Global| Sep 16 2020

Global| Sep 16 2020U.S. Business Inventory Slide Halted in July

Summary

• Business inventories edged up 0.1% in July after six consecutive monthly declines. • Sales jump 3.2%, but still 1.9% below January peak. • Inventory-to-Sales ratio falls to six-year low. Total business inventories ticked up 0.1% in [...]

• Business inventories edged up 0.1% in July after six consecutive monthly declines.

• Sales jump 3.2%, but still 1.9% below January peak.

• Inventory-to-Sales ratio falls to six-year low.

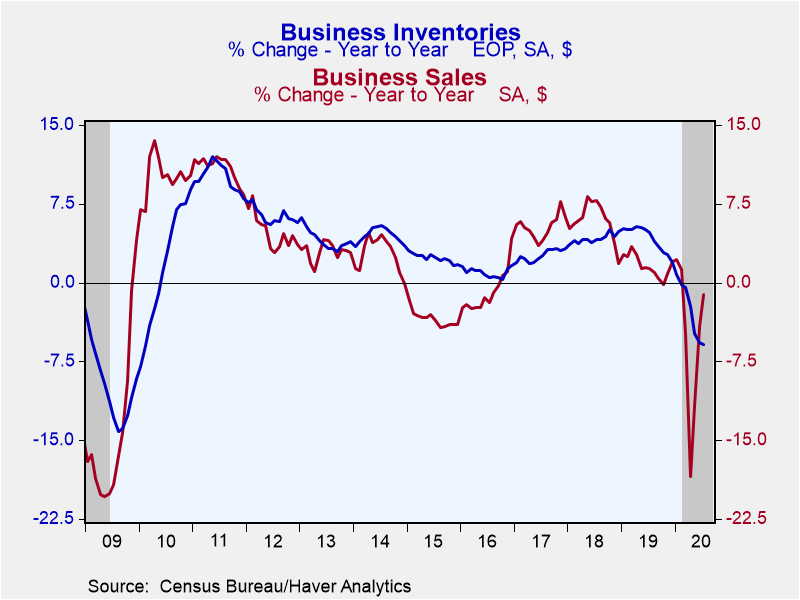

Total business inventories ticked up 0.1% in July (-5.9% year-on-year) after falling an unrevised 1.1% in June. This is the first increase in seven months. Total business sales gained 3.2% (-1.2% y/y) following an 8.6% jump in June. This leaves sales 1.9% below their January peak. The inventory-to-sales (I/S) ratio fell to 1.33, a six-year low; in April the I/S ratio hit a 27-year high of 1.67. Manufacturing output as well as imports -- neither of which are reported in this release -- drive a wedge between inventories and sales. Factory production was up 3.9% in July, while goods imports jumped 12.3%.

Business inventory swings can have a meaningful impact on GDP. While inventories subtracted 3.46 percentage point to GDP growth in the second quarter, this was overwhelmed by shifts in the final sales components such as consumption and investment. We expect a similar situation in the third quarter.

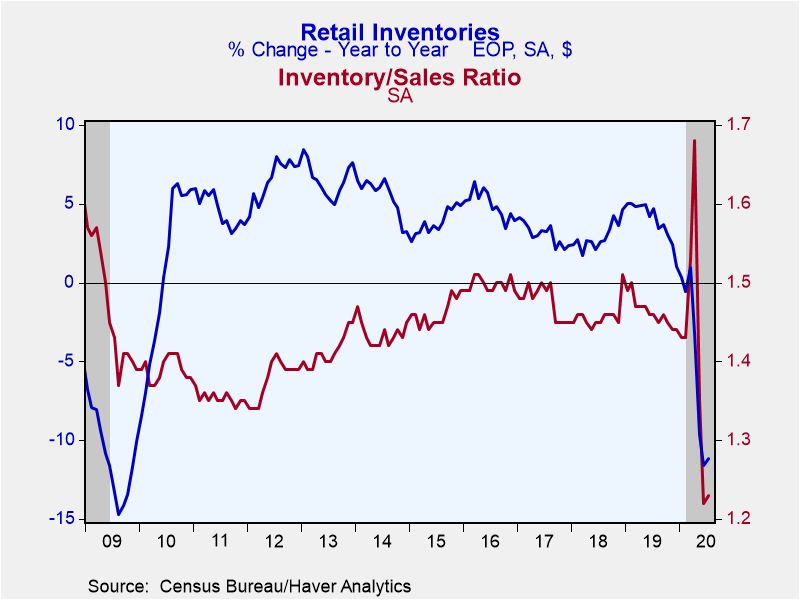

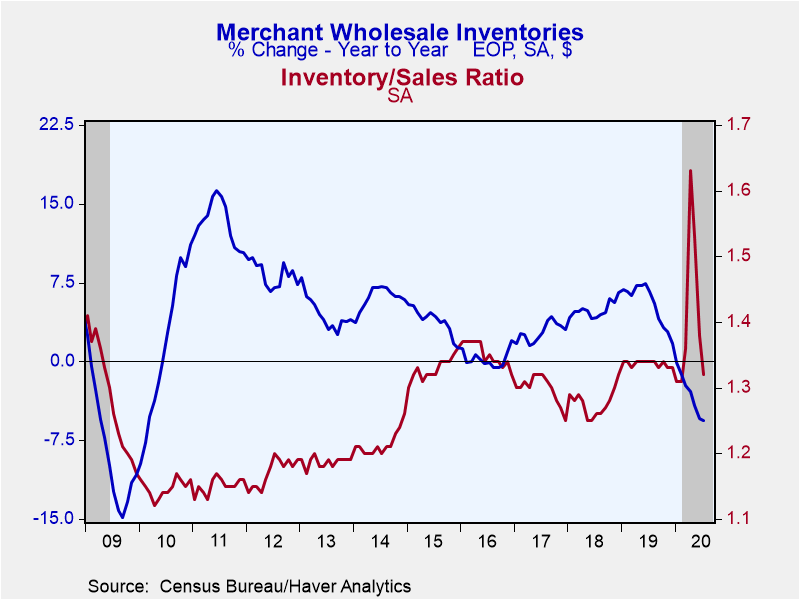

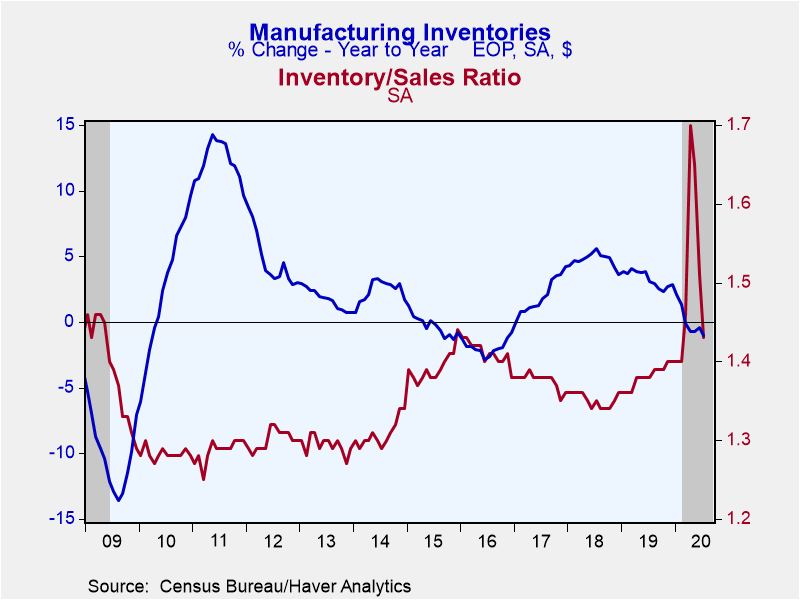

Retail inventories increased 1.2% in July (-11.2% y/y). Auto inventories, which comprise roughly 30% of retail inventories, grew 2.7% (-25.2% y/y). Non-auto retail inventories gained 0.6% (-3.4% y/y). General merchandise inventories, the second largest retail sector was up 1.9% (-6.5% y/y). The troubled department store sector -- a subset of general merchandise -- saw inventories decrease 0.9% (-17.5% y/y). Wholesale and factory sector inventories declined 0.3% and 0.5% respectively (-5.6% and -1.0% y/y).

After a very strong May and June, retail sales growth slowed in the summer. Retail sales increased a downwardly-revised 0.5% in July (was 0.8%) and 5.5% y/y, with non-auto sales growing 1.0% (5.3% y/y). Note: the advanced retail sales data for August was released today showing a 0.1% gain (5.1% y/y). Wholesale sector sales and shipments from the factories both grew 4.6% in July (-4.0% and -4.4% y/y respectively).

The inventory-to-sales ratio in the retail sector edged up to 1.23 from last month's record low of 1.22 (data goes back to 1967). In April the retail I/S ratio hit a 26-year high of 1.68. The non-auto I/S ratio was unchanged at its record low of 1.12. The wholesale and factory sector I/S ratios declined to the more typical levels of 1.32 and 1.43 respectively.

The manufacturing and trade, industrial production and international trade data are in Haver's USECON database. Detailed industrial production data can be found in the IP database.

| Manufacturing & Trade | Jul | Jun | May | Jul Y/Y | 2019 | 2018 | 2017 |

|---|---|---|---|---|---|---|---|

| Business Inventories (% chg) | 0.1 | -1.1 | -2.3 | -5.9 | 1.9 | 4.9 | 3.2 |

| Retail | 1.2 | -2.7 | -6.2 | -11.2 | 1.0 | 4.6 | 2.4 |

| Retail excl. Motor Vehicles | 0.6 | -0.9 | -1.6 | -3.4 | 1.9 | 3.7 | 2.2 |

| Merchant Wholesalers | -0.3 | -1.3 | -1.2 | -5.6 | 1.7 | 6.5 | 3.0 |

| Manufacturing | -0.5 | 0.5 | 0.2 | -1.0 | 2.8 | 3.6 | 4.2 |

| Business Sales (% chg) | |||||||

| Total | 3.2 | 8.6 | 8.5 | -1.2 | 1.6 | 5.9 | 5.3 |

| Retail | 0.5 | 6.9 | 17.3 | 5.5 | 3.4 | 4.2 | 4.6 |

| Retail excl. Motor Vehicle | 1.0 | 6.3 | 10.5 | 5.3 | 3.3 | 5.1 | 4.9 |

| Merchant Wholesalers | 4.6 | 9.0 | 5.7 | -4.0 | 0.6 | 6.8 | 6.7 |

| Manufacturing | 4.6 | 10.0 | 3.0 | -4.4 | 1.0 | 6.6 | 4.7 |

| I/S Ratio | |||||||

| Total | 1.33 | 1.37 | 1.50 | 1.39 | 1.39 | 1.36 | 1.38 |

| Retail | 1.23 | 1.22 | 1.35 | 1.46 | 1.46 | 1.46 | 1.48 |

| Retail excl. Motor Vehicles | 1.12 | 1.12 | 1.20 | 1.22 | 1.23 | 1.22 | 1.24 |

| Merchant Wholesalers | 1.32 | 1.38 | 1.53 | 1.34 | 1.34 | 1.28 | 1.30 |

| Manufacturing | 1.43 | 1.51 | 1.65 | 1.38 | 1.38 | 1.35 | 1.38 |

Gerald D. Cohen

AuthorMore in Author Profile »Gerald Cohen provides strategic vision and leadership of the translational economic research and policy initiatives at the Kenan Institute of Private Enterprise.

He has worked in both the public and private sectors focusing on the intersection between financial markets and economic fundamentals. He was a Senior Economist at Haver Analytics from January 2019 to February 2021. During the Obama Administration Gerald was Deputy Assistant Secretary for Macroeconomic Analysis at the U.S. Department of Treasury where he helped formulate and evaluate the impact of policy proposals on the U.S. economy. Prior to Treasury, he co-managed a global macro fund at Ziff Brothers Investments.

Gerald holds a bachelor’s of science from the Massachusetts Institute of Technology and a Ph.D. in Economics from Harvard University and is a contributing author to 30-Second Money as well as a co-author of Political Cycles and the Macroeconomy.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates