Global| May 28 2013

Global| May 28 2013U.S. Case-Shiller Home Price Index Builds Forward Momentum

by:Tom Moeller

|in:Economy in Brief

Summary

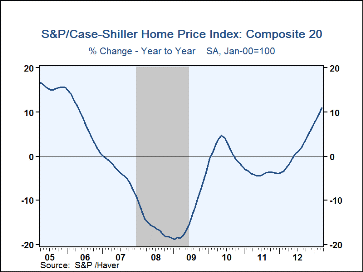

Home price strength is quite uneven around the country this year, but improvement is apparent everywhere. The seasonally adjusted Case-Shiller 20 City Home Price Index gained 1.1% (10.9% y/y) during March following a little-revised [...]

Home price strength is quite uneven around the country this year, but improvement is apparent everywhere. The seasonally adjusted Case-Shiller 20 City Home Price Index gained 1.1% (10.9% y/y) during March following a little-revised 1.3% February rise. The 3-month annualized rate of increase of 14.9% was the strongest since late-2005. Home prices in the narrower 10 city group rose 1.4% in March (10.2% y/y).

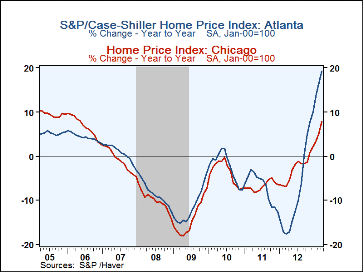

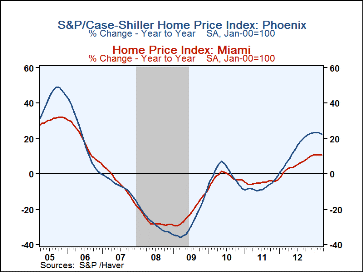

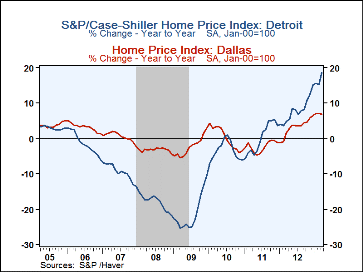

Home prices have risen in each metropolitan area with the strongest gains in Phoenix, San Francisco, Las Vegas, Atlanta, Detroit, Los Angeles, Portland and Minneapolis. Lagging the rest of the country have been home price gains in New York, Cleveland, Boston and Dallas.

The Case-Shiller home price series is value-weighted, i.e., a greater index weight is assigned to more expensive homes. It is a three-month moving average and is calculated using the "repeat sales method," where the item measured is the price change for a specific house compared to the price for that same house the last time it sold. The nation-wide S&P/Case-Shiller home price indexes can be found in Haver's USECON database, and the city data highlighted below are in the REGIONAL database.

Monetary Policy in a Low Policy Rate Environment from the Federal Reserve Bank of St. Louis can be found here.

| S&P Case-Shiller Home Price Index (SA, %) | Mar | Feb | Jan | Mar Y/Y |

2012 | 2011 | 2010 |

|---|---|---|---|---|---|---|---|

| 20 City Composite Index | 1.1 | 1.3 | 1.1 | 10.9 | 0.9 | -3.9 | 1.3 |

| Regional Indicators | |||||||

| Phoenix | 1.8 | 1.9 | 2.0 | 22.5 | 13.9 | -7.3 | -0.3 |

| San Francisco | 2.6 | 2.3 | 2.3 | 22.2 | 3.5 | -4.9 | 9.3 |

| Las Vegas | 3.2 | 1.9 | 1.8 | 20.6 | -0.3 | -6.5 | -7.7 |

| Atlanta | 1.7 | 1.1 | 2.0 | 19.1 | -7.8 | -7.0 | -2.4 |

| Detroit | 3.3 | 0.4 | 1.1 | 18.5 | 8.0 | 0.0 | -3.4 |

| Los Angeles | 2.6 | 1.8 | 1.6 | 16.6 | 0.7 | -3.4 | 5.3 |

| Portland | 2.6 | 1.5 | 1.2 | 12.8 | 1.7 | -7.1 | -3.2 |

| Minneapolis | 0.7 | 1.4 | 1.6 | 12.5 | 6.0 | -8.2 | 3.2 |

| San Diego | 2.0 | 0.9 | 0.4 | 12.1 | 1.2 | -4.4 | 7.3 |

| Tampa | 2.4 | 1.5 | 2.1 | 11.8 | 2.7 | -6.6 | -4.0 |

| Miami | 1.7 | 1.0 | 1.3 | 10.7 | 5.1 | -4.9 | -2.1 |

| Seattle | 2.6 | 0.5 | 1.2 | 10.6 | 2.1 | -6.6 | -3.6 |

| Denver | 0.9 | 1.0 | 1.1 | 9.8 | 4.5 | -2.1 | 0.9 |

| Chicago | 1.5 | 1.3 | 0.8 | 7.8 | -2.8 | -6.8 | -3.7 |

| Washington, D.C. | 2.3 | 0.1 | 0.5 | 7.7 | 2.1 | -0.4 | 4.7 |

| Dallas | 0.8 | 0.8 | 0.9 | 6.8 | 3.2 | -2.4 | 0.1 |

| Boston | 1.9 | 1.2 | 0.6 | 6.7 | 0.5 | -2.0 | 1.9 |

| Cleveland | 0.4 | 0.3 | 0.8 | 4.8 | -0.1 | -4.3 | 0.7 |

| New York | 0.4 | 0.9 | 0.5 | 2.6 | -2.3 | -3.1 | -1.5 |

Tom Moeller

AuthorMore in Author Profile »Prior to joining Haver Analytics in 2000, Mr. Moeller worked as the Economist at Chancellor Capital Management from 1985 to 1999. There, he developed comprehensive economic forecasts and interpreted economic data for equity and fixed income portfolio managers. Also at Chancellor, Mr. Moeller worked as an equity analyst and was responsible for researching and rating companies in the economically sensitive automobile and housing industries for investment in Chancellor’s equity portfolio. Prior to joining Chancellor, Mr. Moeller was an Economist at Citibank from 1979 to 1984. He also analyzed pricing behavior in the metals industry for the Council on Wage and Price Stability in Washington, D.C. In 1999, Mr. Moeller received the award for most accurate forecast from the Forecasters' Club of New York. From 1990 to 1992 he was President of the New York Association for Business Economists. Mr. Moeller earned an M.B.A. in Finance from Fordham University, where he graduated in 1987. He holds a Bachelor of Arts in Economics from George Washington University.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates