Global| May 01 2018

Global| May 01 2018U.S. Construction Spending Slumped in March, Big Upward Revisions to January and February

by:Sandy Batten

|in:Economy in Brief

Summary

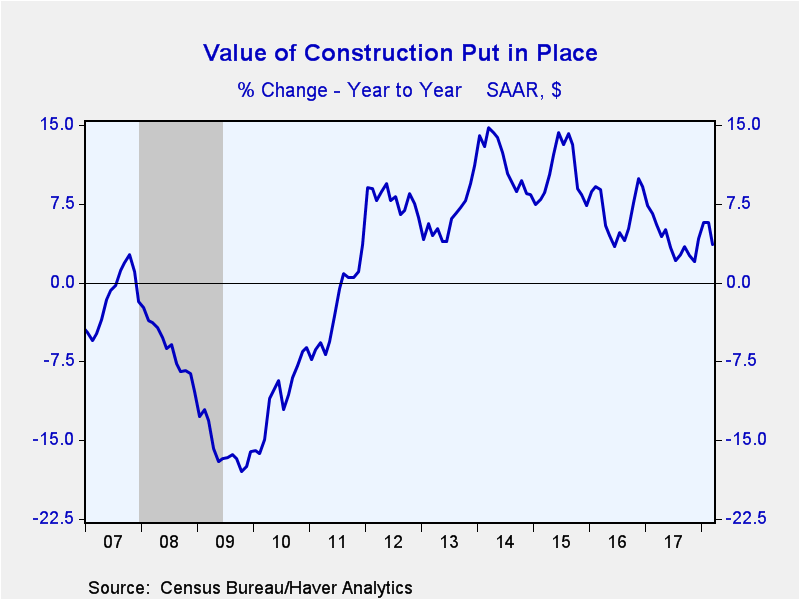

The value of construction put-in-place slumped in March, falling 1.7% m/m (+3.9% y/y). The Action Economics Forecast Survey had looked for a 0.5% m/m rise in building activity. Unusual winter-like weather was probably at the heart of [...]

The value of construction put-in-place slumped in March, falling 1.7% m/m (+3.9% y/y). The Action Economics Forecast Survey had looked for a 0.5% m/m rise in building activity. Unusual winter-like weather was probably at the heart of the March weakness as it was widespread across all categories--private and public, residential and nonresidential. However, the tepid readings previously reported for January and February were revised meaningfully stronger. The 0.1% m/m rise previously reported for February was revised to a 1.0% m/m increase and the unchanged reading previously reported for January was revised to a 1.7% m/m jump. So, notwithstanding the sharp monthly drop in March, for all of the first quarter, construction spending was up 3.3% q/q versus a 2.4% q/q rise in 4Q.

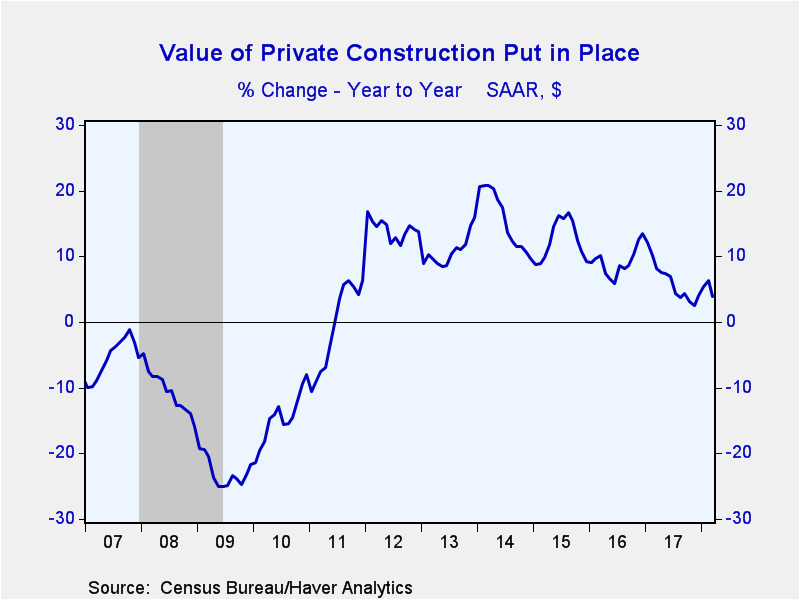

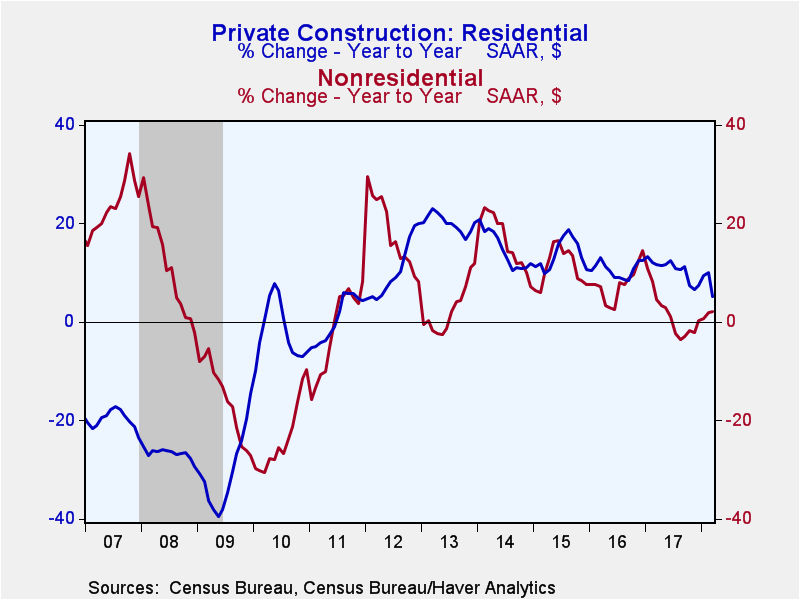

Private sector building activity fell 2.1% m/m (+3.8% y/y) in March. But again, there were significant upward revisions to January and February. The 0.7% m/m decline previously reported for January was revised to a 1.5% m/m increase. For February, the 0.7% m/m increase was revised to a 1.2% m/m rise. The weakness in private-sector construction spending in March was concentrated in residential, which fell 3.5% m/m (+4.8% y/y). Moreover, an 8.0% m/m drop in spending on home improvements (the largest monthly decline in 17 years) dragged down the headline figure in March. This category is generally viewed as less reliable than other parts of the report and is not used as source data to estimate GDP. Private nonresidential construction spending declined a more modest 0.4% m/m in March (+2.6% y/y).

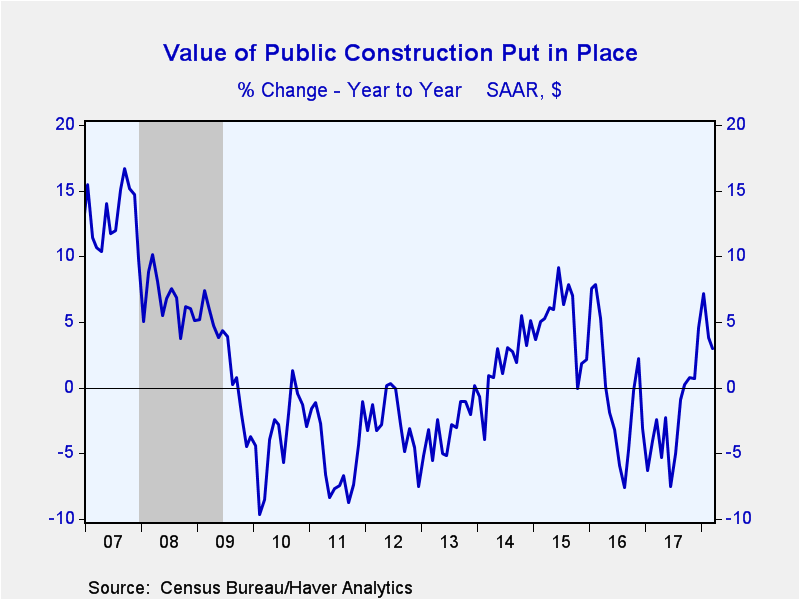

The value of public sector building activity was unchanged in March from February (+4.3% y/y). Again there were significant upward revisions to February. The originally reported 2.1% m/m decline was revised up to a 0.1% m/m increase. Highway and street construction, the largest component of public sector construction, rose a solid 1.2% m/m, its third consecutive monthly increase.

The construction spending figures, some of which date back to 1946 (e.g., public construction figures), are in Haver's USECON database and the expectations reading can be found in the AS1REPNA database.

| Construction Put in Place (SA, %) | Mar | Feb | Jan | Mar Y/Y | 2017 | 2016 | 2015 |

|---|---|---|---|---|---|---|---|

| Total | -1.7 | 1.0 | 1.7 | 3.9 | 4.1 | 6.5 | 10.7 |

| Private | -2.1 | 1.2 | 1.5 | 3.8 | 6.2 | 9.2 | 12.9 |

| Residential | -3.5 | 1.2 | 3.2 | 4.8 | 10.9 | 10.5 | 14.2 |

| Nonresidential | -0.4 | 1.2 | -0.5 | 2.6 | 1.1 | 7.7 | 11.5 |

| Public | 0.0 | 0.1 | 2.2 | 4.3 | -2.5 | -1.2 | 5.1 |

Sandy Batten

AuthorMore in Author Profile »Sandy Batten has more than 30 years of experience analyzing industrial economies and financial markets and a wide range of experience across the financial services sector, government, and academia. Before joining Haver Analytics, Sandy was a Vice President and Senior Economist at Citibank; Senior Credit Market Analyst at CDC Investment Management, Managing Director at Bear Stearns, and Executive Director at JPMorgan. In 2008, Sandy was named the most accurate US forecaster by the National Association for Business Economics. He is a member of the New York Forecasters Club, NABE, and the American Economic Association. Prior to his time in the financial services sector, Sandy was a Research Officer at the Federal Reserve Bank of St. Louis, Senior Staff Economist on the President’s Council of Economic Advisors, Deputy Assistant Secretary for Economic Policy at the US Treasury, and Economist at the International Monetary Fund. Sandy has taught economics at St. Louis University, Denison University, and Muskingun College. He has published numerous peer-reviewed articles in a wide range of academic publications. He has a B.A. in economics from the University of Richmond and a M.A. and Ph.D. in economics from The Ohio State University.