Global| Mar 31 2020

Global| Mar 31 2020U.S. Chicago Business Barometer Fell in March

by:Sandy Batten

|in:Economy in Brief

Summary

• Chicago PMI fell to 47.8 in March, the ninth consecutive month below 50 growth mark. • ISM-Adjusted measure calculated by Haver Analytics fell even more to 46.9. • Survey extended only to March 16; so it doesn't capture most of the [...]

• Chicago PMI fell to 47.8 in March, the ninth consecutive month below 50 growth mark.

• ISM-Adjusted measure calculated by Haver Analytics fell even more to 46.9.

• Survey extended only to March 16; so it doesn't capture most of the coronavirus impact.

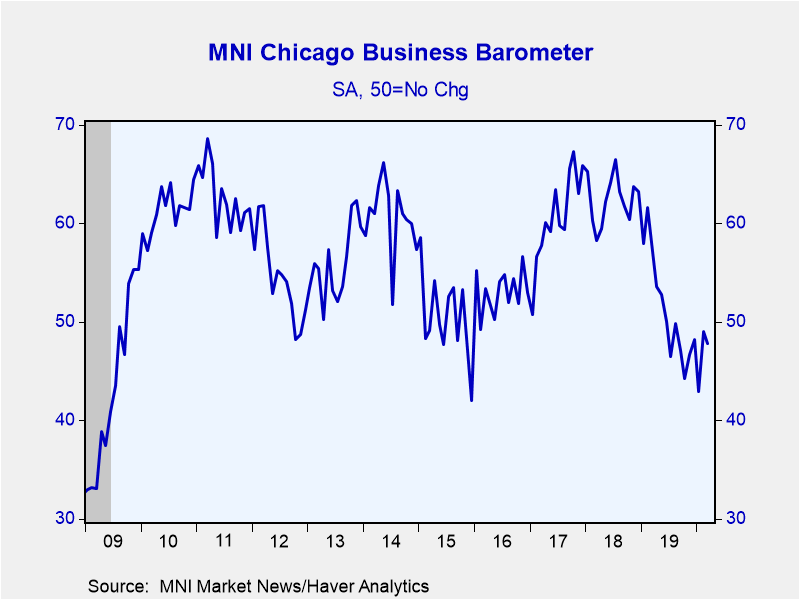

The Chicago Purchasing Managers Business Barometer fell to 47.8 in March from 49.0 in February. A reading below 50 for this diffusion index suggests contracting activity in the Chicago area. The Action Economics Forecast Survey expected a larger decline to 41.0, likely reflecting the adverse impact of the spreading coronavirus. However, the survey period ended on March 16. So, the March results don't capture the massive slowdown in economic activity that transpired over the second half of March.

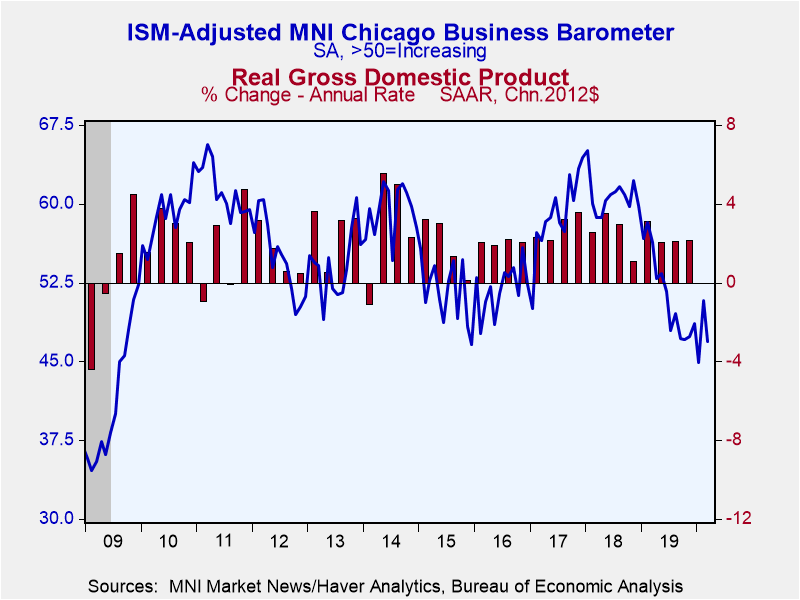

Haver Analytics constructs an ISM-Adjusted Chicago Business Barometer with similar methodology to the ISM Composite Index. This measure fell to 46.9 in March from 50.8 in February. The February reading had been the first one above the key 50 mark in the previous eight months. The Chicago ISM-Adjusted index has a 78% correlation with the national ISM Manufacturing Index, which is scheduled for release tomorrow.

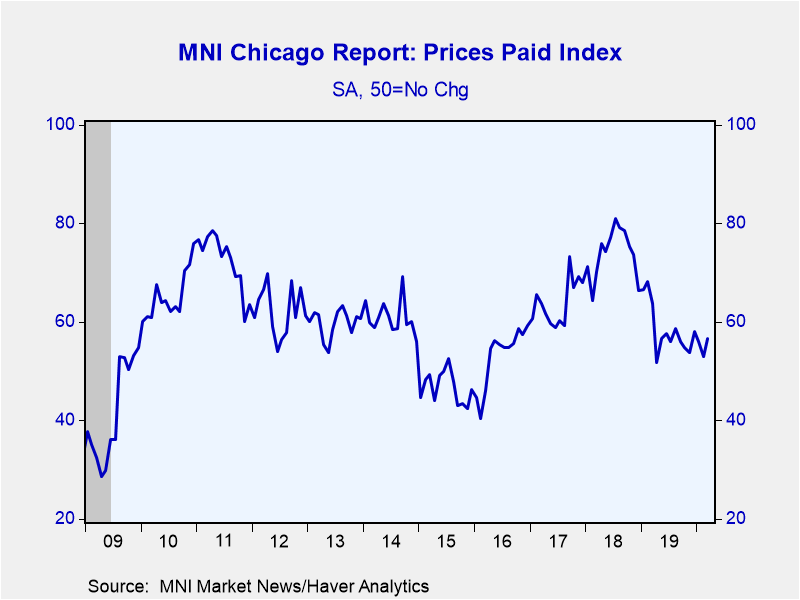

Of the five main indicators, production and new orders posted monthly declines and were well below the 50 mark. In contrast, supplier deliveries recorded a significant increase, moving even further above 50. Extended supplier deliveries are typically seen as indicating demand putting pressure on supply. However, in the current environment, they probably point to strained supply chains. The employment index edged up in March but remained well below 50, indicating that employment in the Chicago area was being challenged even before the big layoffs from the coronavirus that the economy experienced in the second half of March.

The MNI Chicago Report is produced by MNI in partnership with ISM-Chicago. The survey covers a sample of over 200 purchasing professionals in the Chicago area with a monthly response rate of about 50%. Summary data are contained in Haver's USECON database, with detail including the ISM-style index in the SURVEYS database. The Action Economics Forecast Survey is available in AS1REPNA.

| Chicago Purchasing Managers Index (%, SA) | Mar | Feb | Jan | Mar '19 | 2019 | 2018 | 2017 |

|---|---|---|---|---|---|---|---|

| General Business Barometer | 47.8 | 49.0 | 42.9 | 57.2 | 51.3 | 62.4 | 60.8 |

| ISM-Adjusted General Business Barometer | 46.9 | 50.8 | 44.9 | 56.3 | 51.4 | 60.8 | 59.0 |

| Production | 44.4 | 51.0 | 42.7 | 60.3 | 51.2 | 64.5 | 64.2 |

| New Orders | 45.2 | 49.1 | 41.5 | 58.0 | 52.0 | 63.8 | 63.4 |

| Order Backlogs | 40.3 | 38.2 | 34.6 | 44.9 | 46.9 | 58.0 | 55.2 |

| Inventories | 34.6 | 48.1 | 40.2 | 48.4 | 48.7 | 55.4 | 54.9 |

| Employment | 44.9 | 44.5 | 47.0 | 54.1 | 49.6 | 55.3 | 52.9 |

| Supplier Deliveries | 65.3 | 61.3 | 53.3 | 60.7 | 55.6 | 64.8 | 59.4 |

| Prices Paid | 56.7 | 52.9 | 56.1 | 63.7 | 58.5 | 73.9 | 64.0 |

Sandy Batten

AuthorMore in Author Profile »Sandy Batten has more than 30 years of experience analyzing industrial economies and financial markets and a wide range of experience across the financial services sector, government, and academia. Before joining Haver Analytics, Sandy was a Vice President and Senior Economist at Citibank; Senior Credit Market Analyst at CDC Investment Management, Managing Director at Bear Stearns, and Executive Director at JPMorgan. In 2008, Sandy was named the most accurate US forecaster by the National Association for Business Economics. He is a member of the New York Forecasters Club, NABE, and the American Economic Association. Prior to his time in the financial services sector, Sandy was a Research Officer at the Federal Reserve Bank of St. Louis, Senior Staff Economist on the President’s Council of Economic Advisors, Deputy Assistant Secretary for Economic Policy at the US Treasury, and Economist at the International Monetary Fund. Sandy has taught economics at St. Louis University, Denison University, and Muskingun College. He has published numerous peer-reviewed articles in a wide range of academic publications. He has a B.A. in economics from the University of Richmond and a M.A. and Ph.D. in economics from The Ohio State University.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates