Global| Apr 01 2011

Global| Apr 01 2011U.S. Construction Spending Still Down

Summary

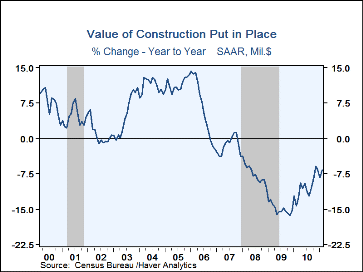

Severe winter weather and continuing fragility in the homebuilding market interacted once again to produce still another decline in construction put-in-place in February, as well as marked downward revisions to January and December [...]

Severe winter weather and continuing fragility in the homebuilding market interacted once again to

produce still another decline in construction put-in-place in February, as well as marked downward revisions to

January and December results. February activity was off 1.4%, with January revised to -1.8% from -0.7% and December

to -3.2% from -1.6%. Consensus expectations as indicated in the Actions Economics survey had called for no change in February.

Severe winter weather and continuing fragility in the homebuilding market interacted once again to

produce still another decline in construction put-in-place in February, as well as marked downward revisions to

January and December results. February activity was off 1.4%, with January revised to -1.8% from -0.7% and December

to -3.2% from -1.6%. Consensus expectations as indicated in the Actions Economics survey had called for no change in February.

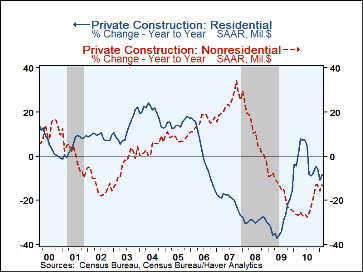

The sluggishness in residential construction hit all three major categories. Single-family homebuilding was down 1.7% in February, disappointing after three consecutive modest monthly increases; the sector is off 7.7% from a year ago. Multifamily home construction fell 1.5% in February and is down 18.7% from a year ago. This latter is actually the smallest year-on-year drop since March 2009; the largest of these was 60.9% in March 2010. These two categories of new construction constitute only about half of private residential outlays; improvements are the rest, 48% of this total in February. That segment too has been weak, down 5.8% in the month and 7.2% from a year ago. Often if people can’t afford to buy a new home, they’ll fix up the old one, making this segment somewhat more resilient. The sizable drop in February may thus well illustrate the role of bad weather, then.

Nonresidential construction activity increased a bit in February, 0.9%, although January and December both experienced noticeable downward revisions. The year-on-year change remained at January’s -13.2%. February gains were seen in transportation, communication, power generation and manufacturing. All other sectors except commercial had drops of at least 1%, and commercial was off 0.8%. Besides commercial, the other largest sectors, office and healthcare, were down 1.9% and 1.1%, respectively.

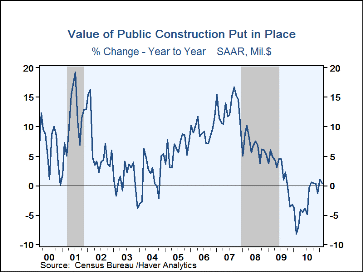

Public construction activity fell 1.3% in February, following a revised 0.4% decrease in January, originally reported as a 0.1% rise. The February decline hit all but three of the public construction line items; those showing increases were power, highways and streets and conservation. The biggest decreases were in water supply, 6.1%, offices, 3.3% and educational, 3.7%.

The construction put-in-place figures are available in Haver's USECON database. The expectations figure is contained in Haver's AS1REPNA database.

| Construction Put in Place (%) | Feb | Jan | Dec | Y/Y | 2010 | 2009 | 2008 |

|---|---|---|---|---|---|---|---|

| Total | -1.4 | -1.8 | -3.2 | -6.8 | -10.4 | -14.9 | -7.5 |

| Private | -1.4 | -2.5 | -3.4 | -10.8 | -14.3 | -21.9 | -12.2 |

| Residential | -3.7 | 3.6 | -3.5 | -8.1 | -1.4 | -29.9 | -29.0 |

| Nonresidential | 0.9 | -8.0 | -3.3 | -13.2 | -23.4 | -15.0 | 10.5 |

| Public | -1.3 | -0.5 | -2.9 | 0.5 | -3.1 | 2.2 | 6.6 |

Carol Stone, CBE

AuthorMore in Author Profile »Carol Stone, CBE came to Haver Analytics in 2003 following more than 35 years as a financial market economist at major Wall Street financial institutions, most especially Merrill Lynch and Nomura Securities. She had broad experience in analysis and forecasting of flow-of-funds accounts, the federal budget and Federal Reserve operations. At Nomura Securities, among other duties, she developed various indicator forecasting tools and edited a daily global publication produced in London and New York for readers in Tokyo. At Haver Analytics, Carol was a member of the Research Department, aiding database managers with research and documentation efforts, as well as posting commentary on select economic reports. In addition, she conducted Ways-of-the-World, a blog on economic issues for an Episcopal-Church-affiliated website, The Geranium Farm. During her career, Carol served as an officer of the Money Marketeers and the Downtown Economists Club. She had a PhD from NYU's Stern School of Business. She lived in Brooklyn, New York, and had a weekend home on Long Island.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates