0.1%, after a 0.6% rise in October, and food stores saw marginal increases both months.

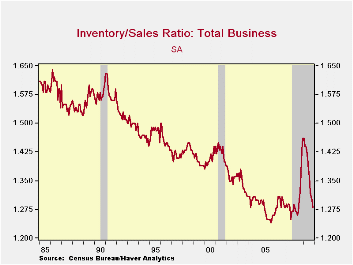

Retailers' inventory/sales ratio fell to 1.37 from 1.40 in October and 1.60 a year earlier. Wholesalers' sales surged 3.3% in November, pushing their I/S ratio down to 1.14 from 1.17 the month before. And manufacturers' shipments were up 1.0% in November, so that their I/S ratio decreased to 1.32 from 1.34 in October. As indicated in the graph, these stock adjustments bring the relationship of stocks to sales back to the general range that was prevailing in the months before the economy's mid-2008 collapse. With such tight inventory control techniques now in wide use, it's hard to know whether the low inventory positions are so undesirably "low" compared to sales by now that stronger production schedules are guaranteed, but at least the necessary corrections do seem to have been accomplished.

The business sales and inventory data are available in Haver's USECON database.

| Business Inventories (%) | November | October | September | Y/Y | 2008 | 2007 | 2006 |

|---|---|---|---|---|---|---|---|

| Total | 0.4 | 0.4 | -0.5 | -11.1 | 0.6 | 4.0 | 6.4 |

| Retail | -0.2 | 0.0 | 0.5 | -12.0 | -3.1 | 2.5 | 3.3 |

| Retail excl. Auto | -0.4 | -0.2 | -0.7 | -6.6 | -1.8 | 2.7 | 4.7 |

| Wholesale | 1.5 | 0.6 | -0.8 | -11.0 | 3.1 | 6.2 | 8.2 |

| Manufacturing | 0.2 | 0.6 | -1.3 | -10.3 | 2.1 | 3.7 | 8.2 |

Carol Stone, CBE

AuthorMore in Author Profile »Carol Stone, CBE came to Haver Analytics in 2003 following more than 35 years as a financial market economist at major Wall Street financial institutions, most especially Merrill Lynch and Nomura Securities. She had broad experience in analysis and forecasting of flow-of-funds accounts, the federal budget and Federal Reserve operations. At Nomura Securities, among other duties, she developed various indicator forecasting tools and edited a daily global publication produced in London and New York for readers in Tokyo. At Haver Analytics, Carol was a member of the Research Department, aiding database managers with research and documentation efforts, as well as posting commentary on select economic reports. In addition, she conducted Ways-of-the-World, a blog on economic issues for an Episcopal-Church-affiliated website, The Geranium Farm. During her career, Carol served as an officer of the Money Marketeers and the Downtown Economists Club. She had a PhD from NYU's Stern School of Business. She lived in Brooklyn, New York, and had a weekend home on Long Island.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates