Global| Mar 31 2021

Global| Mar 31 2021U.S. Chicago Business Barometer Hit a Multi-Year High in March

Summary

• The ISM-Chicago Purchasing Managers Business Barometer expanded to 66.3 in March. • Production posted the largest gain. The ISM-Chicago Purchasing Managers Business Barometer rose to 66.3 in March, the highest level since July 2018, [...]

• The ISM-Chicago Purchasing Managers Business Barometer expanded to 66.3 in March.

• Production posted the largest gain.

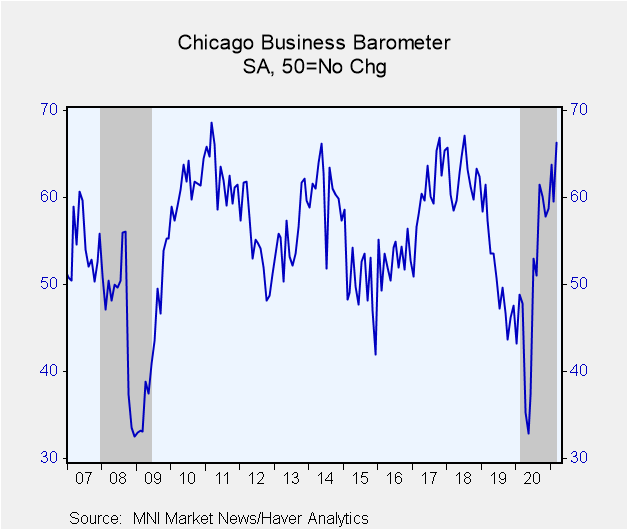

The ISM-Chicago Purchasing Managers Business Barometer rose to 66.3 in March, the highest level since July 2018, and more than reversing the February 4.3 points decline. The Action Economics Forecast expected a reading of 60.3. An index above 50 suggests growing business activity in the Chicago area.

Haver Analytics constructs an ISM-Adjusted Chicago Business Barometer with methodology similar to the ISM Composite Index. This measure rose to 64.9 from 57.6 in February, keeping the index well above the low of 40.7 reached in June 2020.

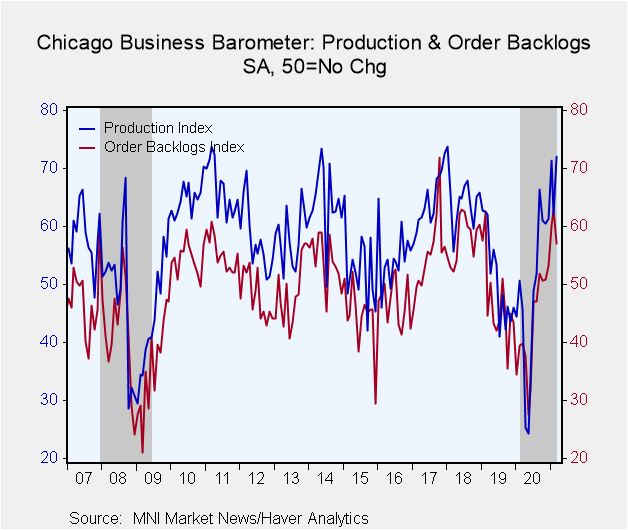

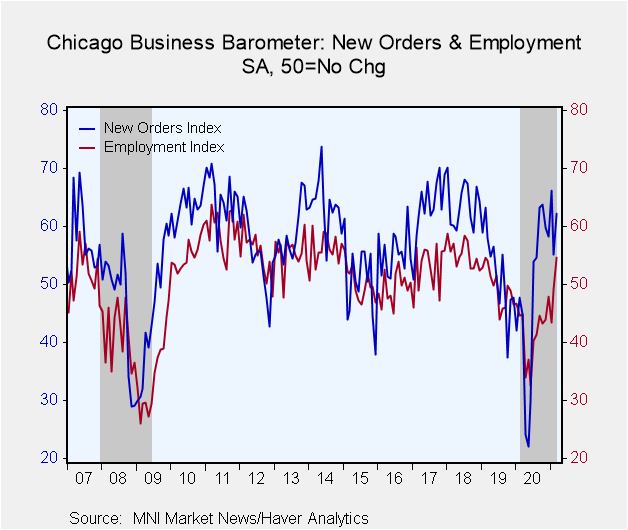

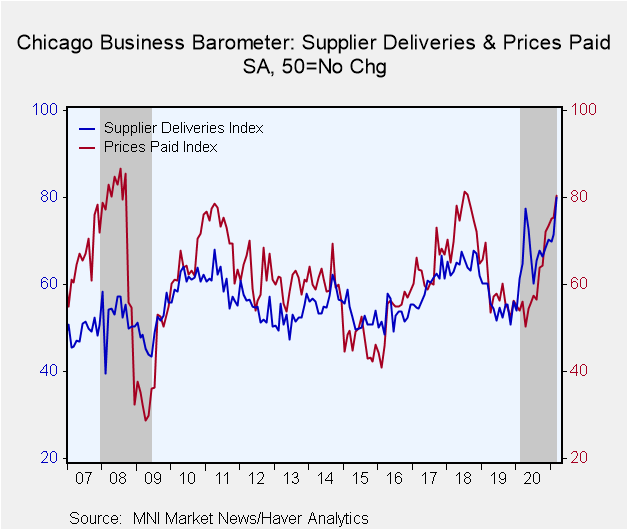

Production jumped 10 points to 72, new orders rose by 7.1 points to 62.3. Order backlogs was the only component to post a decline in March to 57 from 63 in February. Inventories rose 5.1 points, reportedly driven by supply chain issues. Supply chain issues also continued to impact supplier deliveries, which rose to 79.9, up from 71.5 in February. For an historical perspective, the index stood at 73.8 in Q1:2021, the highest level since Q2:1974.

Employment reached above the expansion threshold of 50 for the first time since June 2019 with a read of 54.6.

Prices paid reached a milestone as well, jumping to 80.4, the highest level since August 2018.

In response to this month's special question "As the first quarter of 2021 comes to an end, are you planning to amend your inventory position due to any of the following conditions?" 67.6% of respondents planned changes due to supplier lead-times.

The MNI Chicago Report is produced by MNI in partnership with ISM-Chicago. The survey is collected online each month from manufacturing and non-manufacturing firms in the Chicago area. Summary data are contained in Haver's USECON database with detail including the ISM-style index in the SURVEYS database.

| Chicago Purchasing Managers Index (%, SA) | Mar | Feb | Jan | Mar '20 | 2020 | 2019 | 2018 |

|---|---|---|---|---|---|---|---|

| General Business Barometer | 66.3 | 59.5 | 63.8 | 47.8 | 49.0 | 51.4 | 62.4 |

| ISM-Adjusted General Business Barometer | 64.9 | 57.6 | 61.2 | 47.1 | 49.6 | 51.5 | 60.8 |

| Production | 72.0 | 62.0 | 71.3 | 45.7 | 47.9 | 51.3 | 64.6 |

| New Orders | 62.3 | 55.2 | 66.2 | 44.8 | 47.1 | 52.0 | 63.8 |

| Order Backlogs | 57.0 | 63.0 | 60.1 | 39.9 | 42.6 | 46.9 | 58.0 |

| Inventories | 55.6 | 50.4 | 55.1 | 35.2 | 44.7 | 48.7 | 55.4 |

| Employment | 54.6 | 49.1 | 43.4 | 44.9 | 41.8 | 49.6 | 55.2 |

| Supplier Deliveries | 79.9 | 71.5 | 69.9 | 64.9 | 66.4 | 55.6 | 64.8 |

| Prices Paid | 80.4 | 75.3 | 75.2 | 56.0 | 59.5 | 58.5 | 74.0 |

Kathleen Stephansen, CBE

AuthorMore in Author Profile »Kathleen Stephansen is a Senior Economist for Haver Analytics and an Independent Trustee for the EQAT/VIP/1290 Trust Funds, encompassing the US mutual funds sponsored by the Equitable Life Insurance Company. She is a former Chief Economist of Huawei Technologies USA, Senior Economic Advisor to the Boston Consulting Group, Chief Economist of the American International Group (AIG) and AIG Asset Management’s Senior Strategist and Global Head of Sovereign Research. Prior to joining AIG in 2010, Kathleen held various positions as Chief Economist or Head of Global Research at Aladdin Capital Holdings, Credit Suisse and Donaldson, Lufkin and Jenrette Securities Corporation.

Kathleen serves on the boards of the Global Interdependence Center (GIC), as Vice-Chair of the GIC College of Central Bankers, is the Treasurer for Economists for Peace and Security (EPS) and is a former board member of the National Association of Business Economics (NABE). She is a member of Chatham House and the Economic Club of New York. She holds an undergraduate degree in economics from the Universite Catholique de Louvain and graduate degrees in economics from the University of New Hampshire (MA) and the London School of Economics (PhD abd).