Global| Nov 27 2019

Global| Nov 27 2019U.S. Chicago Business Barometer Partially Reverses October Drop; Still Indicating Contraction

Summary

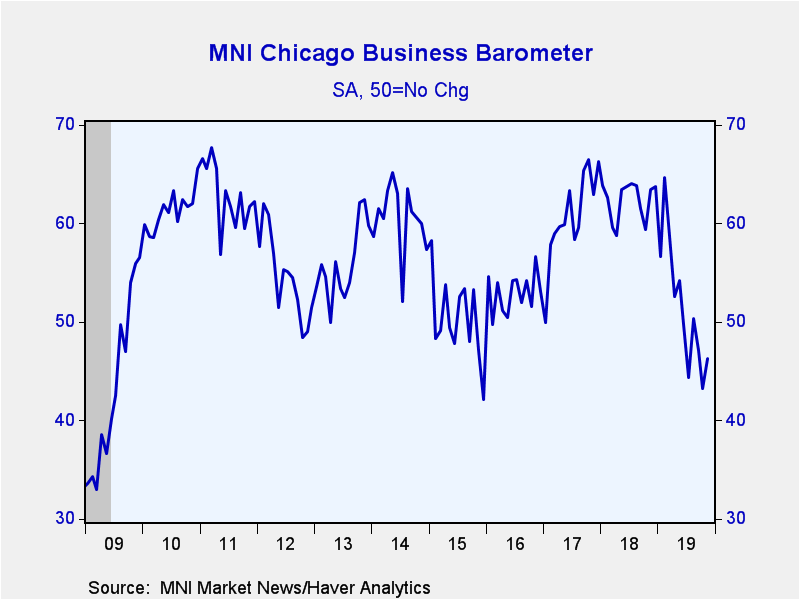

The Chicago Purchasing Managers Business Barometer rose less than expected to 46.3 in November reversing some of October’s decline to 43.2, which was the lowest level in four years. September’s value was 47.1. All of these readings [...]

The Chicago Purchasing Managers Business Barometer rose less than expected to 46.3 in November reversing some of October’s decline to 43.2, which was the lowest level in four years. September’s value was 47.1. All of these readings are below the key 50-mark for a diffusion index suggesting contracting activity in the Chicago area. The Action Economics Forecast Survey expected a reading of 46.8.

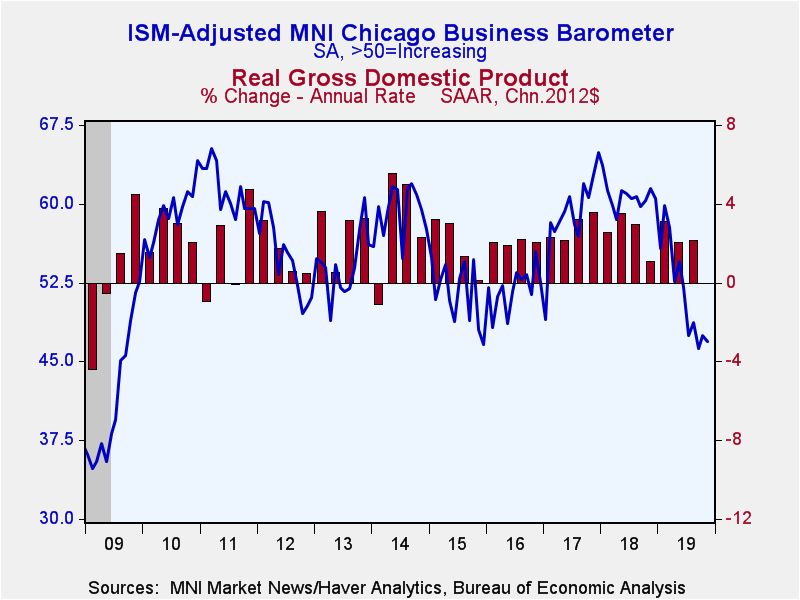

Haver Analytics constructs an ISM-Adjusted Chicago Business Barometer with similar methodology as the ISM Composite Index. This measure declined to 46.9 from 47.5. September’s reading of 46.2 was the lowest since 2009 during the early part of the recovery. The Chicago index has a 77% correlation with the national ISM Manufacturing Index, which is scheduled for release on Monday.

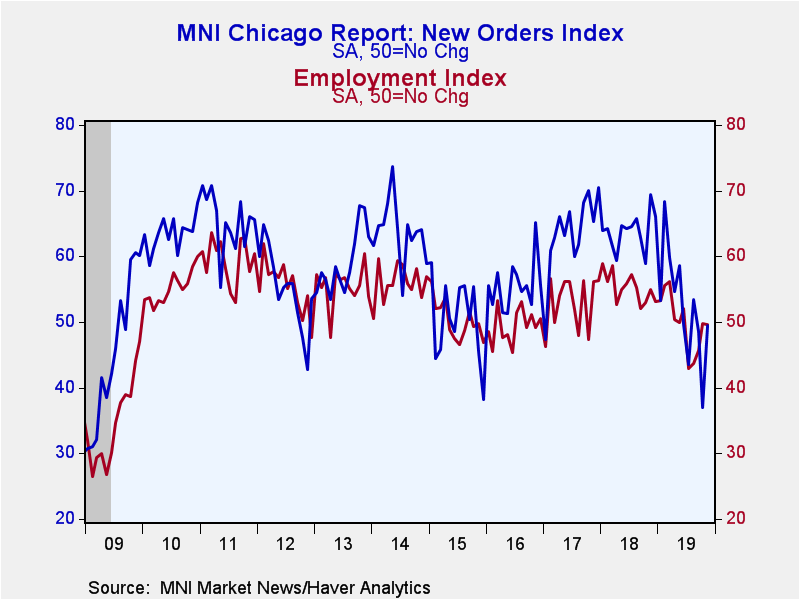

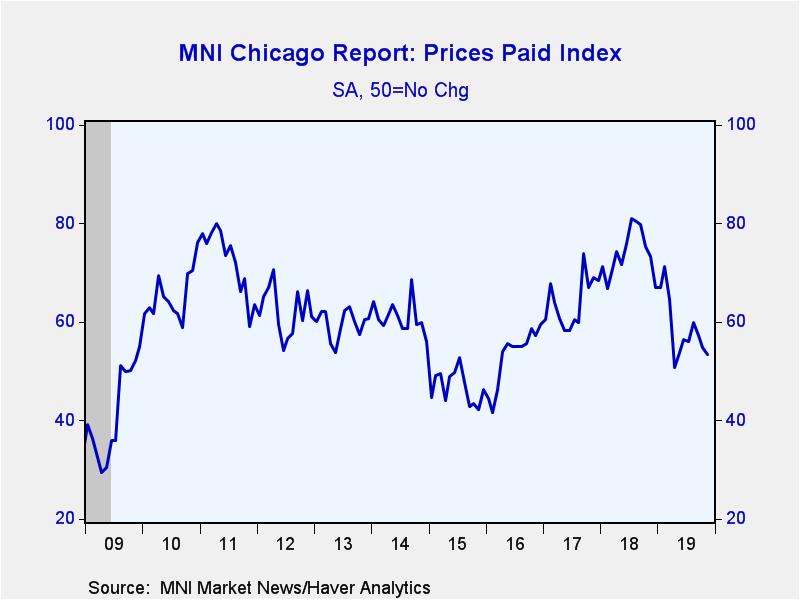

The new orders index jumped to 49.4, more than reversing October’s drop to 37.0, a recessionary reading. Meanwhile, production declined to 42.3 from 46.8. The employment index ticked down to 49.6, just below the 50-growth level. The proportion of survey respondents that indicated both higher and lower employment decreased to 18% from 20% (the respondent share data are not-seasonally adjusted). Supplier deliveries fell to 50.2 from 56.9, a four year low. It is the only activity based index to remain above the 50-mark. The prices paid measure declined to 53.5.

The MNI Chicago Report is produced by MNI in partnership with ISM-Chicago. The survey covers a sample of over 200 purchasing professionals in the Chicago area with a monthly response rate of about 50%. Summary data are contained in Haver's USECON database, with detail including the ISM-style index in the SURVEYS database. The Action Economics Forecast Survey is available in AS1REPNA.

| Chicago Purchasing Managers Index (%, SA) | Nov | Oct | Sep | Nov '18 | 2018 | 2017 | 2016 |

|---|---|---|---|---|---|---|---|

| General Business Barometer | 46.3 | 43.2 | 47.1 | 63.5 | 62.4 | 60.7 | 53.0 |

| ISM-Adjusted General Business Barometer | 46.9 | 47.5 | 46.2 | 61.5 | 60.7 | 59.0 | 51.9 |

| Production | 42.3 | 46.8 | 40.4 | 63.5 | 64.5 | 64.2 | 54.5 |

| New Orders | 49.4 | 37.0 | 48.5 | 69.4 | 63.8 | 63.6 | 55.6 |

| Order Backlogs | 45.0 | 33.1 | 46.8 | 59.4 | 58.0 | 55.2 | 47.1 |

| Inventories | 43.0 | 47.1 | 41.7 | 53.2 | 55.3 | 54.9 | 47.2 |

| Employment | 49.6 | 49.8 | 45.6 | 55.0 | 55.2 | 52.9 | 49.4 |

| Supplier Deliveries | 50.2 | 56.9 | 54.8 | 66.4 | 64.8 | 59.4 | 52.8 |

| Prices Paid | 53.5 | 54.8 | 57.3 | 73.3 | 74.0 | 64.1 | 53.2 |

Gerald D. Cohen

AuthorMore in Author Profile »Gerald Cohen provides strategic vision and leadership of the translational economic research and policy initiatives at the Kenan Institute of Private Enterprise.

He has worked in both the public and private sectors focusing on the intersection between financial markets and economic fundamentals. He was a Senior Economist at Haver Analytics from January 2019 to February 2021. During the Obama Administration Gerald was Deputy Assistant Secretary for Macroeconomic Analysis at the U.S. Department of Treasury where he helped formulate and evaluate the impact of policy proposals on the U.S. economy. Prior to Treasury, he co-managed a global macro fund at Ziff Brothers Investments.

Gerald holds a bachelor’s of science from the Massachusetts Institute of Technology and a Ph.D. in Economics from Harvard University and is a contributing author to 30-Second Money as well as a co-author of Political Cycles and the Macroeconomy.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates