Global| Jul 01 2009

Global| Jul 01 2009U.S. Construction Spending Holding Steady

Summary

Construction outlays fell 0.9% in May, reverting to a decline after April's limp 0.6% increase. That was revised from a 0.8% rise and March was revised to a 0.4% decrease from a 0.4% increase reported last month. This report included [...]

Construction outlays fell 0.9% in May, reverting to a decline after April's limp 0.6% increase. That was revised from a 0.8% rise and March was revised to a 0.4% decrease from a 0.4% increase reported last month. This report included annual revisions, which began in January 2007; the level in 2007 was revised up slightly. For 2008, several months are lower than before, but the steepness of the late-year decline was moderated, leaving recent levels basically unchanged from previous reports.

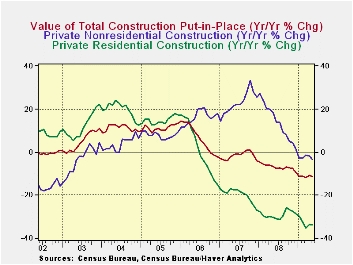

Private nonresidential building outlays remain a main support to overall construction, with a 0.5% gain in May following 1.3% in April. However, the historical revisions cut earlier months, and the sector has shown year-to-year declines now since January. May was down 3.3% from a year ago.This masks divergent trends among divisions: communications are off 28.3% from May 2008 but transportation is now up 5.9%, its first year/year increase this year after a steep drop during the winter. Office construction, with a tiny 0.1% rise in May, may be stabilizing after a continuous month/month contraction since last September; year-on-year, it is off 18.2%. The most traditional forms of private nonresidential construction, power plants and manufacturing facilities, are expanding, with power up 12.0% from a year ago and manufacturing a strong 55.6%.

Residential building activity continues weak. It fell 3.4% month-to-month in May and April's previously reported 0.7% increase was revised to a 0.3% cut. Year-on-year, it is off 33.9%. The best we can say is that this last figure is a bit less severe than April's initially reported 35% drop. Single-family home construction is down 54.1% y/y, although May's monthly performance was down "just" 4.5%, the smallest decline since last August.

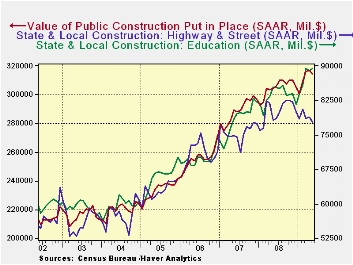

Public construction edged down in May by 0.6%, while April's previously reported 0.6% decrease was revised to a 0.2% rise and March's 1.0% increase is now calculated at 2.2%. Year-on-year, public sector activity is up 3.4%, little different from the prior report of 3.3%. By type, spending on highways and streets is ratcheting lower, with May down 1.3% from April and 0.5% from May 2008. Education, the other big category, has, by contrast, been gaining in most months so far this year; May was up 0.4% on the month and 4.7% on the year. School-building has, with occasional interruption, sustained an uptrend through much of the last five or six years.

The construction put-in-place figures are available in Haver's USECON database.

| Construction (%) | May | April | March | Y/Y | 2008 | 2007 | 2006 |

|---|---|---|---|---|---|---|---|

| Total | -0.9 | 0.6 | -0.4 | -11.6 | -6.9 | -1.6 | 6.3 |

| Private | -1.0 | 0.8 | -1.6 | -17.4 | -11.1 | -5.7 | 5.5 |

| Residential | -3.4 | -0.3 | -4.6 | -33.9 | -29.1 | -19.7 | 1.0 |

| Nonresidential | 0.5 | 0.2 | 0.4 | -3.3 | 13.2 | 23.1 | 16.2 |

| Public | -0.6 | -0.6 | 2.2 | 3.4 | 5.6 | 13.1 | 9.3 |

Carol Stone, CBE

AuthorMore in Author Profile »Carol Stone, CBE came to Haver Analytics in 2003 following more than 35 years as a financial market economist at major Wall Street financial institutions, most especially Merrill Lynch and Nomura Securities. She had broad experience in analysis and forecasting of flow-of-funds accounts, the federal budget and Federal Reserve operations. At Nomura Securities, among other duties, she developed various indicator forecasting tools and edited a daily global publication produced in London and New York for readers in Tokyo. At Haver Analytics, Carol was a member of the Research Department, aiding database managers with research and documentation efforts, as well as posting commentary on select economic reports. In addition, she conducted Ways-of-the-World, a blog on economic issues for an Episcopal-Church-affiliated website, The Geranium Farm. During her career, Carol served as an officer of the Money Marketeers and the Downtown Economists Club. She had a PhD from NYU's Stern School of Business. She lived in Brooklyn, New York, and had a weekend home on Long Island.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates