Global| Aug 13 2009

Global| Aug 13 2009U.S. Business Inventories Still Being Cut Sharply through June

Summary

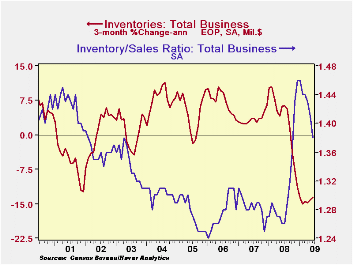

Business inventories have continued to fall sharply through June, and at all three levels of distribution, manufacturing, wholesale and retail. Total inventories were off 1.1% in June alone, following 1.2% in May and 1.3% in April. [...]

Business inventories have continued to fall sharply through June, and at all three levels of distribution, manufacturing, wholesale and retail. Total inventories were off 1.1% in June alone, following 1.2% in May and 1.3% in April. The level at end-June was down an amazing 9.8% from a year ago. Factory stocks were off 0.8% in the month and 8.5% from June 2008, wholesale was down 1.7% in June and 10.3% on the year and retail 1.1% in June and 10.8% from June 2008.

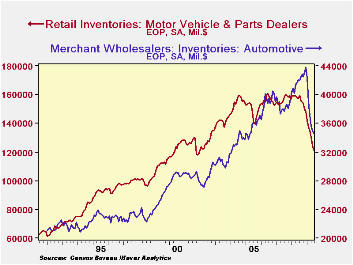

No small part of this shrinkage is in the auto industry alone. Wholesale and retail motor vehicle and parts stocks together were down 2.4% in June and 21.9% from June 2008. Apart from auto dealers, retail inventories are down on the year by "only" 5.2% and total business stocks by 7.9%.

There is a distinctly encouraging note in this report on business inventories and sales for June. Sales rose. They were up 0.9% from May, the first month-on-month increase since July 2008. All three sectors participated in the gain, and total sales excluding the auto industry rose 0.8%. The sales improvement helped bring the inventory/sales ratio down to 1.38 from 1.41 in May, the lowest since last October. The auto industry has contributed to this swing too, but in June, the I/S ratio for non-auto industries fell to 1.33 from 1.35 and was also the lowest figure since October.

Today's accompanying data on retail sales for July remind us that the sales picture remains fragile, though [see Tom Moeller's summary of that], so it's clearly premature to conclude that anything fundamental has shifted in the total sales and inventory picture. But at least this one month looks better, and getting the I/S ratios down more puts the economy another step closer to recovery.

The business sales and inventory data are available in Haver's USECON database.

| Business Inventories (%) | June | May | April | Y/Y | 2008 | 2007 | 2006 |

|---|---|---|---|---|---|---|---|

| Total | -1.1 | -1.2 | -1.3 | -9.8 | 0.6 | 4.0 | 6.4 |

| Retail | -1.0 | -1.7 | -1.4 | -10.8 | -3.1 | 2.5 | 3.3 |

| Retail excl. Auto | -0.3 | -0.7 | -0.7 | -5.2 | -1.8 | 2.7 | 4.7 |

| Wholesale | -1.7 | -1.2 | -1.3 | -10.3 | 3.1 | 6.2 | 8.2 |

| Manufacturing | -0.8 | -0.8 | -1.2 | -8.5 | 2.1 | 3.7 | 8.2 |

Carol Stone, CBE

AuthorMore in Author Profile »Carol Stone, CBE came to Haver Analytics in 2003 following more than 35 years as a financial market economist at major Wall Street financial institutions, most especially Merrill Lynch and Nomura Securities. She had broad experience in analysis and forecasting of flow-of-funds accounts, the federal budget and Federal Reserve operations. At Nomura Securities, among other duties, she developed various indicator forecasting tools and edited a daily global publication produced in London and New York for readers in Tokyo. At Haver Analytics, Carol was a member of the Research Department, aiding database managers with research and documentation efforts, as well as posting commentary on select economic reports. In addition, she conducted Ways-of-the-World, a blog on economic issues for an Episcopal-Church-affiliated website, The Geranium Farm. During her career, Carol served as an officer of the Money Marketeers and the Downtown Economists Club. She had a PhD from NYU's Stern School of Business. She lived in Brooklyn, New York, and had a weekend home on Long Island.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates