Global| Dec 11 2014

Global| Dec 11 2014U.S. Business Inventory Growth Eases in October Despite a Downtick in Sales

Summary

Total business inventories rose 0.2% in October (4.8% y/y) after September's 0.3% increase, which was unrevised. Total business sales edged down 0.1% (+3.4% y/y) following their flat performance in September and August's 0.5% decline. [...]

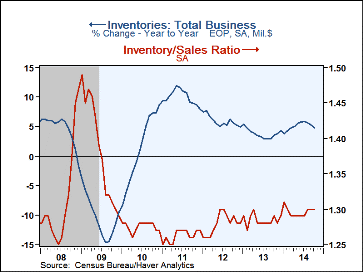

Total business inventories rose 0.2% in October (4.8% y/y) after September's 0.3% increase, which was unrevised. Total business sales edged down 0.1% (+3.4% y/y) following their flat performance in September and August's 0.5% decline. The resulting inventory/sales ratio for October remained at 1.30 for a third consecutive month.

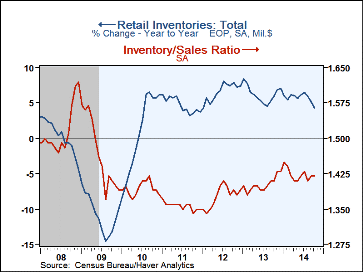

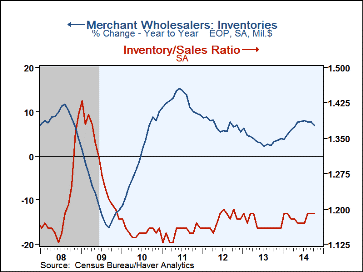

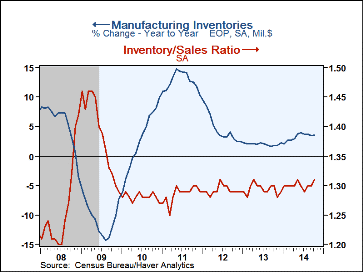

By sector, retail inventories were up 0.2% (4.8% y/y) in October after a similar 0.2% in September, revised from 0.3%. Motor vehicle & parts dealers' inventories were flat (+6.8% y/y), following a 0.3% rise. Retail inventories excluding motor vehicles rose 0.3% (3.1% y/y) after a 0.2% increase in September. Among those retailers, building materials inventories rose 0.7% (4.2% y/y) in October, as did those at clothing stores (3.1% y/y). Stocks at food stores were up 0.5% (3.5% y/y). Inventories decreased at furniture stores by 0.7% (+2.2% y/y) and at general merchandise stores, by 0.5% (+1.2% y/y). Wholesale inventories gained 0.4% (6.8% y/y) while manufacturers' inventories edged up 0.1% (3.5% y/y).

Total business sales, as noted, eased by 0.1% in October (+3.4% y/y) after September's unchanged amount. The October total consisted of a 0.4% gain at retailers (4.1% y/y), after their 0.4% drop the month before, and a 0.2% rise at wholesalers (4.3% y/y), which came after no change in September. These sales increases in October were thus more than offset by a decline in manufacturers' shipments, 0.8% (+2.2% y/y), which followed a modest 0.1% increase in September.

The total business inventory-to-sales ratio remained at 1.30 m/m. This consisted of unchanged ratios at retailers, 1.42, and wholesalers, 1.19. Manufacturers' I/S ratio ticked up to 1.31 in October from 1.30, reflecting their shipments decline.

The manufacturing and trade data are in Haver's USECON database.

| Manufacturing & Trade (%) | Oct | Sep | Aug | Oct Y/Y | 2013 | 2012 | 2011 |

|---|---|---|---|---|---|---|---|

| Business Inventories | 0.2 | 0.3 | 0.1 | 4.8 | 4.3 | 4.9 | 7.9 |

| Retail | 0.2 | 0.2 | -0.2 | 4.3 | 7.1 | 7.4 | 3.7 |

| Retail excl. Motor Vehicles | 0.3 | 0.2 | 0.0 | 3.1 | 3.8 | 3.2 | 3.5 |

| Merchant Wholesalers | 0.4 | 0.4 | 0.6 | 6.8 | 4.0 | 5.5 | 9.2 |

| Manufacturing | 0.1 | 0.2 | 0.1 | 3.5 | 2.3 | 2.4 | 10.2 |

| Business Sales (%) | |||||||

| Total | -0.1 | 0.0 | -0.5 | 3.4 | 3.4 | 4.5 | 10.9 |

| Retail | 0.4 | -0.4 | 0.6 | 4.1 | 4.3 | 5.0 | 7.7 |

| Retail excl. Motor Vehicles | 0.3 | -0.1 | 0.2 | 2.9 | 3.0 | 4.0 | 7.1 |

| Merchant Wholesalers | 0.2 | 0.0 | -0.8 | 4.3 | 4.3 | 4.8 | 12.4 |

| Manufacturing | -0.8 | 0.1 | -1.1 | 2.2 | 2.0 | 4.0 | 12.1 |

| I/S Ratio | |||||||

| Total | 1.30 | 1.30 | 1.30 | 1.29 | 1.28 | 1.28 | 1.26 |

| Retail | 1.42 | 1.41 | 1.41 | 1.41 | 1.40 | 1.38 | 1.36 |

| Retail Excl. Motor Vehicles | 1.22 | 1.22 | 1.22 | 1.22 | 1.22 | 1.21 | 1.23 |

| Merchant Wholesalers | 1.19 | 1.19 | 1.19 | 1.16 | 1.17 | 1.18 | 1.15 |

| Manufacturing | 1.31 | 1.30 | 1.30 | 1.30 | 1.29 | 1.29 | 1.29 |

Carol Stone, CBE

AuthorMore in Author Profile »Carol Stone, CBE came to Haver Analytics in 2003 following more than 35 years as a financial market economist at major Wall Street financial institutions, most especially Merrill Lynch and Nomura Securities. She had broad experience in analysis and forecasting of flow-of-funds accounts, the federal budget and Federal Reserve operations. At Nomura Securities, among other duties, she developed various indicator forecasting tools and edited a daily global publication produced in London and New York for readers in Tokyo. At Haver Analytics, Carol was a member of the Research Department, aiding database managers with research and documentation efforts, as well as posting commentary on select economic reports. In addition, she conducted Ways-of-the-World, a blog on economic issues for an Episcopal-Church-affiliated website, The Geranium Farm. During her career, Carol served as an officer of the Money Marketeers and the Downtown Economists Club. She had a PhD from NYU's Stern School of Business. She lived in Brooklyn, New York, and had a weekend home on Long Island.